ATS Automation Tooling Systems Inc

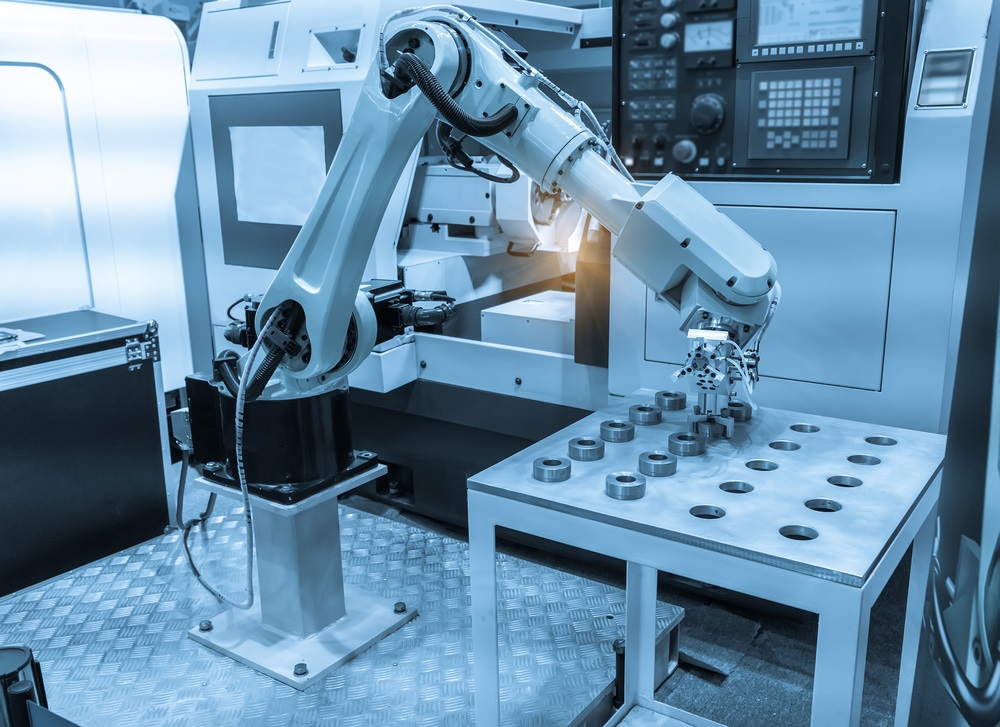

ATS Automation Tooling Systems Inc. (TSX: ATS) is an automation solutions provider. The Company is engaged in planning, designing, building, commissioning and servicing automated manufacturing and assembly systems, including automation products.

Why Should Investor Book the Profit?

Source: REFINITIV, Analysis by Kalkine Group

Stock recommendation

Despite a challenging environment the company presented strong operating margins and record Order Bookings and Order Backlog, Although the revenues in transportation decreased 42.1% due to a slowdown in the transportation market and the implementation of a reorganization plan that reduced exposure to certain aspects of the market. On the technical aspect, the stock on weekly charts has moved close to the upper band of the Bollinger band and the 14-day RSI is also hovering in overbought zone, which suggests that the stock price may consolidate or correct from the current levels. Moreover, the stock is trading on a stretched valuations compared to the industry. Therefore, based on the above rationale, we recommend a “Sell” rating on the stock at the closing price of CAD 36.86 on July 27, 2021.

One-Year Technical Price Chart (as on July 27, 2021). Source: REFINITIV, Analysis by Kalkine Group

MTY Food Group Inc

MTY Food Group Inc (TSX: MTY) is a franchisor in the quick service and casual dining food industry. Its activities consist of franchising and operating corporate-owned locations as well as the sale of retail products under a multitude of banners.

Why Should Investor Book the Profit?

Stock recommendation

The company's financial results for Q2 2021 exceeded management's expectations, especially considering that some of its core markets were still subject to significant restrictions during the period. MTY's network was hit by more than 38,300 missed business days (combined) during the reporting period, and about 321 restaurants were temporarily shuttered at the beginning of the quarter and 359 at the conclusion of the quarter, primarily due to covid restrictions. The number of affected locations would continue to fluctuate in response to the rapidly changing environment, with a corresponding effect on customer traffic volumes and revenue at these locations. Furthermore, the industry continues to face challenges resulting from severe labour shortages and food price inflation. All these are not a healthy sign. Moreover, the stock is trading on a stretched valuations compared to the industry. Therefore, based on the above rationale, we recommend a “Sell” rating on the stock at the closing price of CAD 67.41 on July 27, 2021.

One-Year Technical Price Chart (as on July 27, 2021). Source: REFINITIV, Analysis by Kalkine Group

*The reference data in this report has been partly sourced from REFINITIV.

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.