Air Products and Chemicals Inc

Air Products and Chemicals, Inc. (NYSE: APD) is an industrial gases company. The Company provides essential industrial gases, related equipment, and applications to customers in various industries, including refining, chemicals, metals, electronics, manufacturing, medical, and food. Its segments include Americas, Asia, Europe, and Middle East and India, and Corporate and other.

Recent Business and Financial Updates

Q2 FY24 Financial Performance: In the second quarter of fiscal year 2024, Air Products reported a GAAP EPS from continuing operations of USD 2.57, reflecting a 30 percent increase compared to the prior year. The GAAP net income for the quarter reached USD 581 million, up 29 percent, while the GAAP net income margin improved by 570 basis points to 19.8 percent. This growth was driven by lower charges for business and asset actions, favorable pricing, and reduced other costs, partially offset by lower equity affiliates' income, lower volumes, and higher interest expenses. On a non-GAAP basis, adjusted EPS from continuing operations increased by four percent to USD 2.85, and adjusted EBITDA rose by four percent to USD 1.2 billion. The adjusted EBITDA margin also improved, reaching 40.9 percent, up 490 basis points.

Recent Highlights: Air Products continues to be recognized for its sustainability efforts, being listed among Barron's 100 Most Sustainable Companies for the sixth consecutive year. The company has demonstrated its leadership in hydrogen fueling by announcing plans for new multi-modal stations in Duisburg and Meckenheim, Germany, and a network of stations between Edmonton and Calgary, Alberta, Canada, aimed at fueling heavy-duty and long-range vehicles. Additionally, Air Products increased its quarterly dividend to USD 1.77 per share in January, marking the 42nd consecutive year of dividend increases.

Fiscal 2024 Second Quarter Results by Business Segment: In the Americas, sales amounted to USD 1.2 billion, a nine percent decrease from the prior year. This was primarily due to 12 percent lower energy cost pass-through and one percent unfavorable currency, partially offset by three percent higher pricing and one percent higher volumes. Operating income for this segment was USD 372 million, while adjusted EBITDA was USD 590 million, both reflecting a 15 percent increase due to higher pricing and volumes. In Asia, sales decreased by four percent to USD 780 million, primarily due to unfavorable currency and lower volumes. Operating income in Asia decreased by 13 percent to USD 204 million, and adjusted EBITDA fell by six percent to USD 328 million. In Europe, sales decreased by 11 percent to USD 668 million, mainly due to lower volumes and energy cost pass-through. However, operating income increased by 16 percent to USD 201 million, and adjusted EBITDA rose by five percent to USD 264 million, driven by lower power and other costs.

Middle East, India, and Corporate Segments: In the Middle East and India, equity affiliates' income decreased by 25 percent to USD 74 million, primarily due to higher interest expense and other operating costs. The corporate and other sales segment saw a seven percent decrease to USD 201 million, largely due to lower non-LNG sale of equipment activity.

Guidance and Outlook: Air Products is maintaining its full-year fiscal 2024 adjusted EPS guidance of USD 12.20 to USD 12.50, representing a six to nine percent increase over the prior year's adjusted EPS. For the third quarter of fiscal 2024, the company projects an adjusted EPS of USD 3.00 to USD 3.05. Additionally, Air Products continues to expect fiscal year 2024 capital expenditures to range between USD 5.0 billion and USD 5.5 billion. The company's focus on cost discipline, pricing, and strategic execution is expected to drive continued shareholder value and fulfill its commitments despite challenging economic and geopolitical conditions.

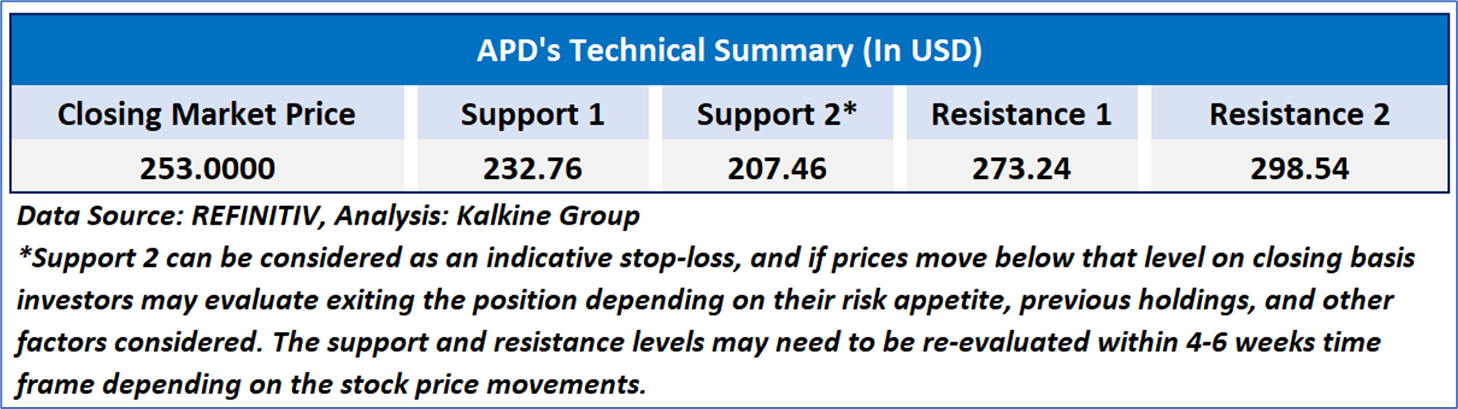

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 37.59, currently recovering from oversold zone, with expectations of a consolidation or a reversal towards higher levels in case the price breaks on the upside above the important resistance zone of USD 260-USD 270. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period EMA, which may serve as dynamic short to medium-term resistance levels.

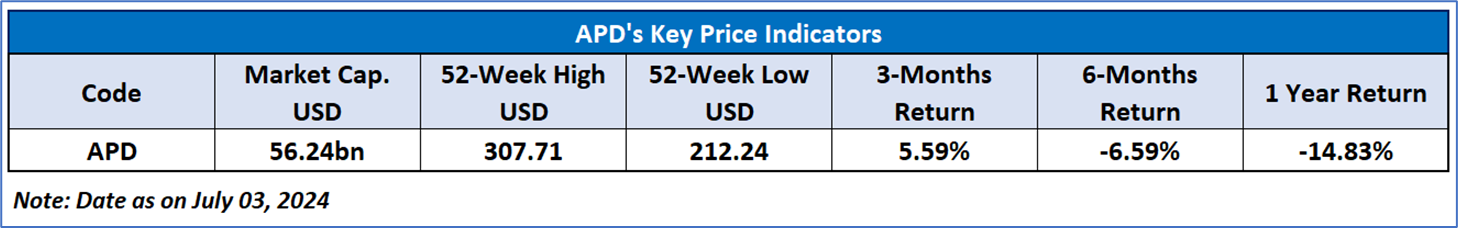

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Air Products and Chemicals, Inc. (NYSE: APD) at the closing market price of USD 253.00 as of July 03, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is July 03, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.