Avangrid, Inc.

AGR Details

Avangrid, Inc. (NYSE: AGR) operates 2 business units, Networks and Renewables.

Financial Results

- The company reported consolidated U.S. GAAP net income of $786 Mn, or $2.03 per share as compared to $881 Mn, or $2.28 per share for the full year 2022. For the Q4 ended December 31, 2023, the consolidated net income stood at $397 Mn, or $1.03 per share as compared to $147 Mn or $0.38 per share, for 4Q ended December 31, 2022.

- The results for the FY 2023 were favorable as compared to FY 2022 after excluding the 2022 gain from restructuring of the company’s New England offshore wind lease partnership agreement of $181 Mn as well as $37 Mn in upfront tax benefits from enactment of 2022 Inflation Reduction Act, reflecting 18% growth YoY.

- On the non-U.S. GAAP adjusted basis, consolidated net income for FY 2023 was $808 Mn.

Key Updates

The company announced that the unaffiliated committee of its Board of Directors received the non-binding proposal from Iberdrola, S.A. on March 6, 2024 for the acquisition of all of the issued as well as outstanding shares of common stock of the company not owned by Iberdrola, S.A. or its affiliates for $34.25 in cash per share. Iberdrola, S.A. is owning ~81.6% of Avangrid’s issued and outstanding shares of common stock.

Outlook

The company priorities for FY 2024 include delivering earnings outlook, executing on multi-year rate plans, etc. For 2024, its adjusted EPS is expected in the range of $2.17-$2.32.

Key Risks

Slowdown in the global growth, volatility in the equity market, increased inflation, changes in regulatory policies, etc. are some of the risks AGR faces.

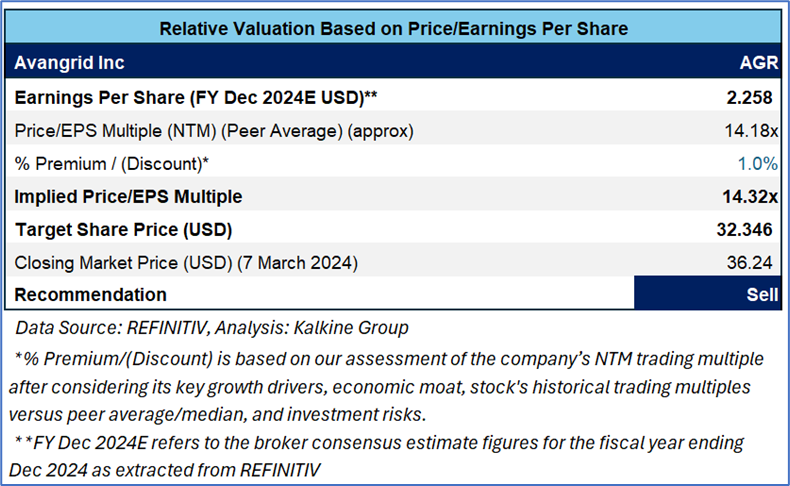

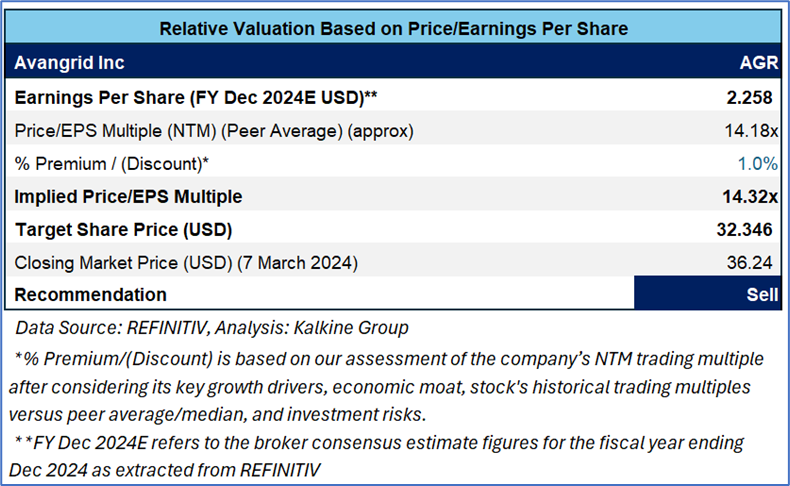

Fundamental Valuation

P/E Based Relative Valuation (Illustrative)

Stock Recommendation

The stock has made a 52-week low and high of USD 27.46 and USD 41.22, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Also, the climate related proceedings and legislation might result in alteration of the public utility model in the states it operates in which could adversely impact the business and operations. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 36.24 per share, up by 12.97% as on 7 March 2024

Technical Overview:

Daily Price Chart

AGR Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on March 7, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Please wait processing your request...

Please wait processing your request...