Company Overview: ConocoPhillips is an independent exploration and production company. The Company explores for, produces, transports and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG) and natural gas liquids. The Company operates through five segments: Alaska, Lower 48, Canada, Europe and North Africa, Asia Pacific and Middle East, and Other International. The Alaska segment explores for, produces, transports and markets crude oil, natural gas liquids, natural gas and LNG. The Lower 48 segment consists of operations located in the United States Lower 48 states and the Gulf of Mexico. Its Canadian operations consists of oil sands developments in the Athabasca Region of northeastern Alberta. The Europe and North Africa segment consists of operations and exploration activities in Norway, the United Kingdom and Libya. The Asia Pacific and Middle East segment has exploration and production operations in China, Indonesia, Malaysia and Australia.

.png)

COP Details

Long Term Value Creation Underpinned by Strong Execution: ConocoPhillips (NASDAQ: COP) is an independent E&P (Exploration and Production) company, headquartered in Houston, Texas with operations and activities in 17 countries. As at 30 June 2019, the group employed around 10,900 employees worldwide and had total assets worth $71 Bn. COP is the world’s largest E&P company in terms of production and proved reserves which came in at 1,303 thousand barrels of oil equivalent per day (MBOED) (excluding Libya) for the six months ended June 30, 2019 and 5.3 BBOE as of December 31, 2018, respectively. It is worth noting that the group was formed through the merger between Conoco Inc. and Phillips Petroleum Company that was accomplished on August 30, 2002; and since then, the group has demonstrated value through its business strategy and exploration plans.

The exploration business aims to produce, transport and market crude oil, bitumen, natural gas, LNG and natural gas liquids on a worldwide basis, operations of which are managed via six operating segments, primarily defined by geographic region- (a) Alaska, (b) Lower 48, (c) Canada, (d) Europe and North Africa, (e) Asia Pacific and Middle East, and (f) Other International. Looking at the production mix of FY18, Crude oil accounted for 51%, followed by natural gas, which represented 36% of the total production. NGL and bitumen contributed 8% and 5%, respectively towards the production portfolio.

The company’s worldwide consolidated sales and other operating revenues at $36,417 million in FY18 from $23,693 million in FY16 witnessed a CAGR growth of 24.0% over the period of FY16-FY18 with long-lived assets of $55,038 million in FY18 from $79,276 million in FY16. Since FY17, the company has taken numerous actions to improve the underlying quality of the business with the strengthened balance sheet. FY18 was characterized by cash from operations that exceeded capital spending by $5.5 billion. The period also saw a debt reduction of $4.7 billion, thus achieving total debt target of $15 billion, 18 months early. The period also witnessed a 35% payout of cash from operations to its shareholders via dividend and share buybacks amounted to $3 billion.

.png)

Historical Revenue and Long-Lived Assets Trend (Source: Company Reports)

Coming to the marketing activities, the company markets its natural gas to the US, Canada, Europe, and Asia whereas crude oil, bitumen and natural gas liquids derive the revenue from the US, Canada, Australia, Asia, Africa, and Europe. LNG is primarily sold under long-term contracts with prices based on market indices to Australia and Qatar. The company has few energy partners such as Marine Well Containment Company (MWCC), Subsea Well Response Project (SWRP), Oil Spill Response Removal Organizations (OSROs), etc.

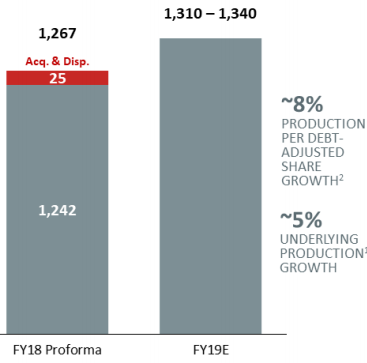

Going forward, COP intends to continue with a disciplined approach like FY18, with a capital budget of $6.1 billion, a focused per share growth, rising dividend, and planned share repurchases for 3rd consecutive year. On the operational front, the company will conduct exploration, appraisal, and development in the Lower 48, Alaska, Canada and Europe, with major project decisions pending in China, Australia, and elsewhere. With 2019 operating plan capital guidance of $6.3 billion, the company’s production is likely to be in the range of 1,310 to 1,340 MBOED with underlying production growth of 5%.

Highlights of 2QFY19 Results: The company recently announced the second-quarter 2019 results, which were highlighted with strong free cash flows and financial returns, and revised buy-back plan for 2019. Total revenue including other income for the quarter was down ~9% to $8,380 million as compared to $9,240 million in 2QFY18. Net income for the period at $1,597 million was dipped by 3% as compared to $1,654 million in the prior corresponding period. Basic and Diluted EPS for the period stood at $1.40 per share as compared to $1.40 and $1.39 per share, respectively in 2QFY18. Sequential adjusted earnings were impacted by lower LNG and gas prices and lower volumes, largely offset by higher crude prices. Decline in yoy adjusted earnings was due to lower realizations, slightly offset by higher volumes.

.png)

2QFY19 Adjusted Earnings (Source: Company Reports)

At the end of the period, cash from operations came in at $2.9 billion. Cash from operation (ex-working capital) stood at $3.40 billion, surpassing capex and investments, with free cash flow of $1.7 billion.

Segment-Wise Performance:

ALASKA: This segment is engaged with exploration, production, transportation and marketing of crude oil, natural gas and natural gas liquids (NGL). COP is the largest crude oil producer in Alaska with a stake in two of North America’s largest oil fields located on Alaska’s North Slope – (a) Prudhoe Bay, (b) Kuparuk. The segment contributed ~23% of the total worldwide liquids production and less than 1% of natural gas production in 2018 with an average daily net production of 186 MBOED. During YTD 2019, in Alaska, the winter exploration program was accomplished with inspiring outcomes on the Greater Willow Area and Narwhal appraisal tests.

Lower 48: This segment involves the activities located in the contiguous US and the Gulf of Mexico. In 2018, the segment accounted for ~36% of the company’s worldwide liquids production and ~21% of natural gas production. During YTD 2019, the segment witnessed accelerated activities in the Big 3 unconventionals with higher production for 2Q, which came at 367 MBOED.

.png)

Big 3 Production (Source: Company Reports)

Canada: This segment comprises the development of oil sands in the Athabasca Region of northeastern Alberta and a liquids-rich unconventional play in western Canada. In 2018, the segment reflected the contribution of 8% of the company’s worldwide liquids production and less than 1% of natural gas production. During YTD 2019, the segment completed the operations on the 14-well Montney pad and construction activities related to infrastructure advanced as planned with a startup on track for 4Q.

Europe and North Africa: The segment comprises operation and exploration activities in Norway, UK and Libya and contributed 19% of the company’s worldwide liquids production and 18% of natural gas production in 2018. During YTD 2019, the company completed turnarounds in 2Q, predominantly at Greater Ekofisk in Norway, Surmont in Canada and Prudhoe Bay in Alaska.

Asia Pacific and Middle East: This segment involves E&P operations in China, Indonesia, Malaysia, and Australia along with production activities in Qatar and Timor-Leste. The segment contributed 14% of the company’s worldwide liquids production and 60% of natural gas production in 2018. During YTD 2019, in Qatar, the company continued interest in North Field expansion and in Malaysia, first gas from KBB to 3rd party floating LNG unit was completed with ramping up activities from 2H19.

Other International: The segment is engaged with activities related to exploration in Colombia and Chile.

6-Months FY19 Review: Earnings for the period stood at $3.4 billion or $3.0 per share in comparison with earnings in the prior corresponding period of $2.5 billion or $2.13 per share. Adjusted earnings for the period came in at $2.3 billion or $2.01 per share against $2.4 billion or $2.05 per share in 6 months of FY18. The period saw a production (ex-Libya) of 1,303 MBOED with a rise of 87 MBOED on the production of 1,216 MBOED for the same period in 2018. Ex-net A&D (acquisitions and dispositions) benefit of 28 MBOED, production witnessed a growth of 5%, largely driven by growth from Big 3 unconventional, development programs and major projects, however, slightly offset by normal field decline and higher planned downtime.

Healthy Free Cash Flows: It was the seventh quarter in a row when the company generated free cash flows while sticking to its disciplined plans and delivering on targets. The first half of FY19 saw cash by operating activities of $5.8 billion with CFO amounted to $6.4 billion, surpassing the total of $3.4 billion in capex and investments, $2.0 billion in share repurchases and $0.7 billion in dividends.

.png)

Strong FCF with Prudent Allocation (Source: Company Reports)

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together form around 30.33% of the total shareholding. The Vanguard Group, Inc., and State Street Global Advisors (US) hold the maximum interest in the company at 8.11% and 5.04%, respectively.

.png)

Top 10 Shareholders (Source: Thomson Reuters)

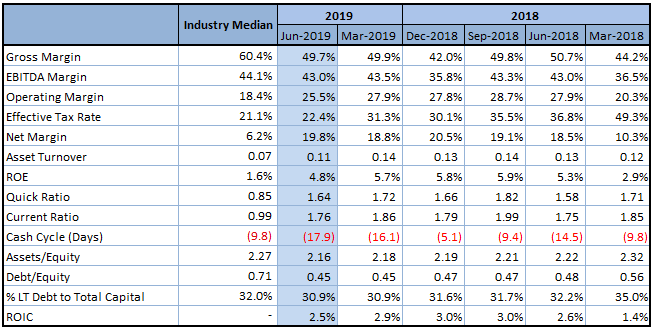

Key Metrics: During 1Q, the company posted strong operating and net margin at 25.5% and 19.8%, higher than the industry median of 18.4% and 6.2%, respectively. ROE for 2Q at 4.8% was also higher as compared to the industry median of 1.6%.

Key Ratio Metrics (Source: Thomson Reuters)

Share Repurchase Plan for 2019: The Management has increased its planned Share Repurchase Program to $3.5 billion. During the quarter, the company bought back shares worth $1.2 billion and paid $0.3 billion in dividends to its shareholders in 2QFY19. The buy-back and payment of dividend, both were fully funded from free cash flow, which represented a return of 47% of CFO (cash from operations) to shareholders.

2019 Operating Plan Sets up Strong Multi-Year Outlook: The Management expects operating plan capital to be at $6.3 billion as compared to $6.1 billion, owing to additional exploration and appraisal drilling in Alaska and the addition of a drilling rig in the Eagle Ford Field at mid-year. This guidance does not include ~$0.3 billion for opportunistic acquisitions completed or announced. The projection also does not include the obligations under the recently announced production sharing contract extension awarded by the Government of Indonesia.

Production for the third quarter of 2019 is likely to come in the range of 1,290 - 1,330 MBOED, which reflects planned turnarounds in Alaska, Europe and Asia Pacific. FY19 production is projected to be in the range of 1,310 - 1,340 MBOED. The projection does not include Libya.

Production Guidance (Source: Company Reports)

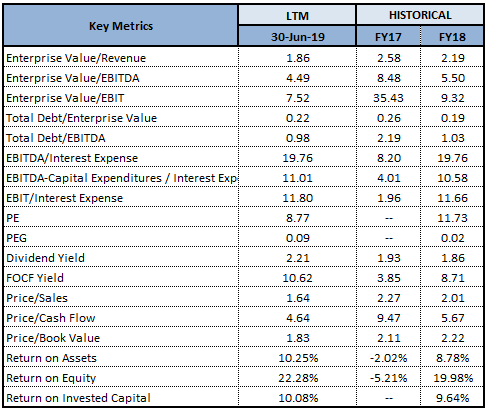

Key Valuation Metrics (Source: Thomson Reuters)

Valuation Methodology:

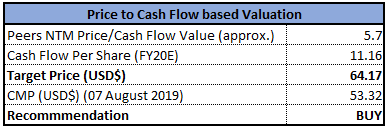

Method 1: Price/Cash Flow Based Valuation (NTM):

Price/Cash Flow Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

Method 2: EV/EBITDA Based Valuation (NTM):

.png)

EV/EBITDA Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: At the current market price of $53.32, the stock is available at a price to multiple of 8.48x (on TTM basis). On the operational front, the company witnessed production of 1,290 MBOED in 2Q with successful completion of turnarounds. The company accelerated ramp-up of Lower 48 Big 3 production and acquired opportunistic bolt-ons in Lower 48 Big 3 which will support to drive top-line growth in years to come. The company has rewarded the shareholders through free cash flows, strong execution, and decent dividend yield, which is currently at 2.23%. Based on the foregoing, we have valued the stock using two relative valuation methods, Price to Cash Flow multiple and EV/EBITDA multiple, and have arrived at the target price of ~$64 (+/-20 bps) (double-digit growth (in %)). Hence, we recommend a “Buy” rating on the stock at the current market price of $53.32 per share, down 1.68% on 07 August 2019.

COP Daily Technical Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.