SolarEdge Technologies, Inc.

SEDG Details

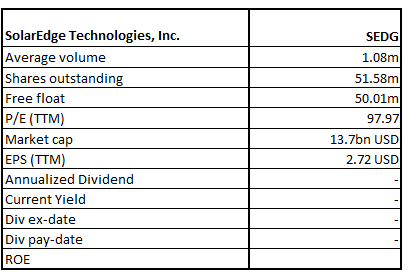

SolarEdge Technologies, Inc. (NASDAQ: SEDG) is a top player in smart energy technology. It is engaged in the business of creating smart energy solutions. It caters to the requirements of various energy market segments through its diversified product offerings such as PV, storage, EV charging, batteries, UPS, electric vehicle powertrains, and grid services solutions.

Annual Performance (For the Year Ended 31 December 2020)

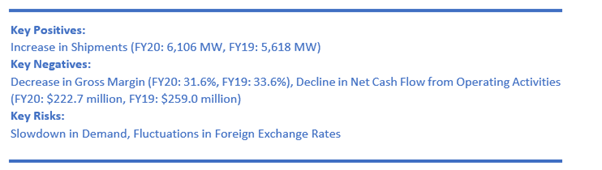

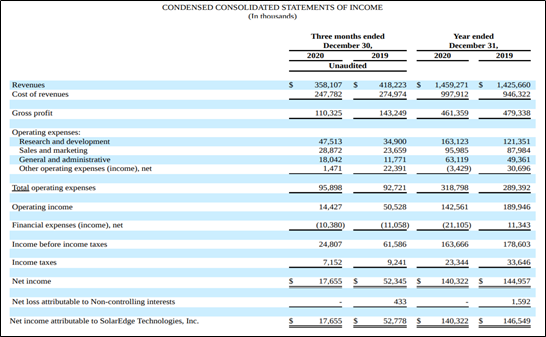

The company has garnered revenue of $358.1 million in Q4FY20 which translated into a record revenue generation of $1.46 billion in FY20, an increase of 2% YoY and record revenues were generated from solar products of $1.36 billion in FY20. Further, the company has achieved record solar revenue in Europe and in Australia in FY20 with a growth of 11% and 30%, respectively, notwithstanding the impact of pandemic globally. SEDG’s gross margin in FY20 reduced to 31.6% from 33.6% in FY19 in GAAP terms. Resultantly, the net income of the company during the period under consideration decreased by 4% to $140.3 million.

Financial Snapshot (Source: Company Reports)

SEDG To Supply Electrical Powertrain and Battery Solution for Fiat E-Ducato

The Company on 16 February 2021, announced that it had been selected for the supply of full electrical powertrain and battery solution which will find its application for the production of the Fiat E-Ducato light commercial vehicle. This will help Fiat in launching the electric version of the E-Ducato light commercial vehicle to cater to the requirements of the European market.

The company’s eMobility division was formed through the acquisition in January 2019 which provides end-to-end solutions for electric and hybrid vehicles, including innovative high-performing powertrains and software for electric vehicles.

Entering into a Supply Agreement with Sunrun

The company on 23 February 2021 updated that it has entered into a strategic supply agreement with one of the major U.S. providers of residential solar, battery storage, and energy services – Sunrun for the supply of its next-generation PV inverter, The SolarEdge Energy Hub. This will cater to the requirements of the residential customers. SEDG happens to be a key partner helping Sunrun to support the complete residential energy ecosystem with seamless integration of smart energy devices as well as optimized home energy management via its SolarEdge Energy Hub inverter.

Outlook

The company is betting big on the solar business. It is anticipated that one-third of the global electricity demand is to be met through renewable energy sources. To en-cash on the burgeoning opportunities, the company is betting on geographic expansion as well as an increase in its market share and segment development.

Meanwhile, it has guided its revenue in Q1FY21 to stay between $385 million to $405 million with revenues from solar products of between $360 million to $375 million. Further, it has guided its gross margin in Non-GAAP terms to be in the range of 34% to 36%.

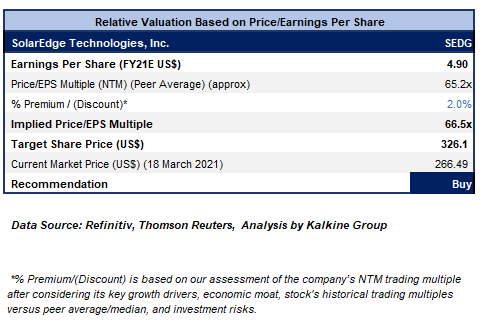

Valuation Methodology: P/E Based Relative Valuation (Illustrative)

Stock Recommendation

Considering the leadership position in core developed markets along with the sustained focus on growing in new markets, healthy liquidity position and decent outlook, we are optimistic about the company to continue with growth momentum underpinned by continuing growth in the solar products.

We have applied P/E based relative valuation (on an illustrative basis) and the target price reflects a rise of low double-digit (in % terms). We have applied a slight premium to Price/EPS Multiple (NTM) (Peer Average) considering the cash-generating capabilities and decent outlook.

However, the investors should keep an eye on related risks like the rapidly evolving and competitive nature of the solar industry and sustained pressure on gross margin.

Thus, we give a “Buy” rating on the stock at the current price of US$266.49 per share, down by 8.56% on March 18, 2021.

SEDG Daily Technical Chart (Source: Refinitiv (Thomson Reuters))

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.