Darktrace PLC (LSE: DARK)

Darktrace PLC is an FTSE 250 listed global leader in cyber security AI. Moreover, it provides the first at-scale deployment of A.I. in cyber security and is a pioneer of autonomous response technology. This Report covers the Investment Highlights, Conclusion, and Recommendation on the stock.

Rationale – Sell at GBX 481.47

- Profit Booking: DARK’s stock price has breached the R1 level suggested in the previous report published on 10 April 2024. Considering the market conditions and the price action, it is prudent to exit the stock and book profit.

- Decline in Net Annual Recurring Revenue Added: The Company’s Net Annual Recurring Revenue Added has declined around 10.8% YoY from USD 72.61 million in H1 FY23 to USD 64.78 million during H1 FY24.

- Macroeconomic Risk: The market sentiments can remain weak in the short-term due to the subdued consumer disposable income, geopolitical tensions, and political risks.

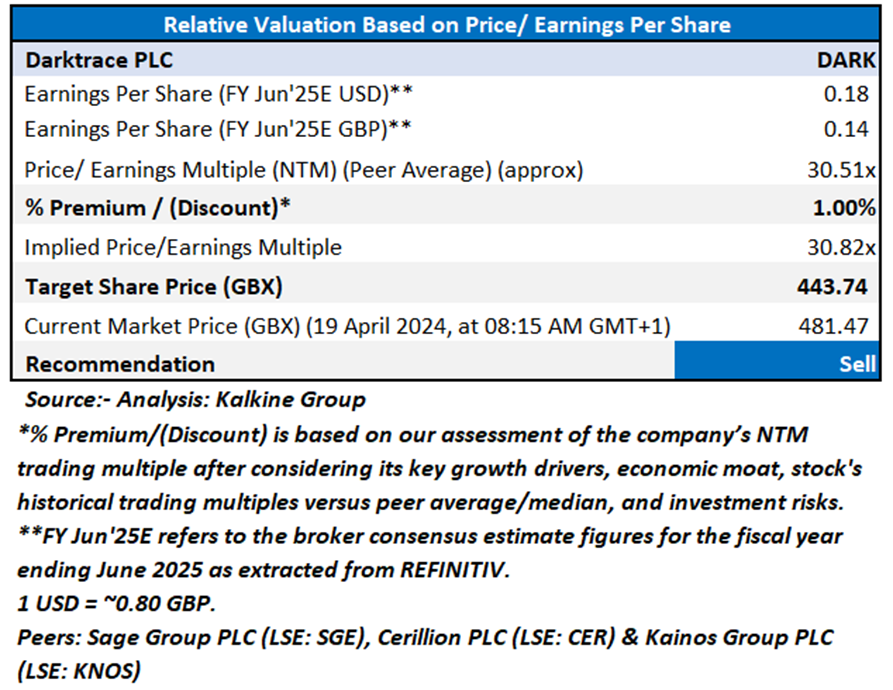

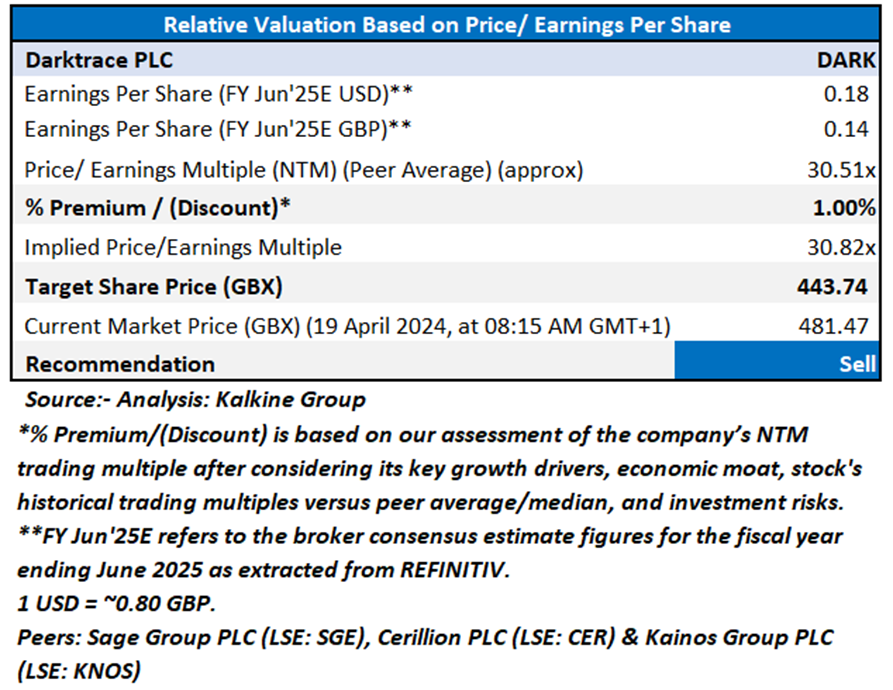

Valuation Methodology: Price/Earnings Approach

Share Price Chart

Conclusion

Based on the notional gains, Decline in Net Annual Recurring Revenue Added, and price action stance, a "SELL" recommendation on Darktrace PLC (LSE: DARK) has been given at the current market price of GBX 481.47 (as of 19 April 2024, at 08:15 AM GMT+1).

Darktrace PLC (LSE: DARK) is a part of Kalkine’s Global Artificial Intelligence and Emerging Technologies Report.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is 19 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level which the stock is expected to reach as per the relative valuation method and/or technical analysis taking into consideration both short-term and long-term scenario.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the London Stock Exchange (LSE) and or REFINITIV. Typically, both sources (LSE and or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

Please wait processing your request...

Please wait processing your request...