ZenaTech Inc

ZenaTech, Inc. (NASDAQ: ZENA) is a Canada-based technology company specializing in artificial intelligence (AI) drone solutions and enterprise SaaS solutions for mission-critical business applications. Its solutions include Drone Technology Solutions and Enterprise Software Solutions. Its drone technology solutions include ZenaDrone 1000 and ZenaDrone IQ. The ZenaDrone 1000 is a drone that combines software technology and custom hardware components, catering to diverse industries.

Recent Business and Financial Updates

Financial Performance: ZenaTech, Inc. (Nasdaq: ZENA) (FSE: 49Q), a technology leader specializing in Artificial Intelligence (AI)-powered drone solutions and enterprise Software-as-a-Service (SaaS) offerings, reported its financial results for the third quarter ending September 30, 2024. The Company achieved a revenue increase of USD 166,886, representing a 15% growth for the nine months ended September 30, 2024, compared to the same period in 2023. This quarter marks ZenaTech’s first as a publicly traded entity on Nasdaq, accompanied by significant achievements that underline its strategic priorities and growth trajectory.

Regulatory Approvals and Product Testing: ZenaTech’s subsidiary, ZenaDrone, reached a significant regulatory milestone with the approval from the U.S. Federal Aviation Administration (FAA) for visual line-of-sight commercial operations of its ZenaDrone 1000. This approval covers various applications, including land surveying, inspection, monitoring, and tracking, as per FAA specifications. To facilitate these operations, live drone testing commenced in the Arizona desert, and the Company expanded its Phoenix office and local operational capabilities. These developments enhance ZenaDrone’s market readiness and regulatory compliance, reinforcing its commercial prospects.

Innovation in AI Drones and Customer Adoption: The quarter also marked the launch of the IQ Nano, a compact, autonomous AI drone designed for indoor applications such as inspections, monitoring, and inventory management. This 10x10-inch drone is tailored for industries like warehousing and logistics, offering cost savings and productivity enhancements. In a significant development, a multinational auto parts manufacturer initiated the first paid trial of the IQ Nano in one of its U.S. warehouses. The drone autonomously collects inventory data by scanning barcodes, seamlessly integrating the information into the customer’s internal ERP systems.

Strategic Acquisitions and Intellectual Property: ZenaTech expanded its technological and revenue base through the acquisition of four software companies, pending shareholder and regulatory approvals. These companies include Jadian, DeskFlex, Interactive Systems, and InterlinkONE, each contributing to ZenaTech’s core drone solutions by integrating advanced functionalities such as compliance, office optimization, and warehouse management. Additionally, the Company acquired a U.S. design patent for the ZenaDrone 1000’s second-generation design. This patented improvement enhances flight performance and payload capacity, solidifying ZenaTech’s competitive edge in the drone technology sector.

Global Expansion and Compliance Initiatives: In a move to strengthen its international footprint, ZenaTech established its first Asian office in Taipei, Taiwan, alongside a new manufacturing entity, Spider Vision Sensors Ltd. The facility will produce sensors and components for ZenaDrone products while ensuring compliance with the U.S. National Defense Authorization Act (NDAA). This initiative enables ZenaTech to position itself as a qualified supplier to the U.S. military. Participation in a Trade Mission to Taiwan by ZenaTech’s CEO and CTO further highlighted the Company’s commitment to global expansion and operational excellence.

Market Presence and Future Outlook: To broaden its investor base and enhance market liquidity, ZenaTech listed its shares on the Frankfurt Stock Exchange under the symbol “49Q,” aligning with its existing European operations. CEO Shaun Passley, Ph.D., emphasized the Company’s progress in launching innovative products, expanding customer trials, and securing acquisitions to enhance recurring revenue. He highlighted the importance of regulatory approvals and manufacturing advancements in positioning ZenaTech for sustainable growth. The Company remains focused on leveraging these achievements to drive long-term value for its stakeholders.

Technical Observation (on the daily chart):

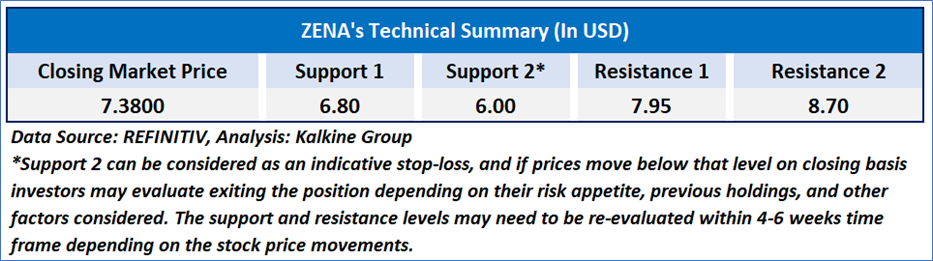

The 14-day Relative Strength Index (RSI) currently registers a value of 58.12, correcting from overbought zone, with the likelihood of consolidation in the near term. Furthermore, the stock is presently positioned above the 50-period Simple Moving Average (SMA), which is expected to act as dynamic support levels in the short to medium term. The price is taking support near the range of USD 5.50-USD 6.00; should this level hold, it may trigger an upward momentum, potentially driving the price toward its 52-week high levels.

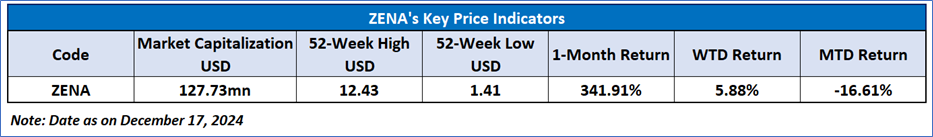

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given for ZenaTech, Inc. (NASDAQ: ZENA) at the closing market price of USD 7.38, as of December 17, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.