Company Overview: Dropbox Inc., is an online company that provides online file storage and sharing services. The Company provides a Dropbox collaboration platform, which enables users to create, access, organize, share, collaborate and secure the content. Its Dropbox paper allow users to co-author content, tag others, assign tasks with due dates, embed and comment on files, tables, checklists and code snippets in real-time. Its Dropbox Smart Sync enables users to access their content on their computers without taking up storage space on their local hard drives. Its Dropbox Showcase enables users to present their work to clients and business partners through a Webpage.

.png)

DBX Details (ROE* with respect to Last 12 months' figure as at March 2019)

Cloud-based content platform provider, Dropbox Inc (NASDAQ: DBX) has lately reported a healthy quarterly result wherein key metrics were seen to be on an uptrend with revenue, average revenue per user (ARPU) and net paying users demonstrating growth much above consensus estimates. Dropbox has now raised its full year revenue guidance and aims to benefit from HelloSign while better operating margin guidance and efforts towards go to-market initiatives will set the next leg of growth for 2020 and beyond. The investment narrative has started looking better while certain challenges including industry-wide competition may prevail. Overall, the company offers an effective self-service platform driven by a decent recurring revenue line and management profile.

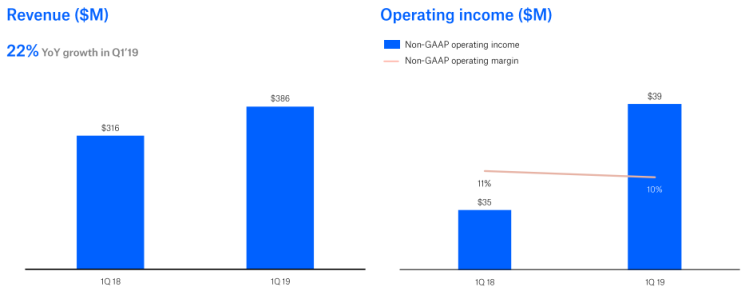

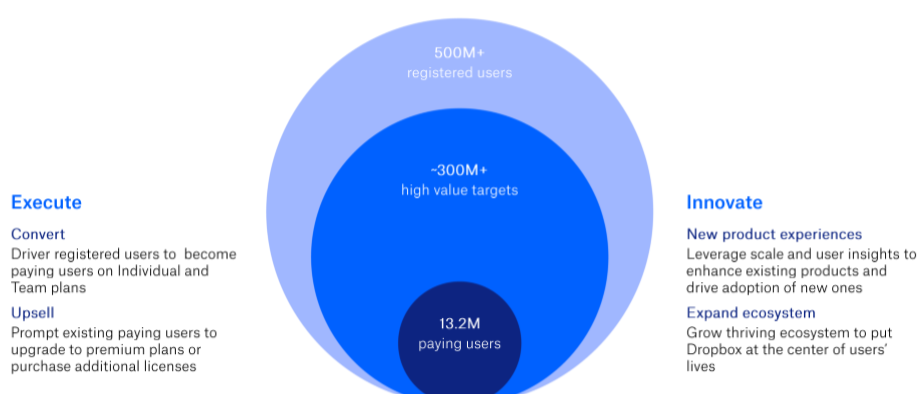

Strong Performance in the First Quarter of FY 19: Dropbox for the first quarter of FY 19, has posted better than expected results. Net loss for the company has narrowed in the first-quarter 2019 as it posted the loss of $7.7 million as compared with loss of $465.5 million in the corresponding period a year ago. DBX in the first quarter of FY 19 has reported the adjusted earnings per share of 10 cents. The company had reported the adjusted revenue growth of 22 percent to $385.6 million in the first quarter of FY 19. The revenue growth was driven by the rise in the total paying users and average revenue per user (ARPU) expansion. At the end of the first quarter 2019, DBX had 13.2 million paying subscribers. The total paying subscribers include the 0.1 million users from HelloSign, newly acquired company. The company’s ARPU increased by 5.9 percent to $121.04. The increase in average revenue per user was due to solid adoption of the premium, professional and advanced plans by new paying users. For the first quarter of 2019, gross margin for the company came in at 75.4% compared to 74.2% in the first quarter of 2018. This expansion in gross margin is on the back of strategic unit cost management of infrastructure hardware which resulted in profit. The gross margin expansion is also contributed by lower depreciation as a share of revenue, which was, however, offset due to rise in compute costs. DBX in 1Q FY19, incurred the Research and Development cost of $117 million, which is 30% of revenue compared to 28% in 1Q FY18. Higher R&D expenses (as a % of revenue) were largely on the back of a rise in headcount as well as investments in new product development and testing. Further, the company is currently incurring overlapping facilities related expenses which are temporary in nature. These expenses are being incurred for both the existing and new headquarters. For the first quarter of 2019, the company has reported the operating profit of $39 million, which means that the company has posted the operating margin of 10%.

Financial Highlights (Source: Company Reports)

At the end of the first quarter of FY 19, the company held cash and short-term investments of $915 million. The company for the quarter has cash flow from operations of $63 million. DBX during the quarter has incurred the capital expenditures of ~$30 million, which has led to the free cash flow of $34 million and forms 9% of revenue. DBX incurred an expense of amount $21 million in the first quarter of FY19 on the new headquarters, out of which $14 mn was adjusted by tenant improvement allowances. The company would have posted the free cash flow of $41 million, which means 10% of revenue, if new headquarter spend, net of TIAs is excluded. Capital lease lines for data center equipment amount to $40 million was also incurred by the company in 1QFY19.

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table which together form around 38.39% of the total shareholding. The Accel Partners and Accel X Associates LLC hold maximum interest in the company at 6.79% and 6.05%, respectively.

Top 10 Shareholders (Source: Thomson Reuters)

Growth Drivers (Source: Company Reports)

Expansion Through HelloSign: DBX has acquired HelloSign during the first quarter 2019 for the total consideration of $230 million, in which $48.5 million will depend on the on-going employee service. The company is currently focusing on the e-signing features and various functions related with it. DBX extends its market leading API to include the e-sign in any app website and workflows. The company has built new API features which will allow HelloSign to function well inside the Dropbox. Moreover, DBX has also launched a new version of HelloWorks, i.e. HelloSign's workflow automation product which includes all the conditional logic functionality.

Strong engagement with Google: DBX has recently launched various new capabilities at Google Cloud Next, allowing the users to deal with Google Docs, Sheets and Slides within Dropbox. The features enable the user to make, edit, share and store Google Docs, Sheets as well as Slides inside the Dropbox UI while viewing and maintaining it along with their traditional files. These new features and capabilities will help the users in organizing and managing their content. It will also be helpful in terms of controlling the access and searching the complete text of the G Suite files within the Dropbox.

Expanded the market reach for Dropbox Paper: In the first quarter of FY 19, DBX had expanded the market reach for Dropbox Paper by the addition of HIPAA compliance, which has applications in the fields like education, healthcare, manufacturing and research. Further, HIPAA compliance will give the users the opportunities to their customers to use it as a proxy for security standards. Organizations engaged in Healthcare, education and non-profit are already making the usage of HIPAA compliant DBX business plans to collaborate the content like medical research and scientific dataset. It will bring an opportunity to the customer/user by adding Dropbox Paper to HIPAA compliance to leverage the tool for collaborating it easily with their corresponding item.

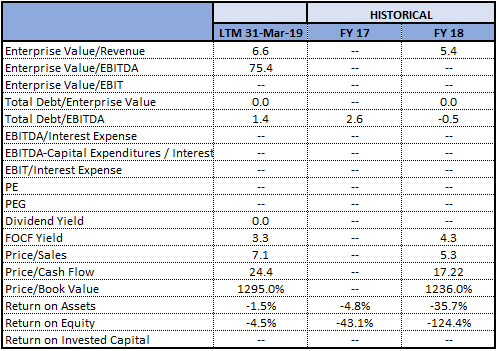

Key Metrics (Source: Thomson Reuters)

A look at Key Ratios: The company has enjoyed healthy gross margin and EBITDA margin at 74.5% and 6.6% respectively in 1Q FY19 and in last three quarters. Net margin has been negative since last few quarters, however, better than industry median of -2.5%. Asset/equity and %LT Debt to Total Capital were healthy at 2.25x and 13.2% respectively.

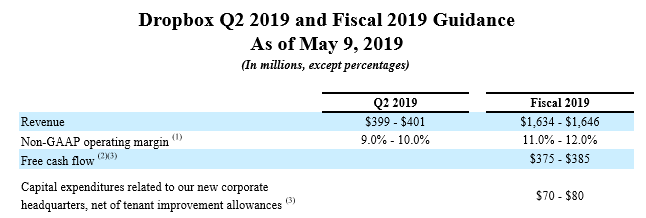

Guidance for 2Q FY19 and FY19 (Source: Company Reports)

Upward Revision in Forecasts for FY 19: The management expects revenue to be in the range of $399 million to $401 million for the second quarter of FY 19. The company also expects the adjusted operating margin for the second quarter 2019 to be in the range of 9%-10%. Meanwhile, the company has raised its full-year 2019 outlook with revenue to be in the range of $1.63 billion and $1.65 billion from the previous guidance of $1.627 billion to $1.642 billion, and its adjusted operating margin is expected to be between 11 percent and 12 percent from the previous projection of 10.5% to 11.5%. The company projects the 2019 capital expenditures to be in the range of $160 - $170 million. This includes the capex to be in the range of $120 - $130 million for developing the new corporate headquarters in San Francisco, CA. The company projects the tenant improvement allowances for this build-out to be $50 million. Moreover, the management expects free cash flow for FY19 in the range of $375 mn - $385 mn. The projection includes one-time expense which is required to build-out the new corporate headquarters. Excluding this expense, free cash flow would be in the range of $445 mn - $465 mn. Further, the company projects that ~1/3rd of FY19 free cash flow will be generated in the first half of 2019 and 2/3rd will be generated in the second half of the 2019.

Key Valuation Metrics (Source: Thomson Reuters)

Below are the key methods that we relied upon for valuation in view of peer related fundamentals.

Valuation Methodology:

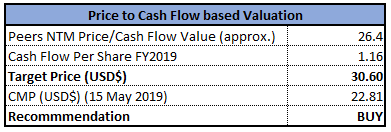

Method 1: Price to Cash Flow Multiple Approach (NTM):

Price/Cash Flow Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

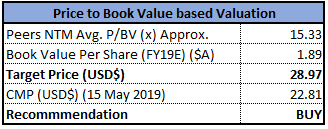

Method 2: Price to Book Value Multiple Approach (NTM):

Price/Book Value Based Valuation (Source: Thomson Reuters), *NTM-Next Twelve Months

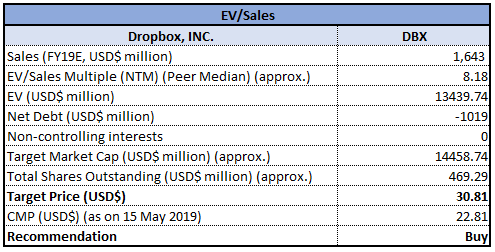

Method 3: EV/Sales Multiple Approach (NTM):

EV/Sales Multiple Approach (Source: Thomson Reuters)

Note: All forecasted figures and peer related information have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: DBX stock is trading at a price of $22.81, and has support at $21.14 level and resistance at $26.41. With the acquisition of HelloSign during the first quarter of FY 19, the company has added 1,00,000 paying subscribers. The company’s loss has narrowed steeply during the quarter and posted better than expected results. Further, the company has raised the FY19 revenue and adjusted operating margin forecasts. Meanwhile, DBX has added new functions to the newly acquired company HelloSign, launched a new version of HelloWorks and has even launched HIPAA compliance for Dropbox Paper. In addition, the company’s strategic partnership with Google will enhance the company’s reach in digital workspace for all types of content. Considering the aforesaid parameters and decent outlook of the business, we give a “Buy” recommendation on the stock at the current market price of $22.81 per share (up 2.79% as on 15 May 2019) in view of expectation of a double digit upside in the next one to two years.

.png)

DBX Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.