JD.com Inc

JD.com Inc (NASDAQ: JD) is a holding company mainly engaged in e-commerce business. The Company operates two segments. JD Retail segment consists of online retail, online marketplace and marketing services in China. The Company offers electronics products, home appliances and other general merchandise categories. The Company has its own online platform, which third-party merchants offer products on it. New Businesses segment includes logistics services provided to third parties, overseas business, technology initiatives, as well as asset management services to logistics property investors and sale of development properties.

Recent Business and Financial Updates

- Updates of Share Repurchase Program: From January 1, 2024, to May 15, 2024, JD.com executed a significant share repurchase initiative, acquiring a total of 98.3 million Class A ordinary shares, equivalent to 49.2 million ADSs, amounting to USD 1.3 billion. These transactions were conducted through open market purchases on both Nasdaq and the Hong Kong Stock Exchange, in accordance with JD.com's publicly announced share repurchase programs. This effort represented approximately 3.1% of JD.com's outstanding ordinary shares as of December 31, 2023. Following the expiration of its previous share repurchase program on March 17, 2024, JD.com had repurchased approximately USD 2.1 billion in shares by that date. Under its newly launched share repurchase program effective through March 18, 2027, JD.com had repurchased approximately USD 0.7 billion in shares as of May 15, 2024, with USD 2.3 billion remaining available under this program as of the same date.

- 10th Anniversary of Listing on Nasdaq: com will celebrate its 10th anniversary of listing on Nasdaq on May 22, 2024. Over the past decade, JD.com has achieved remarkable growth, expanding its total revenues 16-fold from RMB 69.3 billion in 2013 to RMB 1.1 trillion in 2023. Non-GAAP net income attributable to the Company’s ordinary shareholders increased significantly, rising from RMB 223.9 million to RMB 35.2 billion over the same period. JD.com has also returned substantial value to its shareholders through dividends and share buybacks, surpassing the total capital raised over the past ten years. The company has significantly expanded its workforce, providing full-time employment with social insurance and housing fund benefits to 517,124 employees as of the end of 2023, reflecting a thirteen-fold increase compared to a decade ago. Looking ahead, JD.com remains committed to creating ongoing value for its stakeholders across all aspects of its operations.

- Business Highlights:

- JD Retail: On April 16, 2024, JD.com introduced an innovative AI digital representative of its founder and chairman, Mr. Richard Qiangdong Liu, into its livestreaming sessions for supermarkets, home appliances, and home goods. This industry-first initiative attracted over 20 million views within the first hour, underscoring JD.com’s commitment to enhancing its content ecosystem and providing users with a seamless, cost-effective livestream shopping experience supported by competitive pricing, quality products, and superior service.

- JD Health: During the first quarter of 2024, JD Health collaborated with leading pharmaceutical companies such as Pfizer and Sanofi to launch new and specialty drugs online, furthering accessibility to essential medicines. Partnerships with Shanghai Pharmaceuticals, Daiichi Sankyo, Sunshine Mandi Pharmaceutical, and others have strengthened JD Health's comprehensive healthcare services, enhancing medicine retailing and healthcare accessibility.

- JD Logistics: JD Logistics continued its global expansion support for Chinese brands during the first quarter, offering integrated supply chain services to MINISO for their stores in Australia and Malaysia. This collaboration exemplifies JD Logistics' commitment to facilitating international growth opportunities for its partners.

- Environment, Social and Governance (ESG): com remains dedicated to social responsibility, investing RMB 106.6 billion in human resources for the twelve months ended March 31, 2024, demonstrating its commitment to job creation and societal contributions.

- First Quarter 2024 Financial Results

- Net Revenues: com reported a 7.0% increase in net revenues to RMB 260.0 billion (USD 36.0 billion) for the first quarter of 2024, compared to RMB 243.0 billion for the same period in 2023. This growth was driven by a 6.6% increase in net product revenues and an 8.8% increase in net service revenues year-over-year.

- Operating Expenses: Cost of revenues increased by 6.4% to RMB 220.3 billion (USD 30.5 billion) in Q1 2024, while fulfillment expenses rose by 9.3% to RMB 16.8 billion (USD 2.3 billion), primarily due to increased procurement and delivery costs. Marketing expenses increased by 15.6% to RMB 9.3 billion (USD 1.3 billion), reflecting higher promotional activities, including sponsorship of the Spring Festival Gala.

- Income and Margins: Income from operations increased by 19.8% to RMB 7.7 billion (USD 1.1 billion) in Q1 2024, with an operating margin of 3.0%, compared to 2.6% in Q1 2023. Non-GAAP income from operations grew by 12.7% to RMB 8.9 billion (USD 1.2 billion), with a non-GAAP operating margin of 3.4%, up from 3.2% in Q1 2023. JD Retail's operating margin before unallocated items was 4.1% in Q1 2024, down from 4.6% in Q1 2023, reflecting ongoing investments in enhancing user experience.

- Earnings and Cash Flow: Non-GAAP EBITDA increased by 13.6% to RMB 10.8 billion (USD 1.5 billion) in Q1 2024, with a non-GAAP EBITDA margin of 4.1%, compared to 3.9% in Q1 2023. Other non-operating income totaled RMB 2.7 billion (USD 0.4 billion) in Q1 2024.

- Net Income: Net income attributable to JD.com's ordinary shareholders grew by 13.9% to RMB 7.1 billion (USD 1.0 billion) in Q1 2024, with a net margin of 2.7%, compared to 2.6% in Q1 2023. Non-GAAP net income attributable to JD.com's ordinary shareholders increased by 17.2% to RMB 8.9 billion (USD 1.2 billion), with a non-GAAP net margin of 3.4%, up from 3.1% in Q1 2023.

- Diluted EPS: Diluted net income per ADS rose by 15.3% to RMB 4.53 (USD 0.63) in Q1 2024, while non-GAAP diluted net income per ADS increased by 18.7% to RMB 5.65 (USD 0.78), compared to Q1 2023.

- Cash Flow and Liquidity: As of March 31, 2024, JD.com's cash and cash equivalents, restricted cash, and short-term investments totaled RMB 179.3 billion (USD 24.8 billion), compared to RMB 197.7 billion as of December 31, 2023, demonstrating strong liquidity despite operational investments and share repurchases.

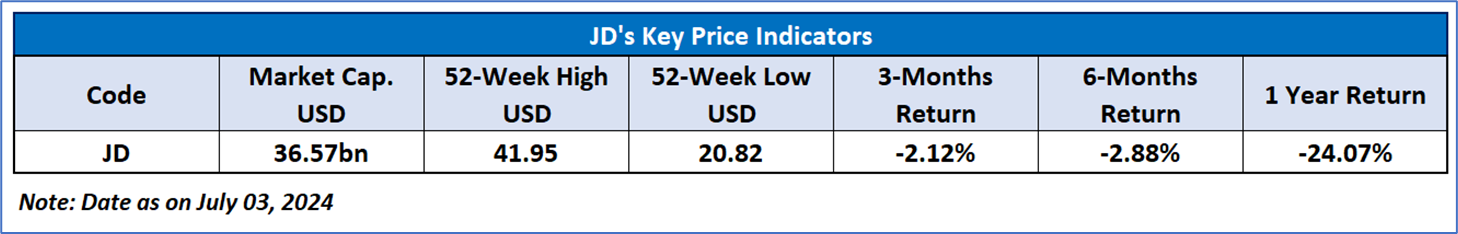

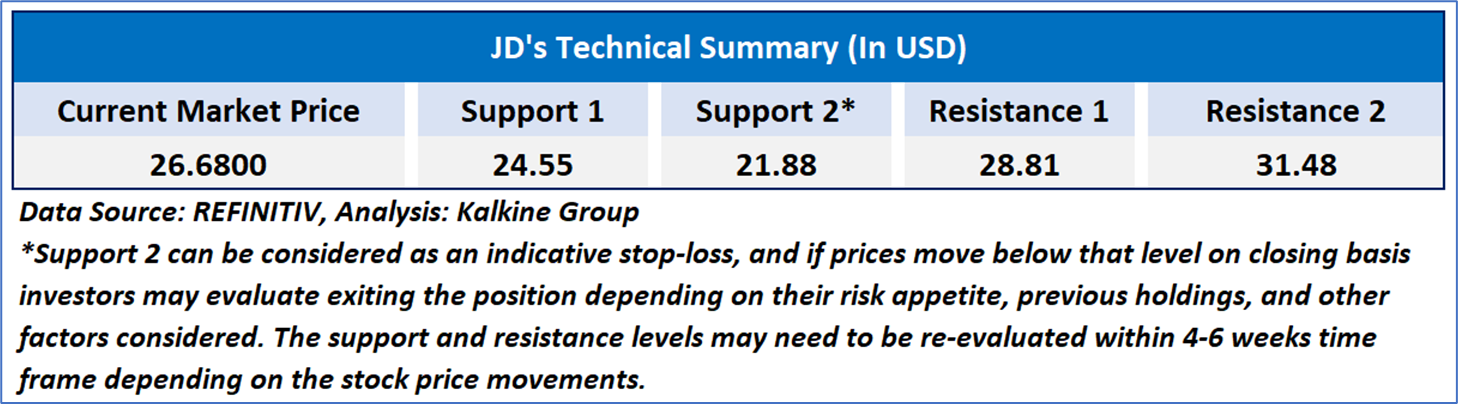

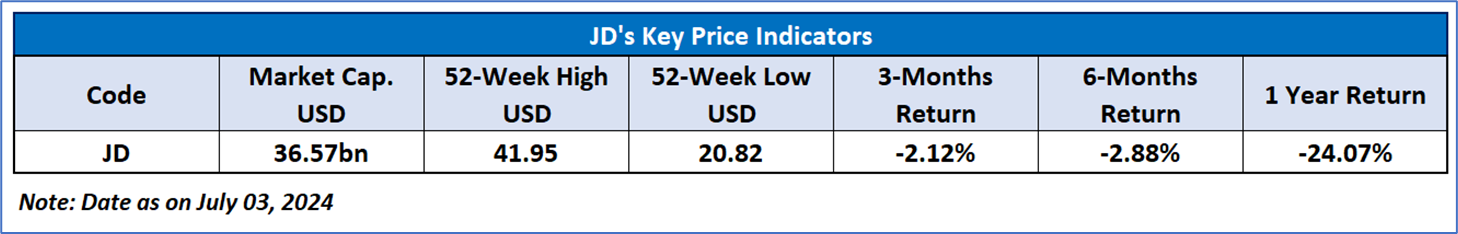

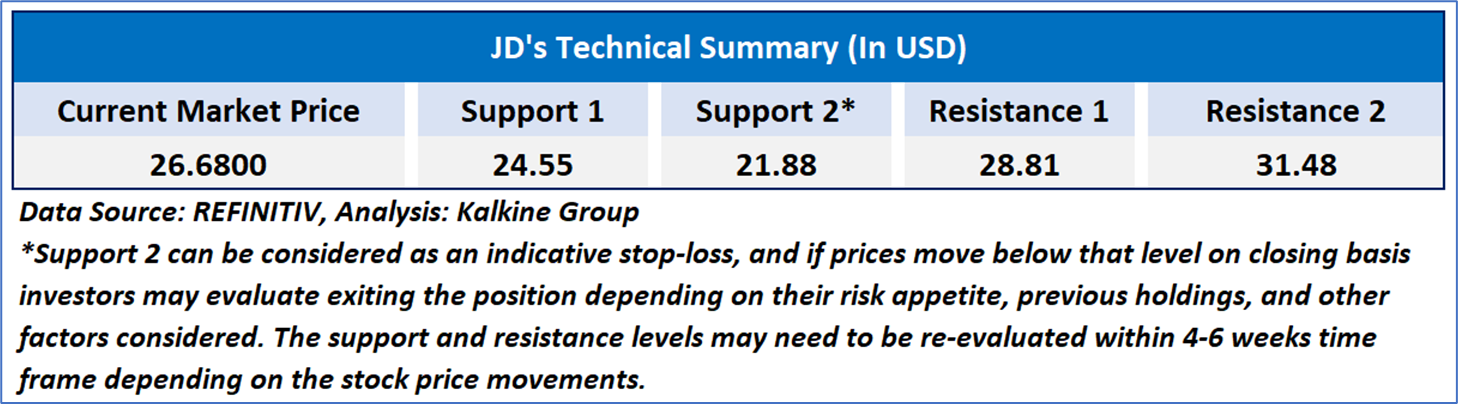

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 36.34, currently recovering from oversold zone, with expectations of a consolidation or a reversal towards higher levels in case the price breaks on the upside above the important resistance zone of USD 28-USD 29. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period EMA, which may serve as dynamic short to medium-term support and resistance levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a “Buy’ rating has been given to JD.com Inc (NASDAQ: JD) at the current market price of USD 26.68 as of July 03, 2024, at 08:30 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is July 03, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.