Image Source : Krish Capital Pty Ltd

Index Update: The S&P/TSX Composite Index rose 0.2% to close at 26,426 on Tuesday, just shy of last week’s record high, supported by optimism over a potential thaw in US–China trade tensions.

Macro Update: Trade negotiations between the world's two largest economies commenced on Monday - and while U.S. Commerce Secretary Howard Lutnick told reporters the talks are "going well," there has been no breakthrough as of yet. The focus is now on the US Labor Department which shall be releasing Consumer Price Index (CPI) data on Wednesday. CPI is a crucial input for the Federal Reserve to decide on the monetary policy and interest rates.

Top Movers: The biggest gainers of the session on the S&P/TSX Composite were Baytex Energy Corp (TSX:BTE), which rose 6.40% or 0.16 points to trade at 2.66 at the close. Tilray Inc (TSX:TLRY) added 5.45% or 0.03 points to end at 0.58 and Linamar Corporation (TSX:LNR) was up 4.82% or 2.99 points to 64.97 in late trade.

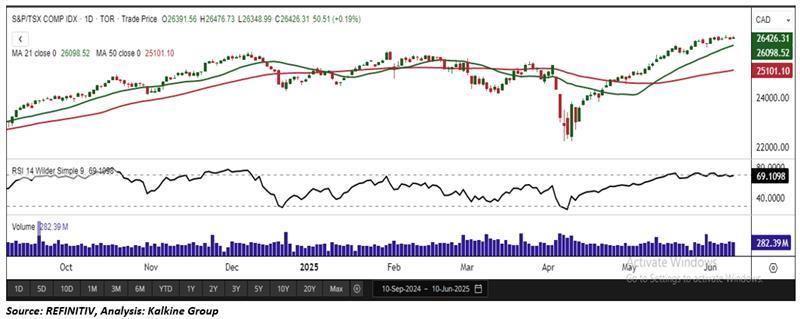

Our Stance: From a technical perspective, the index remains comfortably above its 21-period Simple Moving Average (SMA), reinforcing a bullish short-term outlook. The index is currently testing a key support level of around 26,100. Holding above this threshold is essential to preserve the current bullish trend. A breakdown below could lead to a pullback toward the next support zones near 25,800 and 25,600.

Commodity Update: The dollar held steady on Wednesday as investors welcomed a potential U.S.-China trade agreement framework, raising hopes of easing trade tensions. Gold rose 0.49% to $3,359.59, silver edged up 0.23% to $36.72, and copper gained 0.05% to $9,759.65. Brent crude dipped 0.36% to $66.63 amid cautious sentiment, with traders awaiting President Trump’s review and concerns over weak Chinese demand and rising OPEC+ output.

Technical Update: On Tuesday, the S&P/TSX Composite Index advanced by 50.51 points, closing at 26,426.31 — a gain of 0.19%. The upward move reflects continued investor confidence, supported by strong trading activity, particularly in the healthcare sector, which outperformed with a 3.09% surge. From a technical perspective, the index remains comfortably above its 21-period Simple Moving Average (SMA), reinforcing a bullish short-term outlook. The Relative Strength Index (RSI) stands at 69.10, indicating strong momentum while approaching overbought conditions. The index is currently testing a key support level of around 26,100. Holding above this threshold is essential to preserve the current bullish trend. A breakdown below could lead to a pullback toward the next support zones near 25,800 and 25,600. Sustained movement above these levels will be crucial for maintaining upward momentum in the sessions ahead.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.