Image Source : Krish Capital Pty Ltd

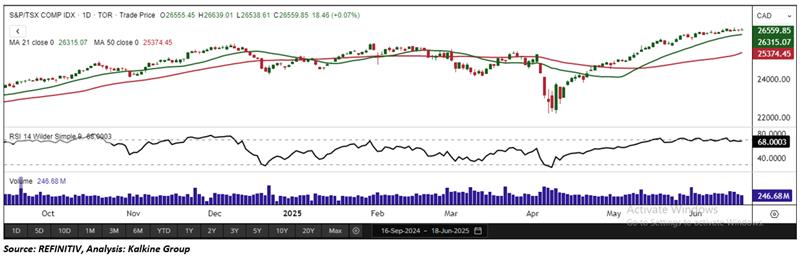

Index Update: The benchmark S&P/TSX Composite Index, after opening past yesterday's close, rallied for an hour hitting the day's high of 26,639.01. It continued to swing past noon after which it managed to settle at 26,559.85 up by 18.46 (or 0.07 percent).

Macro Update: The US Federal Reserve left the interest rates unchanged at 4.25% to 4.50% for the fourth consecutive time. This decision was broadly in line with market expectations. Notably, the Fed has projected two rate cuts later this year. US participation could escalate the crisis by increasing the chances of Iran's allies joining the war and prolong the conflict thus impacting the global financial and commodity markets severely.

Top Movers: Bausch Health Companies (8.46%), Celestica (3.39%), Constellation Software (1.80%), and Brookfield Corporation (2.96%) were the prominent gainers.

Our Stance: The index is currently testing key support near 26,300. Maintaining this level is crucial to sustaining the bullish trend. A break below could trigger a pullback toward the next support areas around 25,900 and 25,700. Conversely, holding above these levels will be important for preserving upward momentum in the sessions ahead.

Commodity Update: The dollar held firm Thursday amid Fed Chair Powell’s cautious inflation stance and rising Middle East tensions, keeping market sentiment fragile. The Fed kept rates unchanged, signaling possible cuts later this year, though consensus was mixed. Gold slipped 0.42% to $3,393.75, silver fell 0.36%, and copper edged down 0.10%. Brent crude declined 0.48% to $76.33 as uncertainty over U.S. action in the Israel-Iran conflict weighed on investors.

Technical Update: On Wednesday, the S&P/TSX Composite Index posted a modest gain of 18.46 points, closing at 26,559.85, an increase of 0.07%. The advance reflects ongoing investor confidence, supported by strong trading volumes with the healthcare sector standing out, surging 4.80% to lead the gains. From a technical standpoint, the index continues to trade comfortably above its 21-period Simple Moving Average (SMA), reinforcing a bullish short-term outlook. The Relative Strength Index (RSI) is at 68.00, highlighting solid momentum, though edging closer to overbought territory. The index is currently testing key support near 26,300. Maintaining this level is crucial to sustaining the bullish trend. A break below could trigger a pullback toward the next support areas around 25,900 and 25,700. Conversely, holding above these levels will be important for preserving upward momentum in the sessions ahead.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.