Enphase Energy, Inc.

ENPH Details

Enphase Energy, Inc. (NASDAQ: ENPH) is the global energy technology company. It delivers smart, easy-to-use solutions which manage solar generation, storage, and communication on one platform.

Financial Results for Q3 FY 2023

- ENPH posted quarterly revenue of $551.1 Mn in Q3 FY 2023, along with 48.4% for non-GAAP gross margin. It shipped 3,905,239 microinverters, or approximately 1,585.6 megawatts DC as well as 86.2 megawatt hours of IQ™ Batteries.

- Its GAAP operating income stood at $118.0 Mn and non-GAAP operating income of $167.6 Mn.

- Due to the macroeconomic conditions, its revenue in the United States for the third quarter of 2023 fell ~16% as compared to the second quarter of 2023.

Key Updates

The company announced that it is expanding the support for virtual power plants (or VPPs) via grid services programs throughout the US powered by the new IQ® Battery 5P.

Outlook

For the fourth quarter of 2023, its revenue is expected in the range of $300.0 Mn - $350.0 Mn, which includes shipments of 80 - 100 megawatt hours of IQ Batteries.

Key Risks

If demand for the solar energy solutions does not grow or grows at the slower rate than the company expects, its business might suffer.

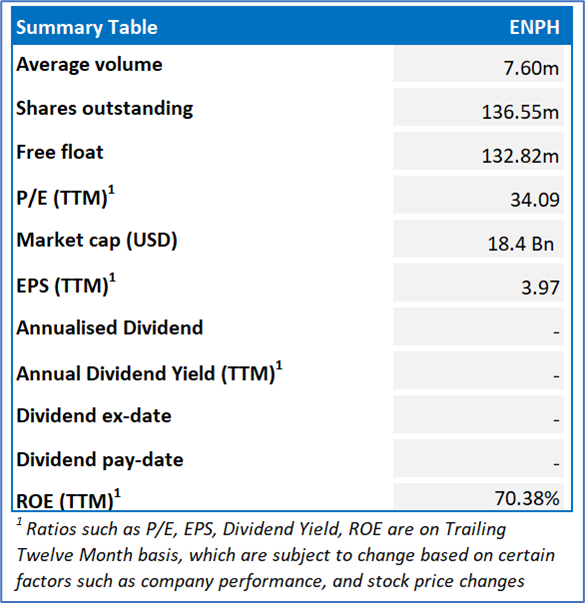

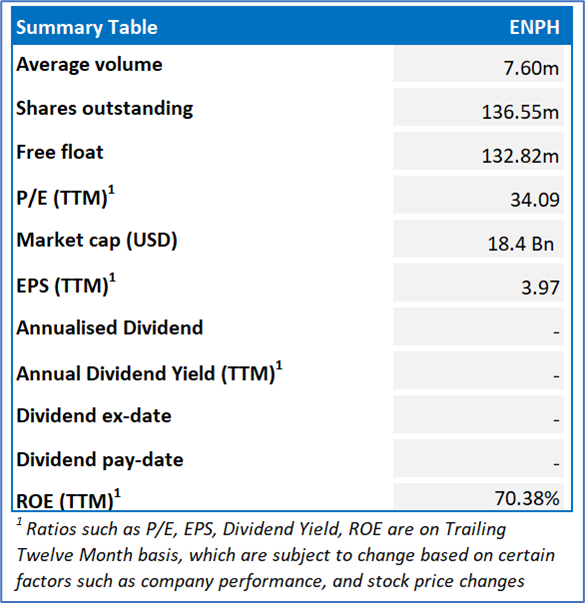

Fundamental Valuation

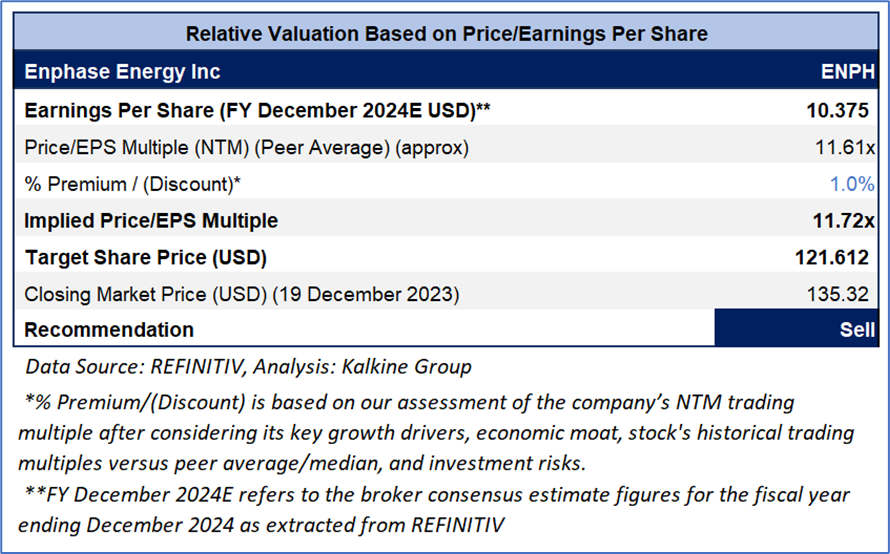

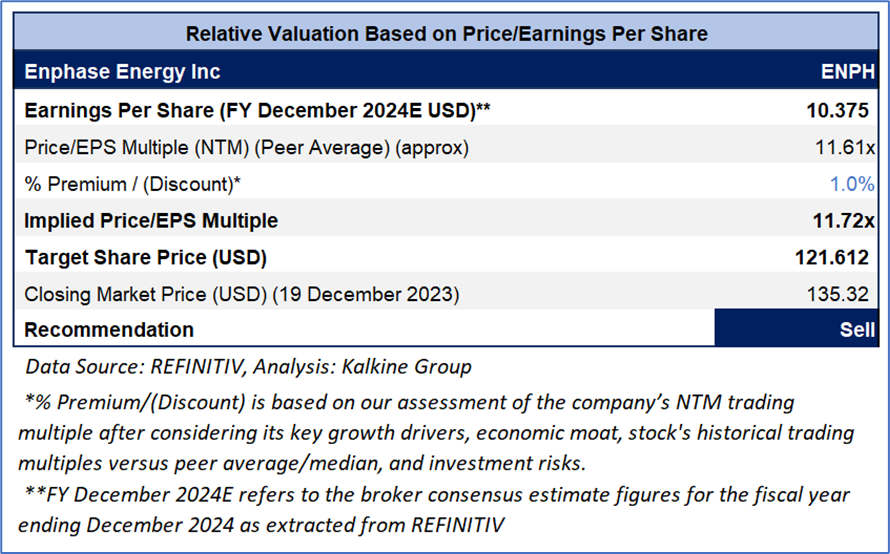

P/E Based Relative Valuation

Stock Recommendation

The stock has made a 52-week low and high of USD 73.49 and USD 317.825, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 135.32 per share, up by 9.1% as on 19th December 2023.

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on December 19, 2022. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Please wait processing your request...

Please wait processing your request...