Company Overview: Dell Technologies Inc., formerly Denali Holding Inc., is a provider of information technology solutions. The Company operates through two segments: Client Solutions and Enterprise Solutions Group (ESG). The Client Solutions segment includes sales to commercial and consumer customers of desktops, thin client products and notebooks, as well as services and third-party software and peripherals closely tied to the sale of Client Solutions hardware. Its offerings include hardware, such as desktop personal computers, notebooks and tablets, and peripherals, such as monitors, printers and projectors, as well as third-party software and peripherals. It also offers cloud-enabled data analytics and infrastructure management services. The ESG segment includes servers, networking and storage, as well as services and third-party software and peripherals that are closely tied to the sale of ESG hardware. It designs, develops, manufactures, markets, sells and supports a range of products and services.

DELL Details

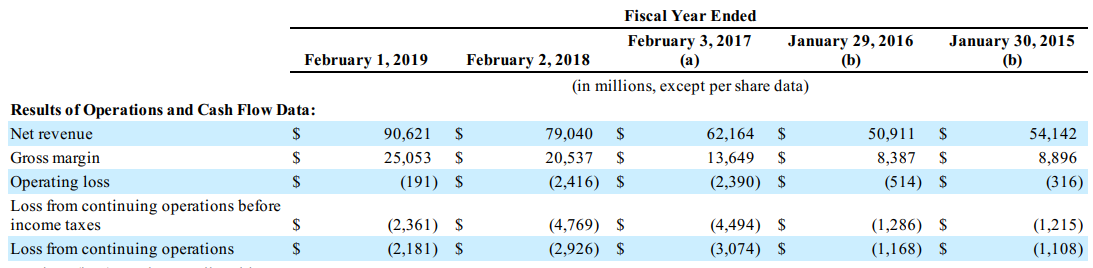

Long-term Business Visibility Aided by Growth Across High End to End IT Solution: Dell Technologies Inc. (NASDAQ: DELL) is an integrated technology company, operating in IT and hardware segment. The company provides services like cloud solutions, manufactures and distributes desktops, laptops, notebooks across the globe. DELL is known for its products like Dell, Dell EMC, Pivotal, RSA, Secureworks, Virtustream and VMware. The company derives revenue from the subscription of fees for providing cloud infrastructure. The company continues to lead across the markets where it competes, and the same include virtualization, storage, servers and PCs. DELL EMC has a market share of ~17.8% in public & private cloud IT infrastructure and ~34.4% in external enterprise storage segment. Looking at the past financial performance, Dell Technologies’ topline grew at a CAGR of ~13.7% over the period of FY15-FY19. The company reduced its operating losses to $191 million in FY19 from $316 million in FY15 and witnessed a turnaround in 1QFY20 with a profit of $293 million which further accelerated in Q2FY20 to $3,689 million. The company tends to benefit from higher IT spending as organizations continue to transform and invest in the solutions that drive their digital transformation.

As per IDC forecast, IT spending through 2023 ex-telco projects growth is likely to grow more than 2x real GDP or ~4.3% per year on average. The company’s operating model is positively driven by a strong product portfolio, which ensures better than industry growth and generation of robust cash flow. The research and development team constantly nurtures the portfolio with the right combination of innovation and integration, in an effort to provide a simplified IT experience to the end-users. The above factors combined show higher business visibility, backed by growing market share in its own segments.

Going forward, with the vision to become the essential infrastructure company – from the edge to the core to the cloud, DELL is likely to continue powering its customers to innovate for their digital future in a hybrid and multi cloud world. We expect DELL to excel further in terms of growth seen in top-line and bottom-line along with margins and cash flows.

Historical Financial Highlights (Source: Company Reports)

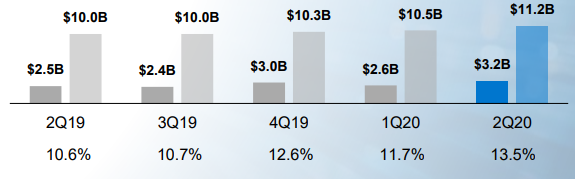

Q2FY20 Financial Highlights for the period ended 2 August 2019: The company posted a decent set of numbers for the quarter wherein profitability continued with robust net margin. DELL reported net revenue of $23,370 million in Q2FY20, posting a growth of ~2% on pcp. Net income stood at $4,505 million as compared to a loss of $461 million on Q2FY19. Non-GAAP revenue at $23,454 million posted a growth of 1% on pcp basis while non-GAAP net income came in at $1,751 million with pcp growth of ~39%. The company reported adjusted EBITDA of $3,156 million, a rise of ~8.5% from the previous corresponding quarter while Non-GAAP EBITDA margin came in at ~13.5% as compared to ~10.6% on Q2FY19.

The quarter was marked by the launch of new OptiPlex 7070 Ultra, an innovative desktop with the industry’s most flexible, zero-footprint desktop design. Additionally, DELL launched Unified Workspace, an integrated solution for end-user computing that simplifies the entire device lifecycle for IT while providing workers with the personalized, frictionless, ready-to-work experience they demand.

Adjusted EBITDA quarterly figures (Source: Company Reports)

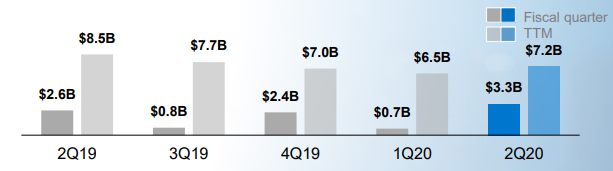

During the quarter, the company reported robust cash flow from operations at $3.3 billion, primarily aided by higher profitability and improvement in working capital, including lower inventory levels.

Cash flow from operations (Source: Company Reports)

During the quarter, research and development expenses came in at $1,229 million, 5% higher from Q2FY19, constituting 5% of the total revenue. The company’s gross margin stood at ~31% as compared to ~27% in the prior corresponding period (pcp). The improvement in the margin was aided by double-digit growth across commercial notebooks, desktops and workstations segment and margin improvement from VMware segment. The company has lowered its gross debt by $2 billion during the quarter and is well-placed to repay its $5 billion gross debt. Cash and investments balance, at the end of the quarter, stood at approximately $10 billion.

Segment-Wise Performance:

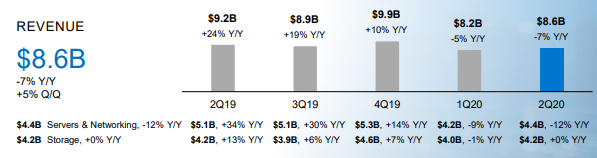

Infrastructure Solutions Group (ISG): This segment derived ~37.75% of the total revenue earned by Dell in Q2FY20 at $ 8.6 billion, reporting a decline of 7% on pcp. Storage revenue came in flat at $4.2 billion, while servers and networking reported revenue of $4.4 billion, declined 12% against the prior corresponding period. Operating income from the segment stood at $1.1 billion during the second quarter, contributed ~21.2% to the company’s operating income. Growth in Server ASPs products remains strong driven by increasingly buying higher-end systems to support higher value workloads.

Infrastructure Solutions Group (Source: Company Reports)

During the year, the company launched Dell Technologies Cloud, specially designed for simplification of hybrid cloud environments and easy to handle with consistent infrastructure, operations, and services. The company launched Unity XT midrange storage solution, and the product experienced strong customer traction. VxRail orders grew ~77% year on year as organizations continue to benefit from its simple integration with VMware Cloud Foundation.

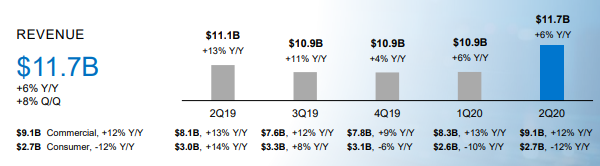

Client Solutions Group: Revenue from Client Solutions Group, during Q2FY20 increased by ~6 % y-o-y at $11.7 billion, contributing ~51.45% to the group’s revenue. Commercial revenue stood at $9.1 billion, up ~6% on pcp while income from consumer was down ~12% on y-o-y to $2.7 billion. Operating income from the segment stood at $982 million during Q2FY20, contributing ~18.88% to the group’s operating income.

Client Solution Group (Source: Company Reports)

The segment reported double-digit revenue growth across commercial notebooks, desktops, and workstations. During the quarter, DELL launched an innovative desktop named OptiPlex 7070 Ultra followed by a launch of Unified Workspace, primarily designed to enhanced end user experience.

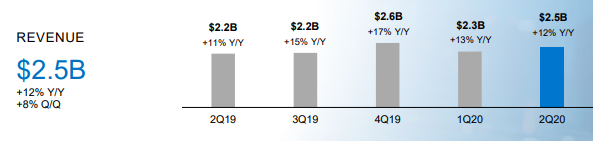

VMware: Income from VMware segment came in at $2.5 billion during Q2FY20, a rise of 12% y-o-y, aided by strong growth across all the products. This segment contributes ~10.8% of the total revenue. Operating income from VMware during the quarter came in at $762 million, derived ~14.64% of the company’s operating income. Core SDDC license bookings grew in the high single digits during the quarter, followed by a growth of 30% in NSX license bookings while vSAN license bookings grew over ~45% during Q2FY20.

VMware (Source: Company Reports)

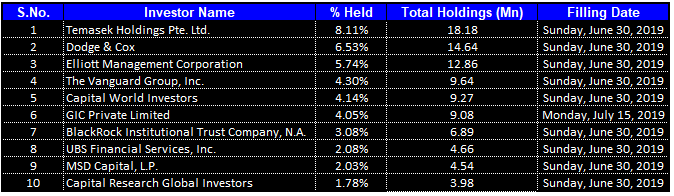

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together form around 41.82% of the total shareholding. Temasek Holdings Pte. Ltd. and Dodge & Cox hold the maximum interest in the company at 8.11% and 6.53%, respectively.

Top 10 Shareholders (Source: Thomson Reuters)

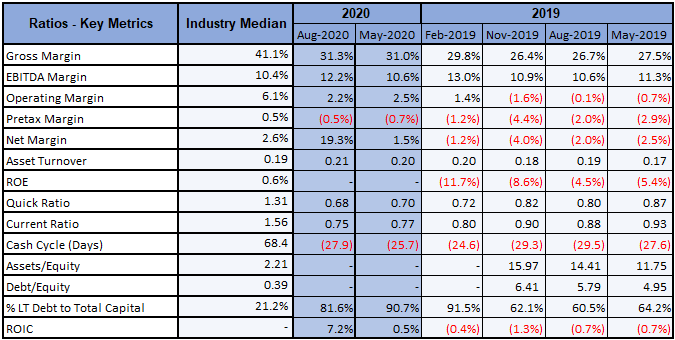

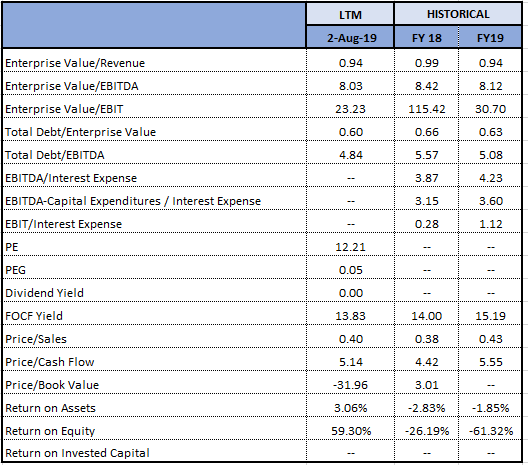

Key Metrics: The company posted healthy margins in the second quarter of FY2020. Gross margin for Q2FY20 stood at 31.3%, showing an improvement over Q1FY20 and Q2FY19, however, remained below the industry median of 41.1%. EBITDA and net margin for 2QFY20 came in at 12.2% and 19.3%, higher as compared to 10.6% and 1.5% in Q1FY20.

Key Metrics (Source: Thomson Reuters)

Industry Outlook: The industry is going through a rapid transformation, and the investment cycle is accelerated with an exponential increase in data and data-centric workloads, which is primarily required for better business outcomes. The industry is also benefited from the growing mobile workforce. Companies are implementing hybrid cloud strategies for smooth and consistent infrastructure functioning and hassle-free operations across private clouds, public clouds, and the edge segments.

Key Valuation Metrics (Source: Thomson Reuters)

Guidance FY20: As per FY20 revenue guidance, Management forecasts FY20 revenue to be in the range of $92.7 billion to $94.2 billion and in Non-GAAP terms, FY20 revenue is expected between $93 to $94.5 billion. The operating income is estimated at $2.9 billion - $3.3 billion, while non-GAAP operating income is forecasted at $9.8 billion - $10.2 billion. Diluted EPS is estimated in the range of $5.45 - $5.90 and non-GAAP diluted EPS has been calculated at $6.95 - $7.40. Management is targeting commercially high-end consumer and gaming segment. The company is focused on innovating and integrating the portfolio to provide technology infrastructure with solutions that simplify IT management.

Valuation Methodologies:

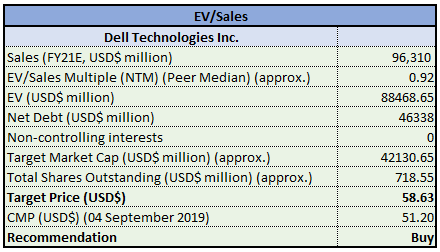

Method 1: EV/Sales Based Valuation:

EV/Sales Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

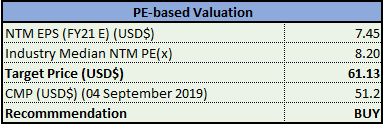

Method 2: P/E Based Valuation:

P/E Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

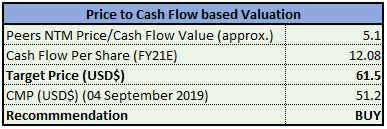

Method 3: Price/Cashflow Based Valuation:

Price to Cashflow Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: At the current market price of $51.20, the stock is currently trading at a price to earnings multiple of 20.32x. During the second quarter of fiscal 2020, DELL posted decent set of numbers and improved margins. The company saw a turnaround during 1QFY20, turning into profit from losses in FY19. Exuberant growth in top-line and bottom-line during the quarter, continuous debt reduction on the balance sheet, new product offerings, strong foothold in the industry etc., augur well for the growth, going forward. With this, we are optimistic about the future growth and prospects of the company. We have valued the stock using three relative valuation methods, EV/Sales, P/E, and Price to Cashflow multiple and have arrived at the target price in the range of $58.63 to $61.5 (lower double-digit growth (in %)). Hence, we recommend a “Buy” rating on the stock at the current market price of $51.20 per share, up 0.25% as on 04 September 2019.

Daily Technical Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.