Peloton Interactive Inc

Peloton Interactive, Inc. (NASDAQ: PTON) is a provider of interactive fitness platforms. The Company provides connected, technology-enabled fitness and the streaming of immersive, instructor-led boutique classes to its members anytime, anywhere. Its segments include Connected Fitness Products and Subscription. The Connected Fitness Products segment includes the Company’s portfolio of Connected Fitness Products and related accessories, Precor branded fitness products, delivery and installation services, Peloton branded apparel, extended warranty agreements, and commercial service contracts.

Key Business & Financial Updates

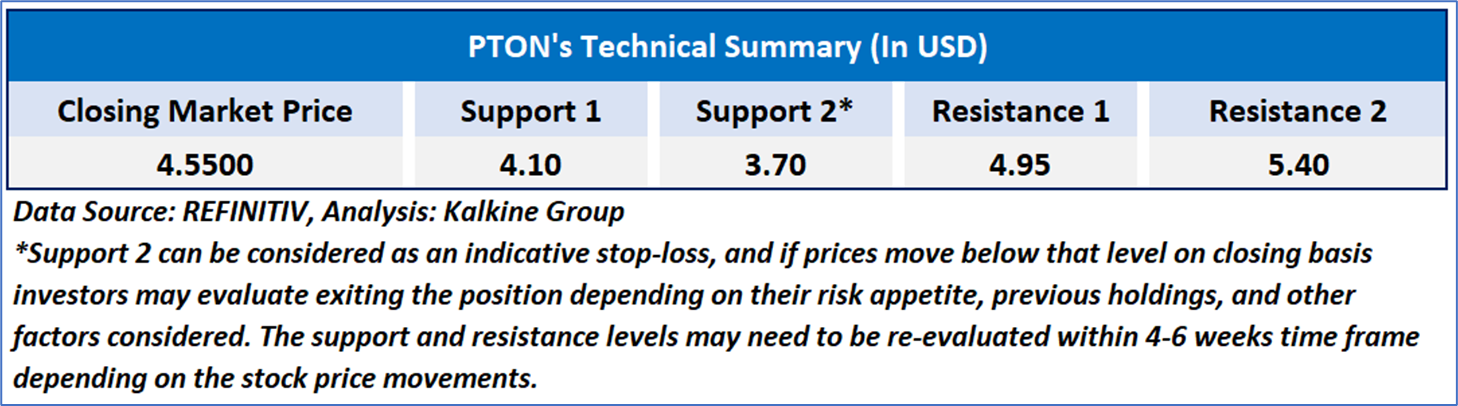

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 75.33, currently inside overbought zone, with the expectations of consolidation or some correction before the continuation on the upside. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

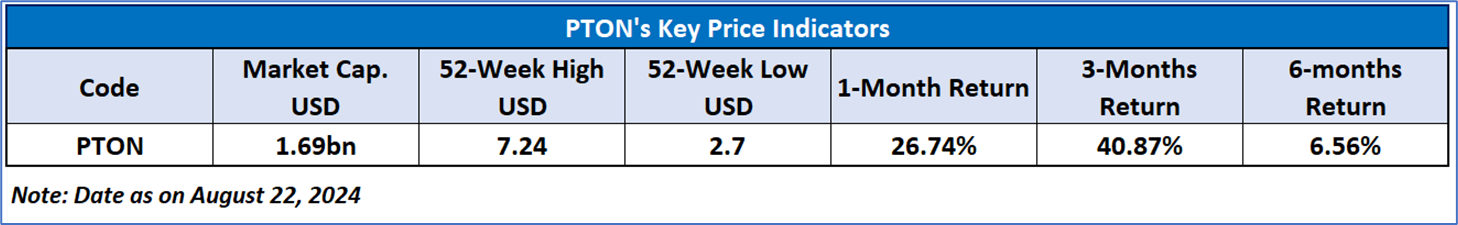

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘WATCH’ rating has been given to Peloton Interactive, Inc. (NASDAQ: PTON) at the closing market price of USD 4.55 as of August 22, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 22, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.