Company Overview: DXC Technology Company provides digital information technology (IT) services and solutions. The Company provides a range of services, including analytics, applications, business process, cloud and workload, consulting, enterprise and cloud applications, security, and workplace and mobility. The Company offers a portfolio of analytics services, to provide insights and accelerate users’ digital transformation. Its analytics services and solutions include Data Discovery Experience, Data Workload Optimization and Managed Business Intelligence Services. The Company addresses analytic solution needs to run the business, including customer analytic services, warranty analytics, predictive maintenance analytics, social intelligence analytics, healthcare analytics, insurance analytics, data pipeline and operations, banking analytics, airline analytics and operational analytics. The Company also offers e-commerce, finance and administration products and services.

.png)

DXC Details

Strategic Collaborations Aid to Customized Offerings: DXC Technology Company (NASDAQ: DXC) designs and deploys integrated digital solutions at scale to update and innovate clients’ mainstream IT, leading to better business outcomes. Most of the global enterprises need integrated IT solutions during their transformation to digital technology. DXC provides desired solutions to the leading enterprises, which include speed and agility, combined with new value and efficiencies so that the client receives optimum services out of the technology investments. On April 1, 2017, CSC (Computer Sciences Corporation), Hewlett Packard Enterprise Company (HPE), Everett SpinCo, Inc. (Everett), and New Everett Merger Sub Inc., a wholly-owned subsidiary of Everett (Merger Sub), completed the strategic combination of CSC with the Enterprise Services business of HPE to form DXC Technology Company. DXC markets and sells technology-based services directly to clients through the company’s direct sales force, which is operated from sales offices spread around the world. The company’s clients include commercial businesses of different sizes from diversified industries and several public sector enterprises. Digital transformation creates an enormous opportunity to niche IT service providers. As organizations embrace digital, they face challenges in scaling their new solutions and integrating them with their existing IT landscapes. The company fixes these challenges and acts as a trusted partner for Global Enterprises.

Looking at the past performance, the company turned into profit in FY18 at $1,751 million from a loss of $123 million in FY17. In FY19 (period ended on March 2019), total revenue stood at $20,753 million, registering a de-growth of 4.51% as compared to $21,733 million during FY18. Net profit for the company came in at $1,257 million in FY19, posting a decline of 28.21% on y-o-y basis.

Going forward, the company will continue to focus on several strategies that will provide better services to its clients in a rapidly changing marketplace. DXC will prioritize on four strategies, namely clients, sales, cost structure, and quality. DXC is likely to deliver new value, faster time to market, and increased productivity while minimizing risk. The strategies have enabled the clients to unlock new opportunities and realize better business outcomes.

.png)

Financial Highlights during FY17-FY19 (Source: Company Reports)

Business Associations: DXC has partnerships with the following industry leading companies:

Partnership with AWS: An Integrated partnership with AWS provides highly secure cloud-first solutions, which provide innovative solutions to enterprises, helping them to modernize for the digital era.

Collaboration with Microsoft: DXC has collaboration with Microsoft and uses its cloud platform that includes Azure, Microsoft 365 and Dynamics 365 and offers products which have unrivaled breadth and depth to its esteemed clients.

Partnership with Oracle: DXC and Oracle help enterprises harness the power of digital innovation. The company helped one of the world’s largest mining companies migrate 300 databases to Oracle’s Cloud at Customer platform running in a DXC data center in Brazil.

Reporting Segments: The business has two reportable segments, namely Global Business Services (GBS) and Global Infrastructure Services (GIS).

Global Business Services: This segment provides innovative technology solutions, enabling the clients to address key business challenges and to accelerate digital transformations while offering customized services as per the specific requirements of clients. GBS offerings include,

(a) Enterprise, Cloud Applications, and Consulting

(b) Application Services

(c) Analytics

(d) Business Process Services

(e) Industry Software and Solutions

Global Infrastructure Services: The company offers a range of services that specializes in foreseeable outcomes and desired results by the enterprises. The technology also works across the reduction of business risk and operational costs for clients. GIS offerings include the followings:

(i) Cloud and Platform Services

(ii) Workplace and Mobility

(iii) Security

Industry Scenario: The segment in which DXC operates has multiple players and is highly competitive in nature. The sector is characterized by the growing importance of offshore labor centers, which has brought several global firms as the company’s peer group.

Q1FY20 Operational Highlights for the period ending 30 June 2019: DXC declared its first-quarter financial results for FY20 wherein, the company reported revenue at $4,890 million as compared to $ 5,282 million in the previous corresponding period and reported net income at $168 million as compared to $259 million during Q1FY19. The company reported adjusted EBIT at $652 million during Q1FY20 as compared to $803 million during the Q1FY19, while adjusted EBIT margin stood at 13.3% as compared to 15.2% in the previous corresponding period. Overall bookings came in at $4.2 billion as compared to $4.6 billion during the previous corresponding quarter. The company reported a y-o-y growth of 35% in digital revenue with a book-to-bill of 1.3x. The business reported selling, general and administrative at $507 million as compared to $440 million on Q1FY19. The business reported total costs and expenses at $4,684 million, which came in lower as compared to $4,922 million in the previous corresponding quarter.

.png)

Q1FY20 Financial Highlights (Source: Company Reports)

.png)

Quarterly Trends of Bookings (Source: Company Reports)

Segment Results:

Global Business Services (GBS): This segment reported revenue at $2,159 million, down 2.4% on y-o-y basis. During Q1FY20, the segment reported a profit of $366 million as compared to $403 million, while the profit margin stood at 17% as compared to 18.2% in the previous corresponding quarter. The segment reported an improvement in bookings at $2.4 billion as compared to $2 billion on pcp. The segment derived 44.15% of the total revenue during the quarter.

.png)

Q1FY20 Global Business Services performance Highlights (Source: Company Reports)

Global Infrastructure Services (GIS): During Q1FY20, the segment derived 55.85% of the total revenue and has reported sales of $2,731 million, 11% lower than Q1FY19. Net bookings from the segment came in at $1.8 billion as compared to $2.6 million in the previous corresponding quarter. Profit from the segment, during the quarter stood at $340 million as compared to $474 million in Q1FY19. GIS witnessed a lower margin at 12.4% as compared to 15.4% in the previous corresponding quarter.

.png)

Q1FY20 Global Infrastructure Services’ performance Highlights (Source: Company Reports)

Q1FY20 non-GAAP Highlights: DXC reported the cost of services at $3,622 million during the first quarter of FY20 as compared to $3,867 million in the previous corresponding period. Selling, general and administrative expenses, excluding depreciation and amortization and restructuring costs came in at $402 million as compared to $370 million during on pcp. Net income during the quarter as per non-GAAP terms came in at $472 million as compared to $599 million in the previous corresponding period.

.png)

Q1FY20 Non-GAAP Results (Source: Company Reports)

Top 10 Shareholders: The top 10 shareholders have been highlighted in the table, which together form around 38.90% of the total shareholding. The Vanguard Group, Inc. and BlackRock Institutional Trust Company, N.A. hold the maximum interests in the company at 11.24% and 5.12%, respectively.

.png)

Top 10 Shareholders (Source: Thomson Reuters)

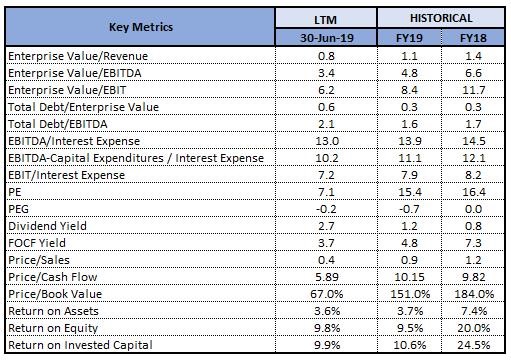

Key Metrics: The Company posted decent margins in the first quarter of FY2020. EBITDA margin for Q1FY20 stood at 20.6%, slightly higher than the industry median of 20.5% and 19.1% in Q4FY19. Net margin for Q1FY20 came in at 3.4%, lower than Q4FY19 of 5.2% and below the industry median of 6.4%. Return on Equity (ROE) during Q1FY20 stood at 1.5%.

Key Metrics (Source: Thomson Reuters)

Recent Update: On 12 September 2019, the stock of DXC plunged 10.99% at market close due to the change in CEO. The company announced Mike Salvino as the new CEO by replacing Mike Lawrie, who served as CEO of DXC since its incorporation in 2017. The new CEO Mike Salvino was associated with the board for the last four months before his appointment for the new post and has more than three-decade of industry experience.

Key Valuation Metrics (Source: Thomson Reuters)

Guidance for FY20: As per the Management guidance, the company expects revenue in the range of $20.2 billion to $20.7 billion during FY20. Non-GAAP EPS is expected between $7.00 to $7.75 in FY20.

Valuation Methodology: Enterprise Value to EBITDA Multiple Approach

(23).png)

Enterprise Value/ EBITDA Valuation (Source: Thomson Reuters)

Note: All forecasted figures and peers have been taken from Thomson Reuters, *NTM-Next Twelve Months

Stock Recommendation: At the current market price of $27.98, the stock is trading at a price to earnings multiple of 6.66x with a market capitalization of ~$7.329 billion. The company helps its clients to modernize their mainstream IT, integrate new digital solutions and deploy at scale. DXC provides desired solutions by leading enterprises, which include speed and agility combined with new value and efficiencies so that the clients get optimum services out of the technology investments. As global organizations embrace digital, they face challenges in scaling their new solutions and integrating them with their existing IT landscapes. The company posted a satisfactory set of numbers in 1QFY20 and expects FY20 adjusted free cash flow at ~90% of adjusted net income, excluding restructuring costs, transaction, separation and integration-related costs, amortization of acquired intangible assets. Considering the aforesaid facts, we have valued the stock, using a relative valuation method, i.e., Enterprise Value to EBITDA multiple, and arrived at a target price of higher double-digit growth (in % term). Hence, we recommend a “Buy” rating on the stock at the current market price of $27.98, up 0.9% on 23 October 2019.

.jpg)

DXC Daily Technical Price Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.