Company Overview: Tesla, Inc., formerly Tesla Motors, Inc., designs, develops, manufactures and sells fully electric vehicles, and energy storage systems, as well as installs, operates and maintains solar and energy storage products. The Company operates through two segments: Automotive, and Energy generation and storage. The Automotive segment includes the design, development, manufacturing, and sales of electric vehicles. The Energy generation and storage segment includes the design, manufacture, installation, and sale or lease of stationary energy storage products and solar energy systems to residential and commercial customers, or sale of electricity generated by its solar energy systems to customers. The Company produces and distributes two fully electric vehicles, the Model S sedan and the Model X sport utility vehicle (SUV). It also offers Model 3, a sedan designed for the mass market. It develops energy storage products for use in homes, commercial facilities and utility sites.

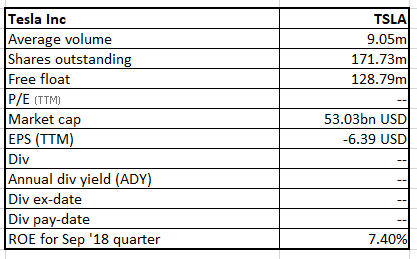

TSLA Details

Tesla Inc (NASDAQ: TSLA), which has a market capitalization of about $53 billion, is an US based electric automobile manufacturer. TSLA stock rose significantly (3.8%) on January 30, 2019 while later the company’s first-ever consecutive quarterly profit in its history was reported. The group although missed the analysts’ earnings estimates for the fourth quarter of FY 18, the overall performance was still a decent one. Group’s total revenue for 2018 was at record levels of $21.4 billion while it reported full year loss. Nonetheless, the group is trying to inch back to profitability levels (with contraction seen in loss reported for full year) while the output levels have doubled from 2017 levels. Chief Executive, Elon Musk had earlier this month said that the company is projecting a “tiny profit” for the first quarter of FY 19, on the back of margin issues with the Model 3 as TSLA is preparing to expand into Europe and Asia. Meanwhile, there has been a significant rise of $718M in cash and cash equivalents of $3.7B at the end of the fourth quarter of 2018. Overall, the group is trying to pull strings in the positive direction with gaining product traction at global level and managing capital position.

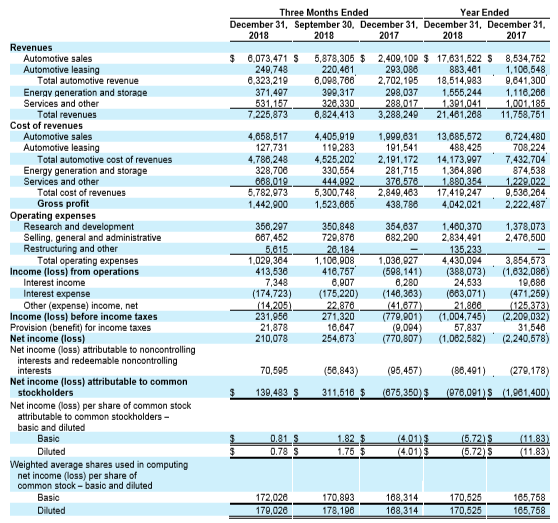

Quarterly and Yearly Performance, in thousands (Source: Company Reports)

Mixed Performance in the Fourth Quarter of 2018: TSLA in the fourth quarter of FY 18 has reported the adjusted earnings per share of $1.93, missing the analysts’ estimates for the adjusted earnings per share of $2.20. The company’s earnings are indeed affected due to decline in revenue driven by lower prices on the Model S and Model X in China and also due to a lower-priced midrange version of the Model 3. Further, sale of regulatory credits along with rise in import duties on parts from China impacted the revenue. The federal tax credit on every TSLA vehicle sold was cut in half to $3,750 at the beginning of the year, after the company sold its allotted 200,000 units. This is actually qualified for the full credit. Nonetheless, the company has reported the adjusted revenue of $7.23 billion in the fourth quarter of FY 18, beating the analysts’ estimates for revenue of $7.12 billion. Moreover, in the fourth quarter 2018, the company has significantly improved the operating margin as seen throughout the second half of 2018 (coming in at par with other carmakers from a negative zone). Despite margins in the automotive industry were lower in the fourth quarter 2018, TSLA’s operating margin remained strong at 5.7% during the quarter. The GAAP net income was reported to be $139 million in the fourth quarter. This was affected from a non-cash charge of $54 million towards non-controlling interests; however, the free cash flow moved up to $910 million. The group reported that Model S and Model X attained all-time high market shares in the US, as seen throughout the 2H of 2018; and Model S represented 38% of its segment in the US. The best-selling passenger car, Model 3 in terms of revenue was recognized to perform well in last two quarters.

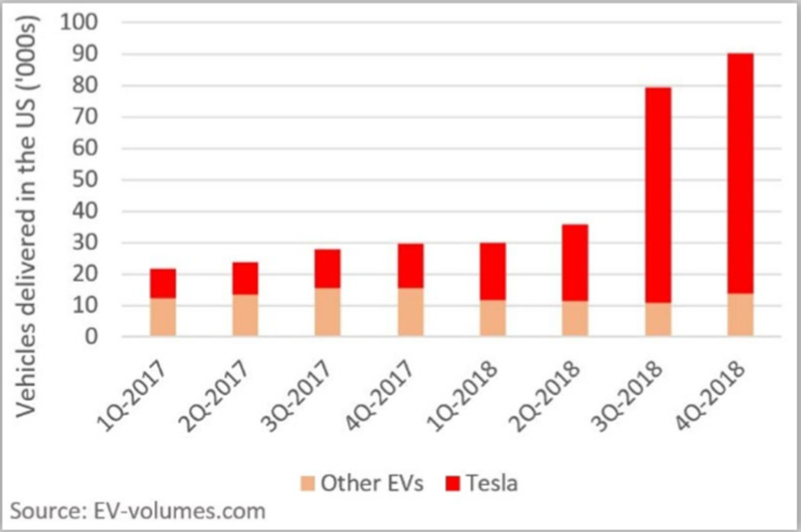

Group showcased Strong Vehicle Production & Deliveries: During the fourth quarter 2018, the company had produced and delivered at the rate of approximately 1,000 vehicles per day, which is a new record for both production and deliveries. There has been an 8% growth in production to 86,555 vehicles in the last quarter over the all-time high noted in the third quarter.

EV Sales in the US (Source: Company Reports)

Company has sufficient cash to pay its debt: TSLA has $920 million worth of convertible bonds issued in 2014. This amount of debt is coming due on March 1st (as the bond is getting matured on this date). The group can exchange the note through cash and stock to manage the debt payment. However the shares should rise about 17 percent from their current level to convertible bonds’ strike price of $359.87, which is based on a 20-day averaging period. Otherwise the debt payment is required to be done in cash. The investors have been worried about the cash payment but now the company has assured the investors that it has sufficient cash at hand to settle the convertible bond in cash. Moreover, TSLA has about $1.3 billion and $977 million of other convertible notes outstanding. Both of them will become due in 2021 and 2022. Further, the company also has another $1.8 billion in traditional bonds, due in 2025. Meanwhile, TSLA’s cash position has improved by $1.45 billion even after the scheduled repayment of a $230 million convertible bond in the fourth quarter of 2018. As of December 31 2018, TSLA had $3.69 billion of cash and cash equivalents.

Owner referral program to end on February 1: Tesla’s owner referral program would end on February 1 on the back of its impact on TSLA's finances. With regards to the same, the company’s customers are expressing disappointment. Further, the company does not intend to change its current referral program with a new one. The referral program has allowed Tesla owners to receive rewards based on the number of customers who use their referral code when buying a Tesla vehicle. The rewards have changed over time, but the most recent ones included a home charging unit and the ability to receive software updates before other owners. Meanwhile, TSLA earlier in January had announced layoffs, which would affect 7% of Tesla's workforce. The company is taking this step in order to prove that it can become consistently profitable. The company is already facing challenges after the introduction of lower-priced vehicles.

Key Personnel Changes: TSLA’s CFO Deepak Ahuja is about to retire and the company is appointing Zach Kirkhorn as the new CFO, who was previously the company’s vice president of finance.

Future Outlook: The company is expecting higher revenues in 2019 as the company is substantially ramping up its production and deliveries this year. The company is targeting for 360,000 to 400,000 vehicle deliveries in 2019, which is approximately 45 to 65 percent more than its deliveries in 2018. TSLA projects that its deliveries will grow 50 percent in 2019, even if the environment remains challenging. Production volumes for Model 3 in Fremont have been estimated to expand to a target of 7k units per week by the end of year 2019. Further, Tesla will have Model 3 vehicle production at the maximum production rates throughout 2019. With an initial target of 3k Model 3 vehicles per week, the company will take into account the Gigafactory Shanghai. TSLA aims to have annualized output for Model 3 of above 500,000 units by fourth quarter of 2019 and second quarter of 2020, excluding any unforeseen challenges with Gigafactory Shanghai. TSLA expects Model 3 non-GAAP gross margin of 25% in 2019 on the back of significant cost reductions combined along with better fixed-cost absorption. The 2019 gross margin for Model S and Model X has been otherwise stated to be in line with that of 2018; while the group also expects rise in revenue from Energy generation and storage with an overall better performance by the storage business. Growth is also expected to come from Services and Other business in 2019, at the back of higher projected used car sales volumes. The operating expenses are expected to be contained within a 10% growth in 2019 and this will help provide leverage given the top line growth in 2019. Reduction is also expected in costs through the restructuring initiatives undertaken during the first quarter by approximately $400 million per annum. In 2019, the capex is expected to be about $2.5 billion and has been slated towards the Gigafactory Shanghai, Tesla Semi and Model Y, and also towards expansion of the Supercharger, service and retail networks. The company plans to engage local banks in China for arranging the financing requirements to fund the capex for Gigafactory Shanghai. Given the above, Tesla aims to demonstrate profitability in the first quarter of FY19 as well.

Stock Recommendation: TSLA stock is trading at a price of $308.77, and has support at $250.57 level and resistance around $380. The company has reported for quarterly profit second time in a row and this comes for the first time in the company’s history. The company is expecting that going forward, the profitability should continue in the first quarter of FY19 given the developments in hand. Moreover, the company has assured that it has sufficient cash to pay its debt after the company improves its cash position. Fundamentally, the group’s gross margin and EBITDA margin at double digit levels have been above the industry levels while return on equity at 7.4% for September 2018 quarter has been well above the industry median of 3%. Its return on invested capital at 1.4% was up 4.9% on quarterly basis. The latest result will enable the group to attain improved levels in many key financial metrics. Given the improving performance and milestones in hand that look achievable, we give a “Buy” on the stock at the current price of $308.77.

TSLA Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.