General Electric Company

GE Details

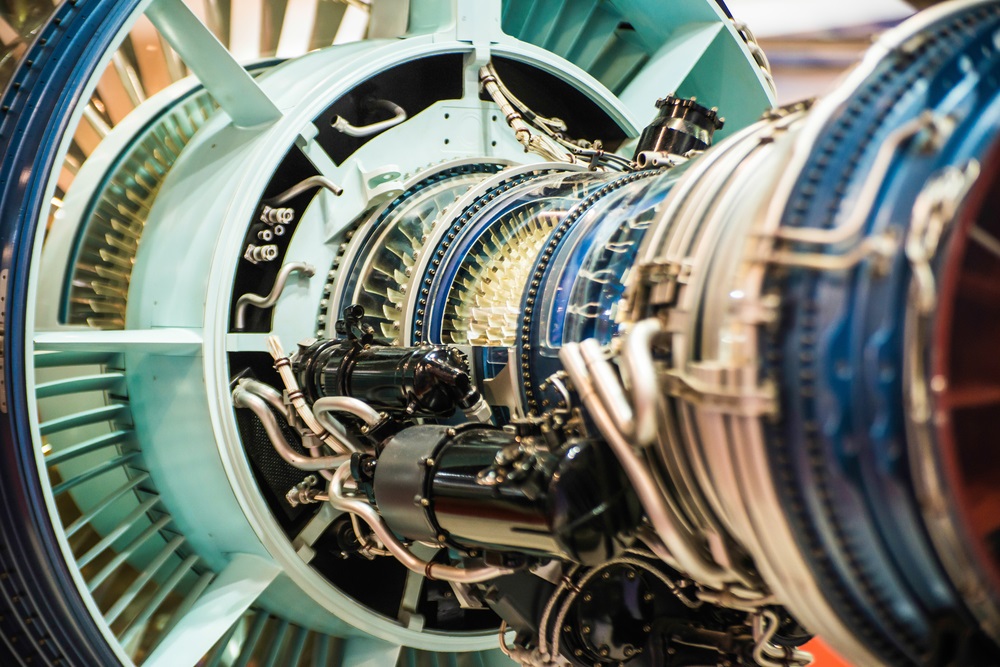

GE Unveils Inkjet-Printed Red Phosphor: General Electric Company (NYSE: GE) is a worldwide digital industrial company, whose products and services include jet engines, energy production solutions, power generation, medical imaging, industrial & financing products. Recently, the company launched important advances with narrow-band red (PFS-KSF) and green phosphors to strengthen its foothold in the micro-LED and mini-LED display markets.

GE Inks Deal With Walcha: In another update, the GE Renewable Energy inked a deal with Walcha Energy to mutually develop the 500MW Dungowan propelled hydro storage project in the New England Renewable Energy Zone (REZ), situated in New South Wales (NSW).

GE to Supply Wind Turbines: Recently, the company stated that its GE Renewable Energy unit received a contract to supply wind turbines for construction and long-term operation to Murra Warra II wind farm in Victoria for an undisclosed amount. Notably, GE will supply 38 cypress of 5.5-158 wind turbines to Murra Warra II wind. The above deal is expected to add ~209 MW of wind capacity in Victoria, Australia. Construction of the project is expected to start later this year and will be fully commissioned and operational by mid-2022.

2QFY20 Key Financial Highlight for the Period Ended 30 June 2020: During the quarter, the company reported and adjusted loss of 15 cents per share, as compared to the year-ago earnings of 16 cents per share. The company noted that the COVID-19 outbreak has taken a toll on its 2QFY20 results. Revenues for the period stood at $17,750 million, depicting a decline of ~24.2% year over year. The quarterly results were impacted by softness in Industrial and GE Capital’s performances. During the quarter, the company’s cost of sales declined by 13.4% on pcp and came in at $15,083 million. Selling, general and administrative expenses in 2QDY20 stood at $3,079 million, down 10.1% year over year. The company exited the period with a cash balance of $88.5 billion, whereas borrowings amounted to $81.9 billion.

2QFY20 Highlights (Source: Company Reports)

Key Risks: The company’s upcoming results are expected to reflect the impacts of the prevalent coronavirus pandemic on its operations. Also, the effects of delays in processes at pharmaceutical diagnostics and healthcare systems along with pandemic-led demand for imaging and monitoring products is likely to hamper Healthcare’s results. However, a healthy liquidity position along with cash and cost-related measures is expected to be a tailwind.

Outlook: For 2020, GE expects cash preservation of $3 billion and operational cost out to be over $2 billion. The company is also taking necessary steps to maintain the safety of the workers and remains on track to continue providing services to customers and preserving business strength. The company expects to accomplish a leverage-neutral position by 2021. In 2021, the company expects positive results from Industrial free cash flow.

Valuation Methodology: P/BV Multiple Based Relative Valuation (Illustrative)

P/B Multiple Based Relative Valuation (Source: Refinitiv, Thomson Reuters)

Note: All the forecasted figures are taken from Thomson Reuters, NTM: Next Twelve Months

Stock Recommendation: The stock closed at $6.14 with a market capitalization of ~$53.7 billion on 4 August 2020. Currently, the stock is trading close to its 52-week low of $5.48. The stock has corrected by ~6% and ~38.9% in the last three months and one year, respectively. The company remains on track to boost its long-term growth prospects, lowering leverage and improving business prospects. Considering the current trading levels, we have valued the stock using the P/BV multiple based relative valuation method (illustrative) and arrived at a target price of low double-digit upside (in percentage terms). Hence, we recommend a ‘Buy’ rating on the stock at the current market price of $6.14, up 0.49% as on 04 August 2020.

GE Daily Technical Chart (Source: Refinitiv, Thomson Reuters)

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.