This report is an updated version of the report published on the 28 December 2023 at 3:55 PM AEDT.

Mineral Resources Ltd (ASX: MIN)

MIN is an Australian listed diversified resources entity with extensive operations in lithium, iron ore, energy, and mining services across Western Australia. The Company has been providing safe, high-quality, low-cost mining, mining construction and mining infrastructure services in Australia.

Recommendation Rationale – SELL at AUD 70.880

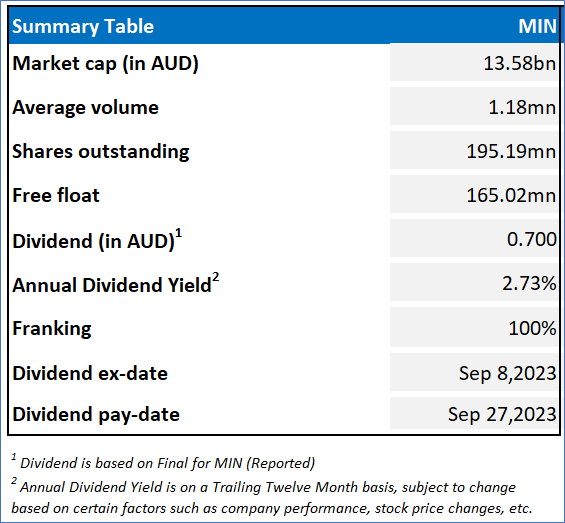

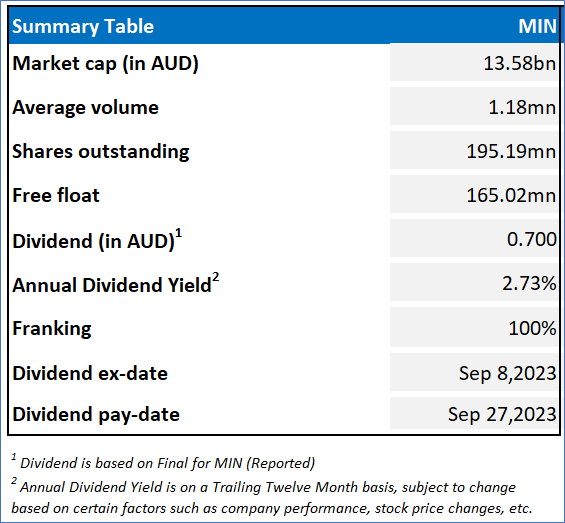

- Financial Performance: In FY23, the company’s revenue went up by 39.8% YoY. MIN's business doubled from 2019 to 2022 through CSI mining services, while advancements in technology are driving new opportunities. Since listing, MIN has delivered 24% and 18% annual growth of consistent full franked dividend and average return on invested capital after tax, respectively.

- Outlook: MIN deployed capital across key growth projects, including expansion of world-class lithium portfolio, construction of long-life Onslow Iron project, and a successful natural gas exploration program in the onshore Perth Basin. These projects should underpin the company’s growth for decades to come.

- Emerging Risks: The company is exposed to various financial risks. The group is exposed to commodity price risk, which arises from the group’s sale of iron ore, lithium hydroxide and lithium spodumene concentrated at contracted or spot prices.

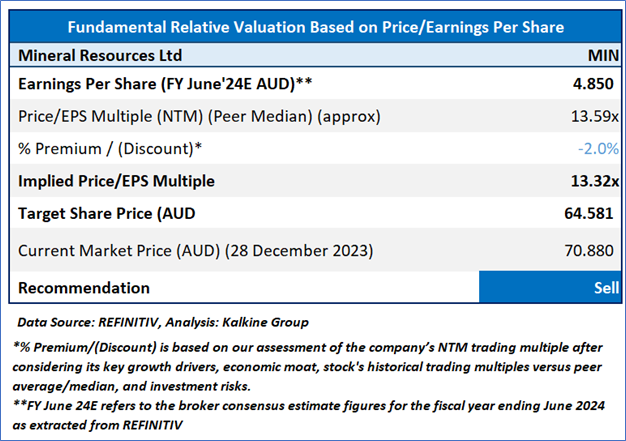

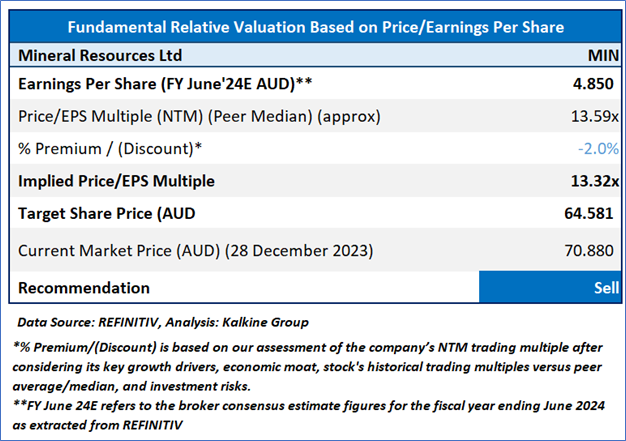

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/EBITDA, EV/Sales, Price/Earnings, Price/Cash Flow and Price/Book) are higher than the median of the Metals & Mining’ industry.

MIN Daily Chart

Valuation Methodology: Price/Earnings Approach (FY June'24E) (Illustrative)

Given the macroeconomic factors, volatility in commodity prices and other material business risks, etc, the company might trade at a slight discount to its peers. For valuation, few peers like Pilbara Minerals Ltd (ASX: PLS), IGO Ltd (ASX: IGO), South32 Ltd (ASX: S32), and others have been considered. Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 70.88 (as of December 28, 2023, at 10:15 AM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 128 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Please wait processing your request...

Please wait processing your request...