Seagate Technology Holdings plc (NASDAQ: STX)

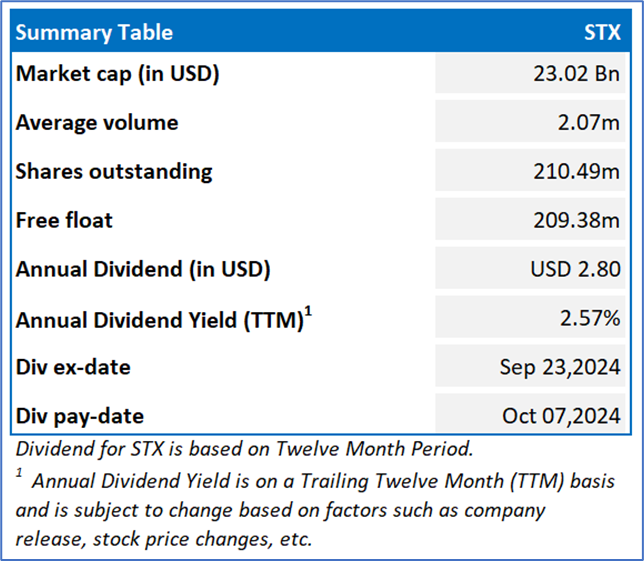

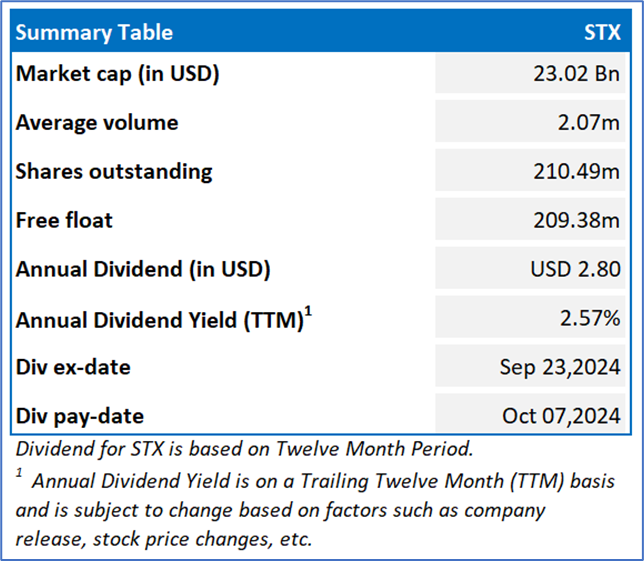

Seagate Technology Holdings plc (NASDAQ: STX) provides mass-data storage infrastructure solution. The Company’s principal products are hard disk drives, commonly referred to as disk drives, hard drives (HDDs).

Recommendation Rationale – Sell at USD 109.38

- The company is dependent on the sales to distributors and retailers, which could increase price erosion as well as the volatility of STX’s sales. Also, changes in demand for computer systems, data storage subsystems and consumer electronic devices could impact the demand for its products.

- Also, the shortages or delays in the receipt of, or higher costs in, critical components, equipment or raw materials required to manufacture the products, as well as reliance on single-source suppliers, could affect the production and development of products.

- The company’s share price is trading close to its R1 level recommended on August 28, 2024. Therefore, there can be a possible decline from the specified resistance levels.

STX’s Daily Price Chart

STX Daily Technical Chart, Data Source: REFINITIV

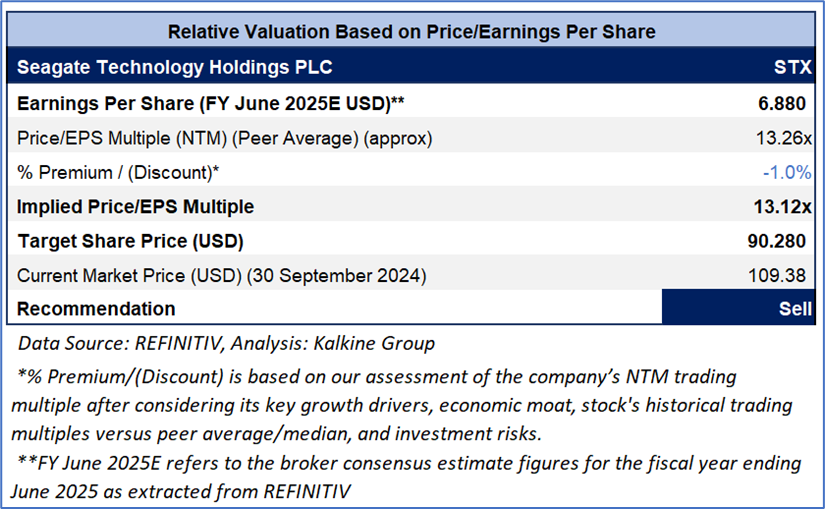

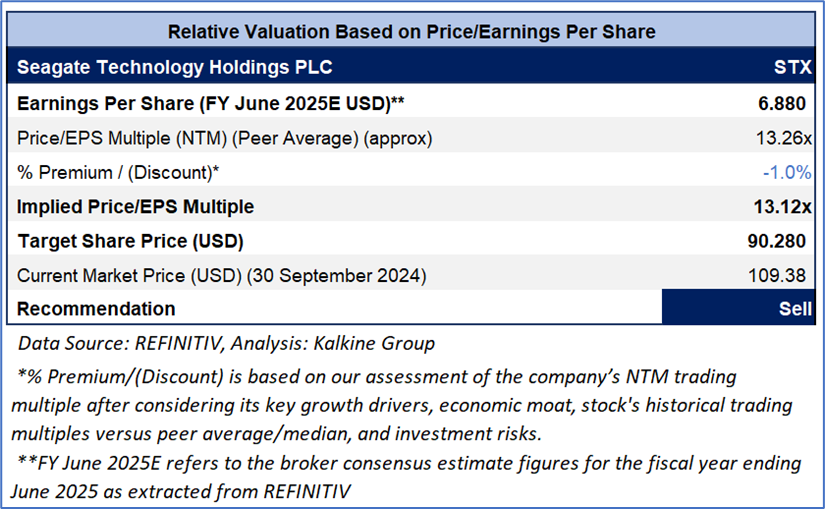

Fundamental Valuation

STX is exposed to the risks related to general economic conditions such as changes in the macroeconomic environment, the negative impact of geopolitical uncertainties, etc. Therefore, STX is expected to trade at slight discount considering the risks associated. For conducting the valuation, the following peers have been considered: Advanced Micro Devices Inc (AMD.OQ), Western Digital Corp (WDC.OQ), etc.

Considering the current trading levels, risks associated, and volatile market conditions, a ‘Sell’ rating is assigned to the ‘STX’ at the current market price of USD 109.38 as of Sep 30, 2024 (7:39 am PDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 30 September 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

CA

Please wait processing your request...

Please wait processing your request...