Nano Nuclear Energy Inc

Nano Nuclear Energy Inc. (NASDAQ: NNE) is an early-stage nuclear energy company. The Company is focused on developing smaller, cheaper, and safer advanced portable clean energy solutions utilizing proprietary reactor designs. It is focused on four business lines, including Micro Nuclear Reactor Business, Fuel Fabrication Business, Fuel Transportation Business and Nuclear Consultation Services.

Recent Business and Financial Updates

- Initial Public Offering and Financials: NANO Nuclear recently announced the closing of the sale of an additional 384,375 shares of its common stock at USD 4.00 per share. This sale was pursuant to the full exercise of the underwriter’s over-allotment option, granted in connection with the company's initial public offering (IPO), which initially closed on May 10, 2024. The IPO, inclusive of the over-allotment, generated gross proceeds of approximately USD 11,787,500, with net proceeds amounting to approximately USD 10,460,560 after deducting underwriting discounts, commissions, and other expenses. The company’s common stock is traded on the Nasdaq Capital Market under the symbol “NNE”.

- Business Focus and Technological Development: NANO Nuclear is recognized as the first U.S. publicly listed company dedicated to the design and development of portable nuclear microreactors. According to the U.S. Department of Energy, microreactors are typically designed to produce between 1 to 20 megawatts of thermal energy, which can be used as heat or converted into electric power. NANO Nuclear's current designs target reactors producing 1 to 5 megawatts. The company aims to diversify and integrate vertically, seeking multiple revenue streams, including microreactor development, nuclear fuel fabrication, and transportation.

- Use of Proceeds: The net proceeds from the IPO will primarily fund the research and development of NANO Nuclear’s proprietary microreactor designs, named ‘ZEUS’ and ‘ODIN’. Additionally, the funds will be used to advance the company’s exclusive patented license for transporting commercial quantities of High-Assay, Low-Enriched Uranium (HALEU) fuel, crucial for the future of the advanced nuclear industry. NANO Nuclear also plans to develop a domestic source for HALEU fuel fabrication, serving both its microreactors and the broader advanced nuclear reactor industry. The proceeds will also support general corporate purposes and working capital needs.

- Strategic Objectives: NANO Nuclear's strategic goals include becoming a leader in the microreactor sector and ensuring a diversified and vertically integrated business model. By advancing its microreactor technology and establishing a domestic HALEU fuel fabrication pipeline, the company aims to secure a pivotal role in the advanced nuclear reactor industry. Through these efforts, NANO Nuclear seeks to provide clean, portable energy solutions and enhance its market position.

- Overview of Operations: NNE is an early-stage company, and its historical financial results may not be indicative of future performance. The company is currently focused on developing its operations, with a primary emphasis on research and development (R&D) activities. As such, the drivers of future financial results and the components of these results may differ significantly from historical trends. This report compares the financial outcomes for the three months ended December 31, 2023, with the same period in 2022, and the year ended September 30, 2023, with the period from February 8, 2022, to September 30, 2022.

- Research and Development Expenses: R&D expenses increased dramatically due to intensified R&D activities, particularly in the design and analysis of microreactors. For the three months ended December 31, 2023, R&D expenses were USD 520,016, a 307% increase from USD 127,705 in the same period in 2022. For the year ended September 30, 2023, R&D expenses surged by 993% to USD 1,534,000, compared to USD 140,304 for the initial eight-month period ending September 30, 2022. This increase is largely due to the ramp-up in operations as the company began to scale its activities. Equity-based compensation constituted a notable portion of these expenses.

- General and Administrative Expenses: G&A expenses also saw a significant rise, reflecting the expanded operations and increased personnel costs necessary to support R&D activities. For the three months ended December 31, 2023, G&A expenses were USD 828,896, a 49% increase from USD 556,440 for the same period in 2022. For the year ended September 30, 2023, G&A expenses increased by 417% to USD 4,749,395, compared to USD 919,520 for the period from February 8, 2022, to September 30, 2022. The increase was driven by higher office and administrative costs and significant equity-based compensation expenses.

- Other Income and Financial Activities: During the three months ended December 31, 2023, NNE earned USD 34,967 in interest income on its cash held at a financial institution, compared to no interest income in the same period in 2022. For the year ended September 30, 2023, NNE earned USD 32,994 in interest income. Additionally, during the period from February 8, 2022, to September 30, 2022, NNE was awarded a grant of USD 28,000 for subject matter expert support as part of the NRIC Resource Team program. This grant was fully earned by September 30, 2022.

- Liquidity and Capital Resources: As of December 31, 2023, NNE had approximately USD 7.9 million in cash and working capital of USD 7.7 million, compared to USD 7.0 million in cash and USD 6.9 million in working capital as of September 30, 2023. Despite negative operating cash outflows of USD 1,106,733 for the three months ended December 31, 2023, NNE believes its existing cash will fund its operations and R&D plans for at least the next twelve months. The future development towards commercialization will require significant additional cash resources, which the company plans to secure through public or private equity or debt financings, third-party funding, or a combination of these approaches. Failure to obtain additional funding could adversely affect the company’s operations and potentially lead to business failure.

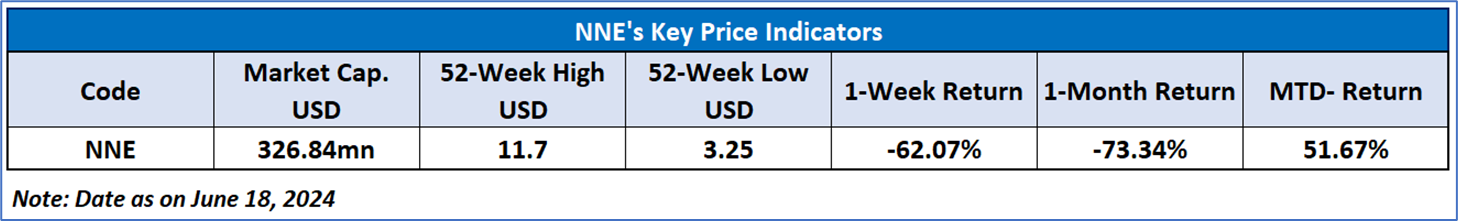

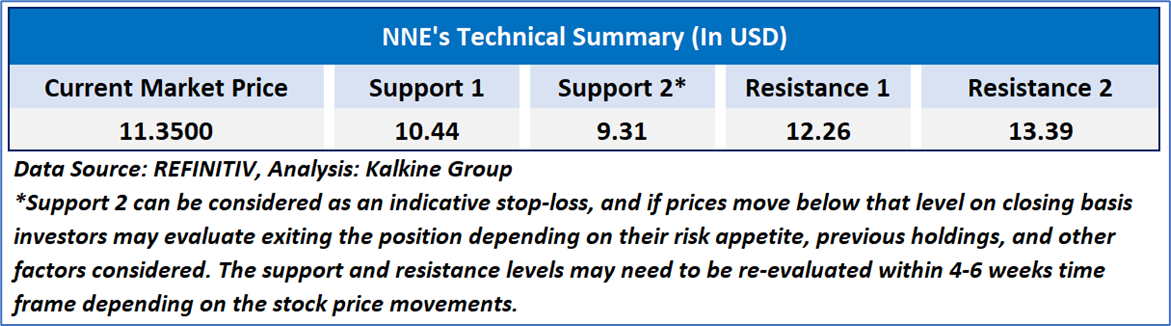

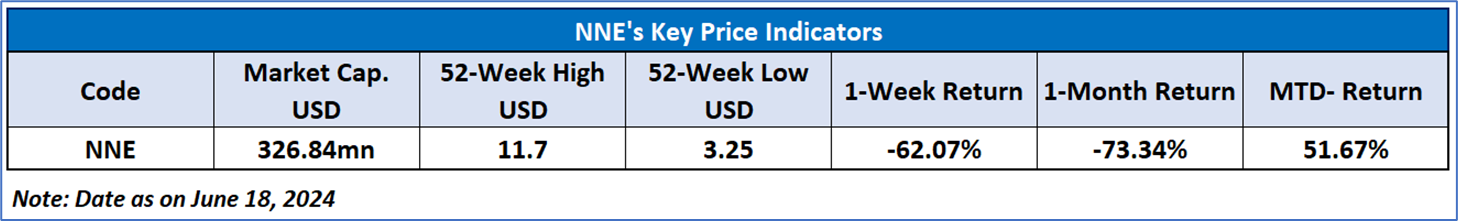

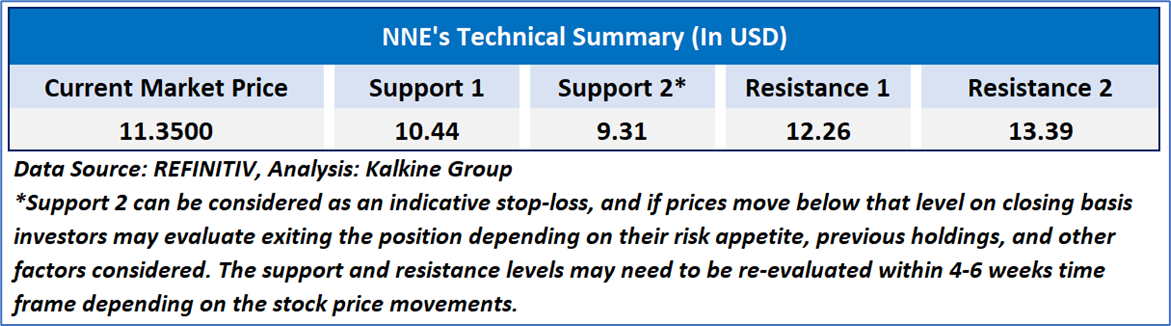

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is June 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

-Copy_06_18_2024_18_26_54_298930.jpg)