What is a Capital Pool Company?

A Capital Pool Company (CPC) is a special purpose company listed on the TSX Venture (TSX-V) Exchange with no assets and commercial transactions except cash. A CPC is a publicly listed company with no commercial operations but has experienced directors and capital at the initial public offering (IPO).

The CPC’s directors focus on acquiring an emerging company, and post-completion, the emerging company has access to the capital and listing prepared by the CPC. Hence, it is considered an alternative technique to raise capital for a private company and get listed on the stock exchange.

In other words, it is a type of shell company that merges with a private company or an active business to go public. Post the CPC merging with the private company, the resulting company is listed on the TSX-V, Toronto, Canada.

According to the TSX website, as of September 30, 2020, 2600 plus capital pool companies have been created, and 85 per cent of them have completed the Qualifying Transaction since the inception of the CPC Program.

What was the need for Capital Pool Companies (CPCs)?

Canada does not have a strong venture capital industry compared to the of the US. Therefore, in order to access capital, the companies tend to list on the Toronto Stock Exchange at an early stage. As a result, the companies end up being abandoned by the investors due to less experience as a public company and the rising public responsibilities at the time of expansion.

CPCs are created and promoted to help early-stage companies with expert director-level guidance and capital that venture capitalists in the United States usually provide. In addition, they are created to provide an alternative path for businesses interested in going public on the TSX-V.

Summary

- A Capital Pool Company is a special purpose company listed on the TSX Venture Exchange with no assets and commercial transactions except cash.

- It is abbreviated as CPC.

- Post the CPC merging with a private company, the resulting company is listed on TSX-V Exchange.

Frequently Asked Questions (FAQs)

- What is the Capital Pool Company Program?

The Capital Pool Company Program (or CPC Program) is a unique invention that assists private companies in completing a go public transaction in Canada. In 2001, the TMX Group structured the program following the acquisition of the Canadian Venture Exchange.

A Qualifying Transaction is a reverse merger of a CPC by an operating business enabling it to access the CPC's shareholders, capital, and expertise to complete a listing on the Toronto Stock Exchange or the TSX Venture Exchange. It is one of the most common ways companies go public in listing on the TSX-V.

Compared to the TSX, European and US exchanges, the TSX-V has easier regulatory requirements and lower listing costs. As a result, it has become home to several rising companies and provides access to the market.

- How is a Capital Pool Company introduced to the market?

The CPC program is a special listing vehicle offering growth companies with an alternative introduction to the capital markets. It takes a two-step process to introduce a Capital Pool Company (CPC):

- Step 1: CPC Initial Public Offering

The program initiates the financial market experience of the investors with the entrepreneurs whose development stage companies seek public company management expertise and capital. Unlike a conventional IPO, this program enables seasoned officers and directors to form a CPC with no commercial operations and assets except cash. It helps companies to get listed on the TSX-V and raise capital for growth and expansion.

- Step 2: Consummation of the Qualifying Transaction

The CPC utilizes the raised funds to seek an investment business opportunity. Once the CPC has consummated the Qualifying Transaction with the acquisition of an operating business and has satisfied the listing requirements, it is eligible for trading as a regular listing on the TSX-V.

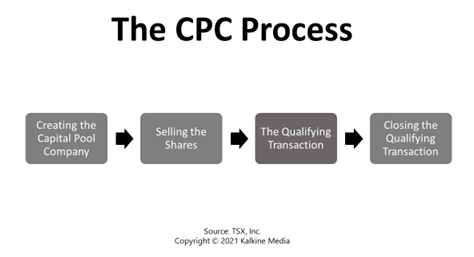

- What is the process of creating a Capital Pool Company?

According to the TMX Group’s website, the process of creating a capital pool company is defined in three steps -- the formation of the CPC board and management team; the CPC seed capital requirements; and the IPO requirements. These three steps are discussed in detail below:

Formation of CPC board and management team

The CPC board and management team (or CPC Founders) consists of at least three individuals having an appropriate combination of a public company and business experience, precisely:

- A positive track record of smaller companies supported with the evidence of their growth.

- The ability to raise funding.

- A positive regulatory and corporate governance history.

- Appropriate technical industry experience in the related sector.

- The ability to identify and develop the right acquisition opportunities.

- Relevant experience as officers or directors in the public companies of the United States and Canada.

CPC Seed Capital Requirement

- The minimum seed share price must be 50 per cent of the IPO price and greater than C$ 0.05.

- The minimum capital to be raised is C$ 100,000 and the maximum is C$ 1,000,000.

- The minimum amount invested by the officers/directors must be greater than C$ 100,000 or 5 per cent of all the proceeds.

- A minimum investment from each officer/director of C$ 5,000.

IPO Requirements

- The minimum share price should be C$ 0.10.

- Raise a minimum of C$ 200,000 and a maximum of C$ 9,500,000.

- The maximum aggregate gross proceeds should be C$ 10,000,000.

- The shares must be distributed among a minimum of 150 shareholders, each with at least 1,000 shares.

- There should be 50,000 free-trading shares.

- 20 per cent of the shares offered must be held by public shareholders.

Please wait processing your request...

Please wait processing your request...