The AES Corporation

AES Details

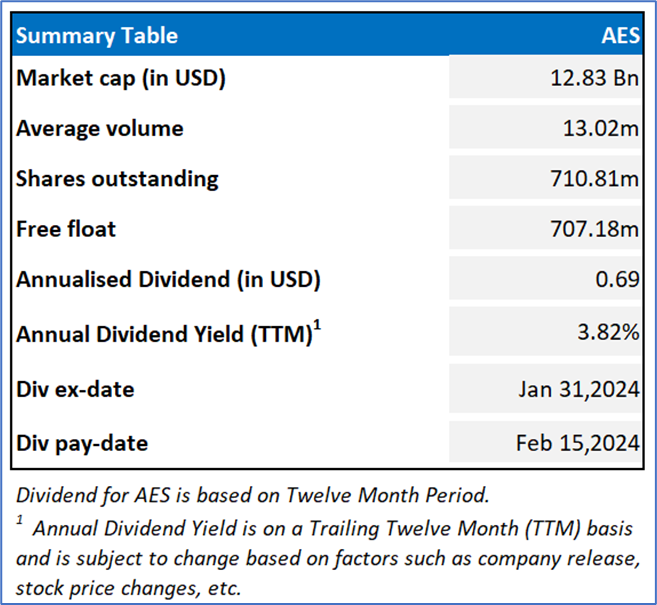

The AES Corporation (NYSE: AES) is the global power company operating throughout 14 countries and 4 continents.

Financial Results for FY 2023

Outlook

The company has initiated 2024 guidance for Adjusted EBITDA of $2,600 - $2,900 million. It has reaffirmed annualized growth target for adjusted EPS of 7% - 9% through 2025, from the base of 2020.

Key Risks

The changes in availability of the generation facilities or distribution systems because of increases in scheduled as well as unscheduled plant outages, equipment failure, failure of transmission systems, etc.

Fundamental Valuation

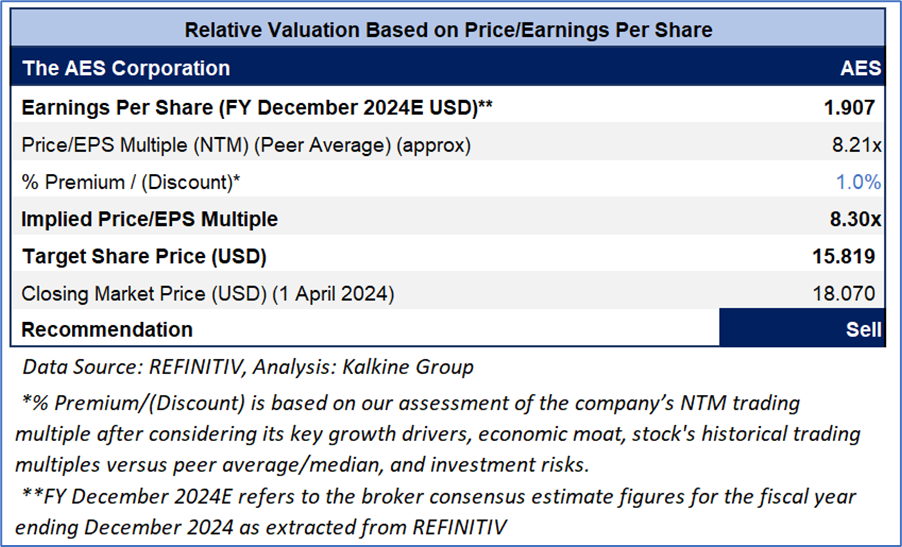

P/EPS Based Relative Valuation

Stock Recommendation

Over the last three months, the stock has given a return of -6.12%. The stock has made a 52-week low and high of USD 11.43 and USD 25.735, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Its FY 2023 net income (Loss) was ($182) Mn, which includes $1.1 Bn of impairments in 2023 mainly associated with the company’s continued exit from coal-fired generation.

The destabilization of markets as well as decline in business activity could negatively impact the company’s customer growth in service territories at its utilities. Apart from this, any sort of further delays to the construction projects, including at the renewables projects, could also impact the business momentum.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of $18.07 per share, up by 0.78% as on 1st April 2024.

Technical Overview:

Daily Price Chart

AES Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on April 1, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.