RY 135.4 1.0674% TD 80.36 -0.4953% SHOP 98.5 1.7037% CNR 166.9 0.2402% ENB 49.76 1.5717% CP 108.92 2.0232% BMO 122.77 -0.4621% TRI 221.91 6.4776% CNQ 102.79 -0.2233% BN 56.78 0.7273% ATD 74.89 -1.1484% CSU 3550.9399 -1.8182% BNS 63.52 -0.2513% CM 64.62 0.1705% SU 52.33 1.0427% TRP 49.85 1.4242% NGT 56.3 0.7516% WCN 223.06 0.0179% MFC 32.46 0.0925% BCE 45.15 -1.333%

Company Overview: POET Technologies Inc (TSXV: PTK): is a Canada-based design and development company specializing in integration solutions. The company offers solutions based on the POET Optical Interposer, a platform enabling the integration of electronic and photonic devices into a single multi-chip module. This integration is made possible through advanced wafer-level semiconductor manufacturing techniques and packaging methods. POET's Optical Interposer aims to streamline the integration process by eliminating costly components and labor-intensive assembly, alignment, and testing methods typically associated with conventional photonics technologies. This Report covers the Price Action, Technical Indicators Analysis along with the Support Levels, Resistance Levels, and Recommendation on this stock.

PTK’s Technical Observation:

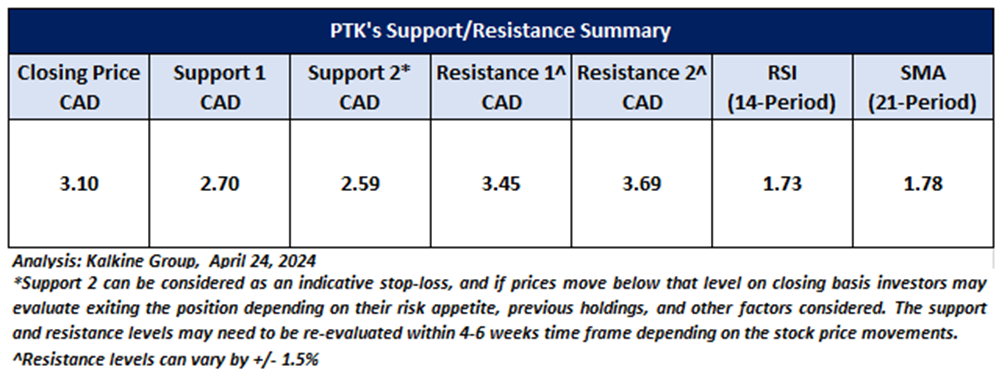

PTK’s prices have recently broken out of a long consolidation zone, driven by the announcement of a collaboration with MultiLane Inc, a provider of high-speed IO and data center interconnect test solutions, which has been strongly received by the market. Consequently, the stock price has surged above the rising trendline with notable momentum. There is an expectation of the current trend to continue at the Closing Price of CAD 3.10, bolstered by a substantial volume buildup. The leading indicator RSI (14-period) stands at 79.18, indicating a bullish trend in the price. Furthermore, the CMP is trading above both the trending indicators, the 21-period SMA and the 50-period SMA, suggesting their potential roles as support levels in the near term. Notably, the important support levels for the stock are situated at CAD 2.70 and CAD 2.59, while key resistance is positioned at CAD 3.45 and CAD 3.69 levels.

Xxxxxx Xxxxxx Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx Xxxxxx Xxxxxx Xxxxxx & Xxxxxx

Xxxxxx Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Xxxxxx

Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx Xxxxxx .

Enter your details below and our team will help you to decide if this product is best for you.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.