Lattice Semiconductor Corporation

Section 1: Company Fundamentals

Company Overview and Performance summary

Company Overview:

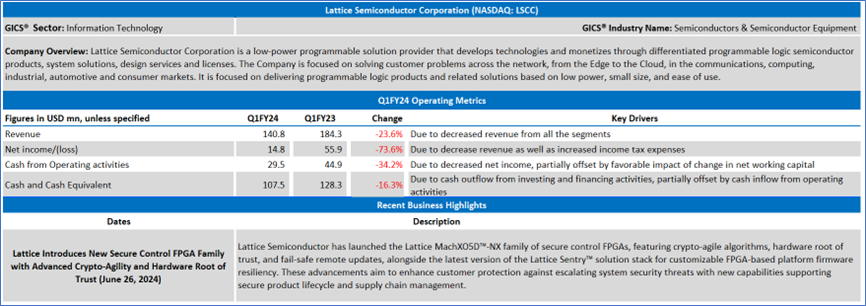

Lattice Semiconductor Corporation (NASDAQ: LSCC) is a low-power programmable solution provider that develops technologies and monetizes through differentiated programmable logic semiconductor products, system solutions, design services and licenses. The Company is focused on solving customer problems across the network, from the Edge to the Cloud, in the communications, computing, industrial, automotive and consumer markets.

This Global AI and Emerging Market Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Price Performance:

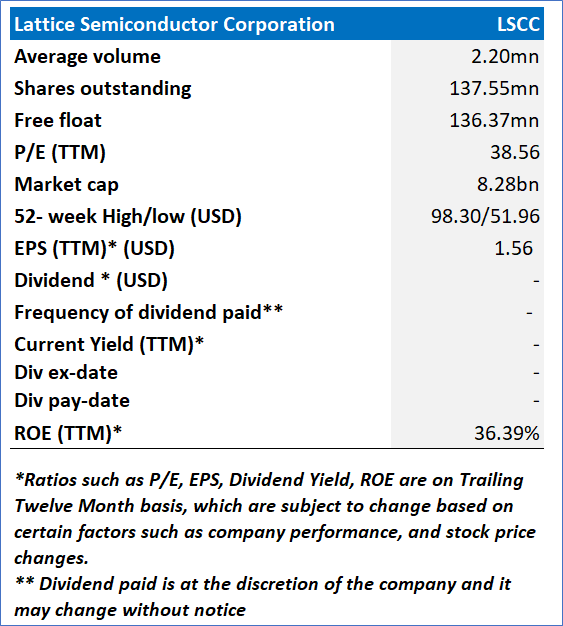

1.2 Summary Table

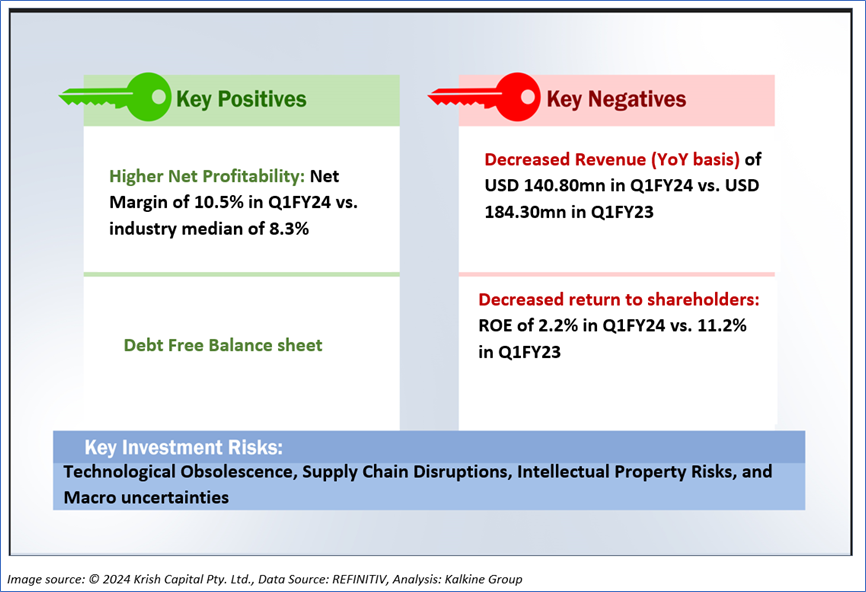

1.3 The Key Positives & Negatives

1.3 Key Metrics

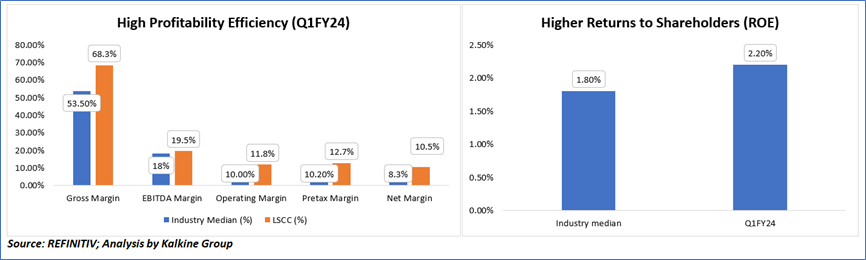

In Q1FY24, LSCC outperformed industry medians across key financial metrics. Specifically, LSCC reported higher gross margin (68.3% vs. industry median of 53.50%), EBITDA margin (19.5% vs. industry median of 18%), operating margin (11.8% vs. industry median of 10.00%), pretax margin (12.7% vs. industry median of 10.20%), and net margin (10.5% vs. industry median of 8.3%). Additionally, LSCC demonstrated a superior return on equity (ROE) at 2.20%, surpassing the industry median of 1.80%. These results underscore LSCC's strong financial performance relative to industry benchmarks during the first quarter of fiscal year 2024.

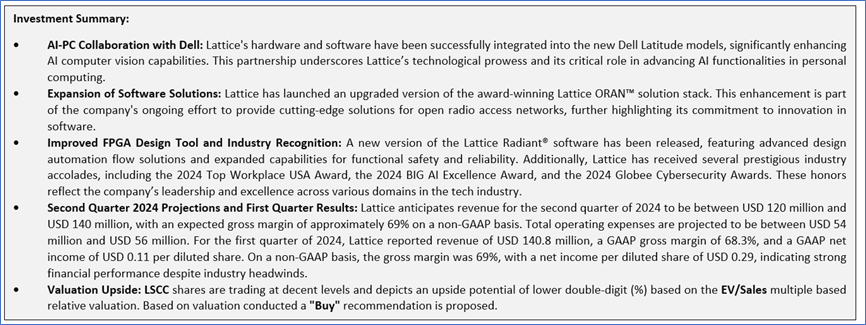

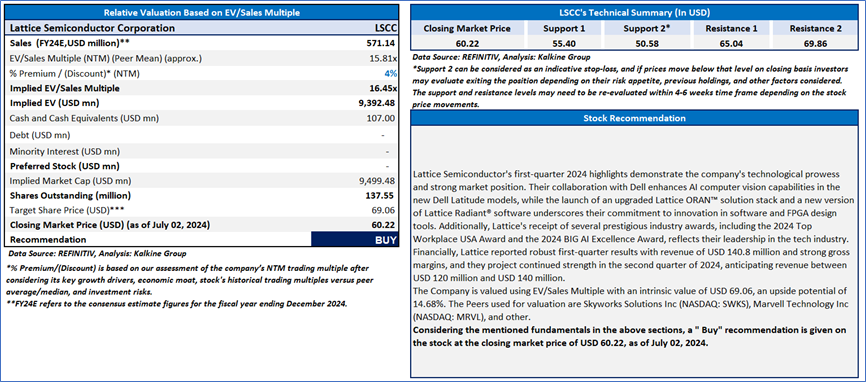

Section 2: Lattice Semiconductor Corporation (NASDAQ: LSCC) (“Buy” at the closing market price of USD 60.22, as of July 02 ,2024)

2.1 Company Details

2.2 Technical Guidance and Stock Recommendation

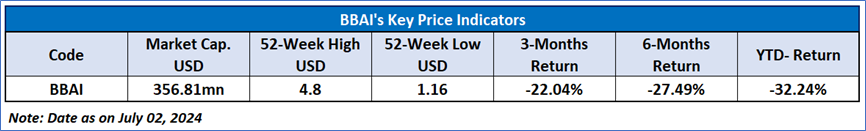

BigBear.ai Inc (NYSE: BBAI)

Section 1: Company Fundamentals

1.1 Company Overview and Performance summary

Company Overview:

BigBear.ai Holdings, Inc. (NYSE: BBAI) is a provider of artificial intelligence (AI)-powered decision intelligence solutions for national security, supply chain management and digital identity. The Company is a technology-led solutions organization, providing both software and services to its customers. The Company operates in two segments: Cyber & Engineering, Analytics.

This Global AI and Emerging Market Report covers the Company Overview & Price performance, Summary table, Key positives & negatives, Key metrics, Company details, technical guidance & Stock recommendation, and Price chart.

Recent Business and Financial Updates

Revenue and Gross Margin: In the first quarter of 2024, revenue decreased by 21.4% to USD 33.1 million from USD 42.2 million in the same period in 2023. This decline was mainly due to the planned wind-down of the Air Force EPASS program and the loss of revenue from Virgin Orbit following their bankruptcy announcement. Additionally, delays in contract awards due to continuing resolutions contributed to this decrease. The gross margin also fell to 21.1% from 24.2%, primarily driven by an increase in equity-based compensation expenses and the loss of revenue from Virgin Orbit.

Net Loss: The net loss for the first quarter of 2024 was USD 125.1 million, including a non-cash goodwill impairment charge of USD 85.0 million and USD 24.0 million of non-cash expenses. These losses were partially offset by gains related to the issuance of 2024 Warrants and the decrease in their fair value. Additional factors contributing to the net loss included equity-based compensation expenses and restructuring charges. In comparison, the net loss for the first quarter of 2023 was USD 26.2 million, which included non-cash expenses related to PIPE warrants, equity-based compensation, and restructuring charges.

Adjusted EBITDA and SG&A: Non-GAAP Adjusted EBITDA improved to (USD 1.6) million in the first quarter of 2024 from (USD 3.8) million in the first quarter of 2023, driven by a focus on reducing operating expenses, including the acquisition of Pangiam. SG&A expenses decreased to USD 16.9 million from USD 20.4 million, reflecting ongoing efforts to reduce costs and achieve synergies from business combinations. Recurring SG&A expenses were reduced from USD 15.3 million to USD 13.6 million, showing a net improvement of USD 1.7 million.

Cash Balance and Backlog: As of March 31, 2024, the ending cash balance increased to USD 81.4 million from USD 32.6 million as of December 31, 2023. This increase was driven by proceeds from exercised warrants and cash acquired from the Pangiam acquisition. The ending backlog was USD 296 million. Consolidated results included contributions from Pangiam from the acquisition date of February 29, 2024, through the end of the quarter.

Momentum and Strategic Contracts: BigBear.ai recently received an USD 8.3 million extension from the U.S. Army G-3/5/7 to continue leading the sustainment and modernization of mission-critical force generation and analytics capabilities. Pangiam, a BigBear.ai company, secured contracts for the implementation of veriScan™ at various airports, including the Metropolitan Washington Airports Authority and Denver International Airport. Additionally, Pangiam was awarded a contract with a key port authority in Canada for a biometric-enabled passenger processing application.

Innovations and Designations: BigBear.ai’s Pangiam signed an agreement with Melbourne Airport in Australia to trial Project Dartmouth, an AI/ML threat detection capability. BigBear.ai was also designated as an "Awardable" vendor for the Chief Digital and Artificial Intelligence Office’s Tradewinds Solutions Marketplace, facilitating the accelerated procurement of their products across the Department of Defense. Additionally, BigBear.ai formed a teaming agreement with Spinnaker SCA to enhance consulting services for manufacturing and warehouse operations.

Revenue Projections: For the year ending December 31, 2024, BigBear.ai projects revenue between USD 195 million and USD 215 million, including results from Pangiam from the acquisition date of February 29, 2024.

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 51.32, upward trending, with expectations of a consolidation or an upward momentum. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

2.2 Technical Guidance and Stock Recommendation

_07_03_2024_14_07_10_891184.png)

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is July 02, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stocks prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.