Company Overview: Caterpillar Inc. is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The Company operates through segments, including Construction Industries, which is engaged in supporting customers using machinery in infrastructure, forestry and building construction; Resource Industries, which is engaged in supporting customers using machinery in mining, quarry, waste and material handling applications; Energy & Transportation, which supports customers in oil and gas, power generation, marine, rail and industrial applications, including Cat machines; Financial Products segment, which provides financing and related services, and All Other operating segments, which includes activities, such as product management and development, and manufacturing of filters and fluids, undercarriage, tires and rims, ground engaging tools, fluid transfer products, and sealing and connecting components for Cat products.

.png)

CAT Details

Delivered Strong Results in 1Q FY19 with Adjusted Profit Per Share at $2.94: Caterpillar Inc. (NYSE: CAT), is the world’s leading manufacturer of construction and mining equipment, and also deals into diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company caters to 3 segments - (a) Construction Industries, (b) Resource Industries, and (c) Energy & Transportation. Offering for financing services comes under the segment of Financial Products for the company. Meanwhile, the company is currently focusing on to double its sales from Machine, Energy & Transportation (ME&T) services to around $28 billion by the year 2026 from ~$14 billion in 2016. CAT currently provides services that include all the things required to support the customer success after they purchase the equipment from the company. This includes, aftermarket parts sales and solutions that are digitally enabled, which helps its customers to maximize asset utilization, increase their efficiency, lower their owning and operating costs and provide the company with regular revenue stream so that the company continues to improve profitability.

.png)

Double ME&T Services Sales by 2026 (Source: Company Reports)

Raised Dividend, Capital Management: The company has decided to increase the quarterly cash dividend by 20% to $1.03 per share of common shares, based on the improved performance and profitability of the company. The dividend will be payable on August 20th, 2019, to the shareholders, who will have their names on record at the close on July 22th, 2019. The company has planned to increase the dividend by at least a high single-digit percentage after every 4 years. Meanwhile, the company had also repurchased $751 Mn of common stock in 1Q FY19 and paid dividends amount to $494 Mn.

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table which together form around 34.48% of the total shareholding. The Vanguard Group, Inc. and State Street Global Advisors (US) hold maximum interest in the company at 8.95% and 8.31%, respectively.

.png)

Top 10 Shareholders (Source: Thomson Reuters)

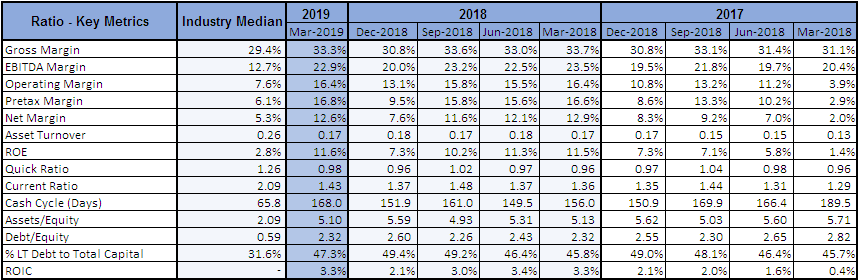

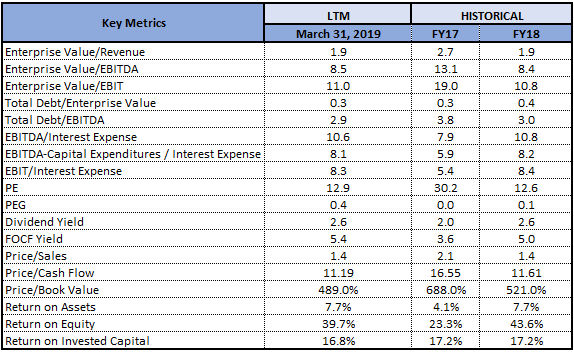

Key Metrics: The company has been enjoying strong margin from the last few quarters with an operating profit margin at 16.4% for the first quarter of FY19 and FY18. EBITDA margin has remained above 20% level in FY18 and for 1Q FY19, depicting healthy operation by the company. ROE above 11% in 1QFY19 is above the industry median of 2.8%, indicating that the company is successful in generating cash internally. Debt Equity ratio in last nine quarters has remained above 2x level which seems justifiable considering the capital-intensive business, the company is into.

Key Metrics (Source: Thomson Reuters)

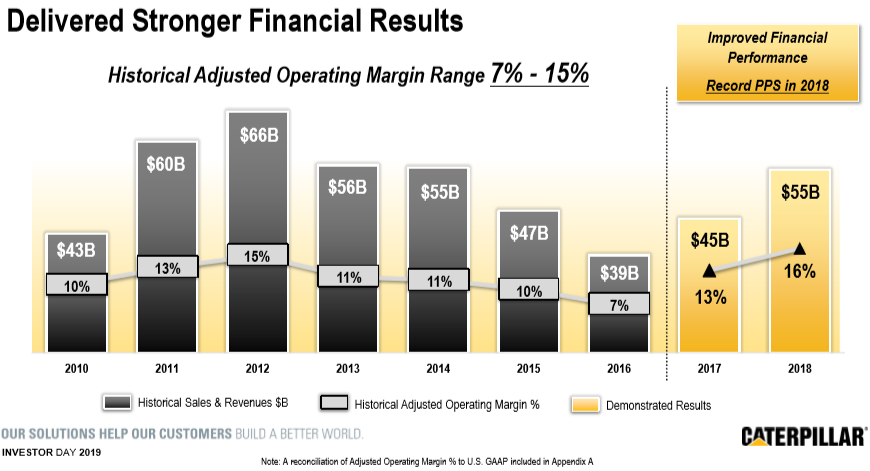

Set New Targets for Operating Margin: Over the past two years, CAT has improved its financial performance substantially. In 2014, the company had reported the sales of ~$55 billion and adjusted operating margin of 11%. At the 2017 Investor Day, the company had projected to improve its adjusted operating margin in the ambit of 2 per cent - 5 per cent, if the company’s sales return to this level further. In 2018, the company had again posted the sales and revenues of ~$55 billion whereas adjusted operating margin improved to 16%, which was the company’s top end of the projected improvement range. Moreover, based on the past performance, the company now intends to increase the targeted future adjusted operating margins in the range of 3-6 percentage points, which will be above the company’s historical performance from 2010 to 2016.

Operating Margin Trend (source: Company Reports)

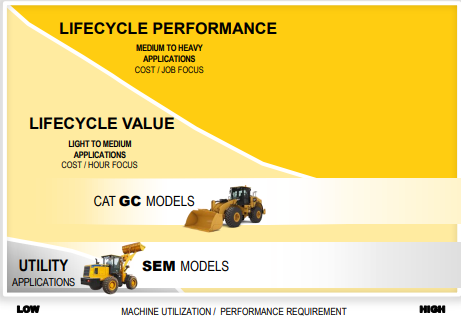

Strong Customer Base through New Offerings: CAT continues to expand its presence into untapped market segments and regions and plans to grow the number of their new offerings by 2021. The company has currently 24 new or refreshed GC Models and 27 new or refreshed Utility Models to offer to its customers. CAT believes in the policy to reach new customers with the right product for right job.

New Offerings to Increase the Customer Base (Source: Company Reports)

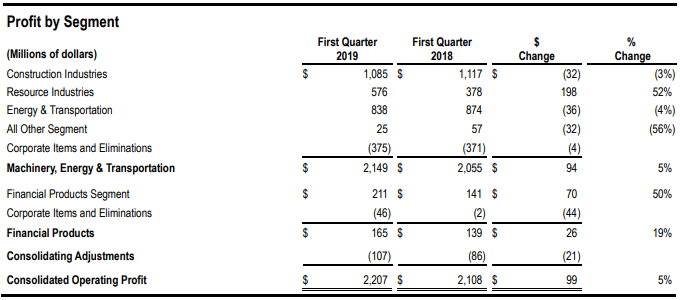

Better than Expected Performance for First Quarter 2019: CAT has posted better than expected results for the first quarter of FY19. The company reported the adjusted earnings per share of $2.94 in 1Q FY19, better than $2.82 in 1Q FY18. The company had reported the adjusted revenue growth of 5% to $13.47 billion in the first quarter of FY 19. CAT has improved its operating profit to $2.207 billion in 1Q FY19, compared with $2.108 billion in the first quarter of 2018 on the back of higher realized price and higher sales volume. Higher manufacturing costs and SG&A (selling, general and administrative), R&D (research & development) expenses adversely impacted the advantage of higher sales volume and realized price. A Rise in manufacturing costs was largely on the back of increase in cost of variable labor and burden (comprises of the freight costs, and material costs, including tariffs). The company recorded higher selling, general and administrative/Research & Development expenses in 1Q FY19 due to a rise seen in investments and the timing of corporate-level expenses, but part of it was offset by the lower short-term incentive compensation expense. The company has posted the operating profit margin of 16.4% for the first quarter of FY19 and FY18. During the first quarter of FY 19, Caterpillar’s mining equipment business reported the strongest growth of 18% in revenue to $2.7 billion on year-on-year basis. Profit from this segment grew by 52% to $576 million and the segment’s margins had expanded by 470 basis points to 21.1% during the first quarter. Caterpillar’s construction equipment segment posted the sales growth of 3% to $5.87 billion and the segment profit was almost flat at $1.085 billion. Revenue from Energy and Transportation was also flat at $5.21 billion during the first quarter and the profit of this segment profit fell slightly to $838 million. This was driven by a stronger U.S. dollar that had offset the gains in pricing and volumes.

Profit from Segment (Source: Company Reports)

On the geographical front, sales in North America witnessed a growth of 13%, driven by higher demand for new equipment, primarily to support road construction activities. Higher price realization supported significant sales growth. Construction activities in Latin America for 1QFY19 remained low. In EAME lower sales was recorded, primarily on the back of a smaller increase in dealer inventories as compared to the 1Q FY18. Weakness in euro was partially offset by positive price realization. Sales in Asia/Pacific witnessed a downtick on the back of unfavorable currency impacts.

Rio Tinto & Caterpillar signed an agreement: The world-renowned Rio Tinto has recently signed an agreement with Caterpillar to supply and support mining machines, automation and enterprise technology systems for its new Koodaideri iron ore mine, located in Western Australia. As per the agreement, Rio Tinto and Caterpillar both will work for the creation of an automated mine operation with the best use of data analytics to optimize production, accelerate the use of mining machine and will ultimately lower the costs. With the advancement of mine construction, WesTrac will play a key role in implementing technology solutions. Further, as per the agreement, CAT will provide to Rio Tinto with 20 autonomous 793F trucks and 4 robotic blast drills, along with other equipment like loaders, water carts, dozers, graders and diggers. Koodaideri mine is owned by Rio Tinto (100%), located ~35 Km north-west of Rio Tinto’s Yandicoogina mine site, and ~110 Km from the town of Newman. Mine worth $2.6 billion was approved in the month of November 2018 with construction commencing earlier in 2019.

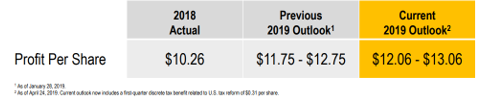

Outlook for FY19: CAT during the first quarter of 2019 had received the discrete tax benefit of $178 million, which is equivalent to $0.31 per share, and was related to U.S. tax reform due to the result of final regulations that is been recently issued by the U.S. Treasury. Due to this discrete tax benefit, the company has revised its outlook for 2019 profit per share and now expects it to be in the range of $12.06 to $13.06, compared to the company’s previous outlook for earnings per share range of $11.75 to $12.75. Additionally, for FY19, CAT expects the short-term incentive compensation to be about $500 million and restructuring costs to be the range of approximately $100 million to $200 million. For the full year 2019, the projected annual tax rate is expected to remain unchanged at 26%, except for the discrete tax item. For FY19, CAT expects the capital expenditures to be in the range of $1.3 billion to $1.5 billion.

Full Year 2019 Outlook (Source: Company Reports)

Key Valuation Metrics (Source: Thomson Reuters)

Valuation Methodology:

Method 1: Price to Cash Flow multiple Approach (NTM):

P/Cash Flow Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

Method 2: EV/EBITDA Multiple Approach (NTM):

.png)

EV/EBITDA Multiple Approach (Source: Thomson Reuters)

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: Stock is trading at a price of $131.95, and has support at $129.37 level and resistance in the range of about $143. The company has achieved decent profitability over the past few years due to the execution of its business strategy meant for growing profit through the operational expertise and expansion of offerings and services. The company invests through the Operating and Execution Model. The company’s existing balance sheet remains strong which will underpin inorganic growth opportunities. The management of the company has increased its quarterly cash dividend by 20% to $1.03 per share (common share, which will be paid on 20 August 2019 with the record date of 22 June 2019. The company is of the view to return major part of its (ME&T) free cash flow to its shareholders via the rise in dividend and share repurchases. Additionally, the company expects to double its ME&T services sales to $28 billion by 2026 and plans to deliver higher adjusted operating margins in the range of 3-6 percentage points which is above the company’s past performance. Caterpillar’s updated long-term guidance suggests that company will be accelerating its service offerings, which will ultimately lead to the improvement of the operating margin. Considering the aforesaid parameters and decent outlook of the business, we give a “Buy” recommendation on the stock at current market price of $131.95 per share (down 1.29% on 08 May 2019) with an expectation of a single-digit upside in the next 12-24 months.

.png)

CAT Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.