Image Source : Krish Capital Pty Ltd

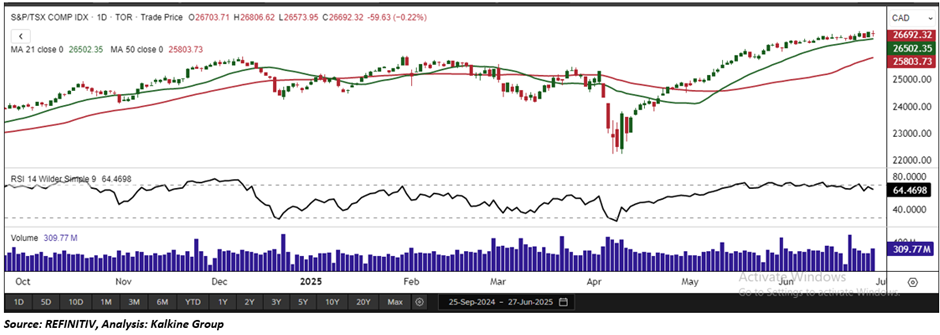

Index Update: The S&P/TSX Composite Index fell 0.22% to below 26,692.32 on Friday, trimming weekly gains to 0.7%, as renewed trade tensions and weak domestic data pressured Canadian equities. President Trump’s termination of trade talks with Canada over the digital services tax and threats of retaliatory tariffs, shook confidence across trade-exposed sectors.

Macro Update: Policy-Driven Rebound Hinges on Trump’s Economic Direction: Markets appear to be betting that Trump 2.0 will back away from aggressive tariff enforcement while pushing forward on tax cuts and deregulation. The removal of Section 899 retaliation tax in the “One Big Beautiful Bill” further supports bullish sentiment, though the return of tariffs after the 90-day pause remains a wildcard. Cracks Widen in the US Housing Market: Affordability has deteriorated for the 14th straight quarter, with median homeownership costs now consuming 33.7% of average income. New home sales have disappointed, inventories are climbing to 2007–09 levels, and builders are increasingly reliant on incentives to move product — all signs of a weakening sector. Housing Sector Weakness May Spill Over Into Broader Economy: The slowdown in housing threatens construction jobs and consumer confidence, both critical to economic momentum. With high mortgage rates and sluggish wage growth, the risk of a housing-led drag on GDP is growing — even if it hasn’t yet shown up in labor data.

Top Movers and Losers: The biggest gainers of the session on the S&P/TSX Composite were CAE Inc. (TSX: CAE), which rose 5.28%. EQB Inc (TSX: EQB) added 5.02% and TC Energy Corp (TSX: TRP) was up 2.43%. Biggest losers included Lundin Gold Inc (TSX: LUG), which fell 7.92%. G Mining Ventures Corp (TSX: GMIN) declined 7.51% and Energy Fuels Inc. (TSX: EFR) down 5.84%.

Our Stance: The index continues to trade above its 21-period Simple Moving Average (SMA), indicating that the broader bullish trend remains intact. The SMA serves as a key gauge of market momentum, and the index’s position above it reinforces the potential for continued upside movement. Additionally, the Relative Strength Index (RSI) currently stands at 64.46, reflecting a balanced market condition that is neither overbought nor oversold.

Commodity Update: The dollar hovered near a four-year low against the euro on Monday amid optimism over U.S. trade deals, boosting expectations of early Fed rate cuts. Uncertainty rose as President Trump abruptly ended trade talks with Ottawa. Gold increased 0.07% to $3,289.90, silver slipped 0.38% to $35.90, and copper fell 0.22% to $9,855.30. Brent crude fell 0.97% to $67.11 as easing geopolitical risks weighed on prices.

Technical Update: On Friday, the S&P/TSX Composite Index closed at 26,692.32, marking a modest decline of 0.22%. The downturn was primarily driven by weakness in the basic materials sector, which recorded a notable drop of 2.82%. Despite this pullback, the index continues to trade above its 21-period Simple Moving Average (SMA), indicating that the broader bullish trend remains intact. The SMA serves as a key gauge of market momentum, and the index’s position above it reinforces the potential for continued upside movement. Additionally, the Relative Strength Index (RSI) currently stands at 64.46, reflecting a balanced market condition that is neither overbought nor oversold. At present, the index is testing a critical support level near 26,400. Holding above this level will be crucial for sustaining upward momentum. If the index manages to remain above this threshold, it could provide a solid base for a renewed rally. Conversely, a decisive break below this support zone may open the door for further downside, potentially triggering a pullback toward the next significant support levels in the 26,100–25,800 range.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.