Guess? Inc

Guess? Inc. (NYSE: GES) designs, markets, distributes and licenses lifestyle collections of apparel and accessories for men, women and children. The Company’s segments include Europe, Americas Retail, Americas Wholesale, Asia, and Licensing.

Recent Business and Financial Updates

- Strong Second Quarter Performance: Guess?, Inc. reported impressive financial results for the second quarter of fiscal 2025, with revenues amounting to USD 733 million, reflecting a growth of 10% in U.S. dollars and 13% in constant currency. The company's operating margin was reported at 6.5%, while the adjusted operating margin stood at 5.2%. Despite the positive revenue growth, Guess?, Inc. recorded a GAAP loss per share of USD 0.28, although the adjusted earnings per share (EPS) were USD 0.42, indicating solid underlying performance.

- Revised Full-Year Outlook: Considering the second quarter results, Guess?, Inc. updated its fiscal 2025 outlook. The company now anticipates revenue growth between 9.5% and 11.0% in U.S. dollars, with GAAP and adjusted operating margins expected to be in the range of 7.2% to 7.7%, and 7.3% to 7.8%, respectively. Moreover, the company forecasts GAAP EPS to range from USD 1.92 to USD 2.14, while adjusted EPS is expected to be between USD 2.42 and USD 2.70, reflecting confidence in the company's strategic direction.

- Strategic Initiatives and Acquisition Impact: CEO Carlos Alberini highlighted the company's strategic initiatives as a key driver behind the 10% revenue growth, with notable contributions from rag & bone acquisition and strong wholesale performance in Europe and the Americas. However, the Asia region underperformed during the quarter. Alberini also emphasized the importance of marketing investments in the international expansion of Guess Jeans and rag & bone, which have impacted profitability but are expected to drive long-term growth.

- Acquisition of rag & bone: Guess?, Inc. successfully completed the acquisition of the fashion brand rag & bone on April 2, 2024, in partnership with WHP Global. The acquisition included the operating assets and liabilities of rag & bone, and the brand is now fully integrated into the company's business segments. The joint venture, equally owned by Guess?, Inc. and WHP Global, holds the intellectual property of rag & bone. This acquisition is expected to strengthen the company's portfolio and contribute to future growth initiatives.

- Financial Results and Segment Performance: For the second quarter of fiscal 2025, Guess?, Inc. reported a GAAP net loss of USD 10.6 million, compared to net earnings of USD 39.0 million in the previous year. This decline was primarily driven by a USD 40.5 million unrealized loss related to derivatives linked to the company’s convertible senior notes. Adjusted net earnings were USD 23.0 million, a 42% decrease from the prior year. The company's revenue breakdown showed growth in Europe and the Americas Wholesale segments, while the Americas Retail and Asia segments underperformed. Licensing revenues also showed a modest increase.

- Six-Month Results and Dividends: For the first half of fiscal 2025, Guess?, Inc. recorded a significant decline in GAAP net earnings, amounting to USD 2.4 million, down 91% from USD 27.2 million in the previous year. Total net revenue for the six-month period increased by 7% to USD 1.32 billion, with a 10% increase in constant currency. The company’s Board of Directors approved a quarterly cash dividend of USD 0.30 per share, and during the first half of the year, Guess?, Inc. repurchased approximately 2.6 million shares of its common stock, totaling USD 60.3 million.

- Adjustments in Strategy: Looking ahead, Guess?, Inc. plans to adjust its revenue and earnings expectations due to the challenging consumer environment. Despite the revised outlook, the company remains focused on cost management, inventory control, and strategic investments in marketing, new stores, and infrastructure. Alberini emphasized that fiscal 2025 represents a transformative year for the company, with continued investments in new brands and business expansion, positioning the company for long-term growth and diversification.

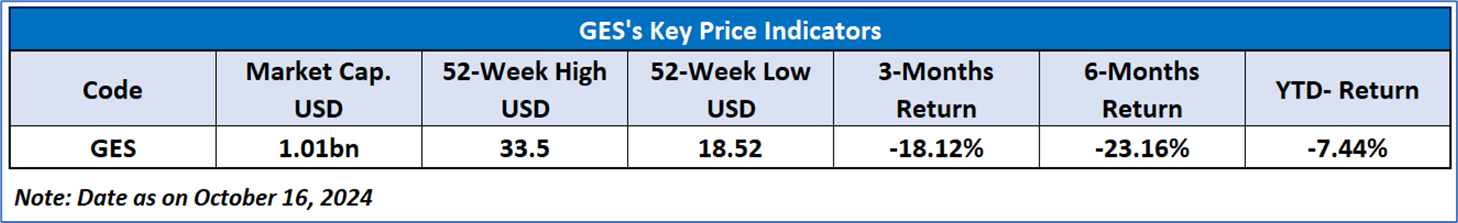

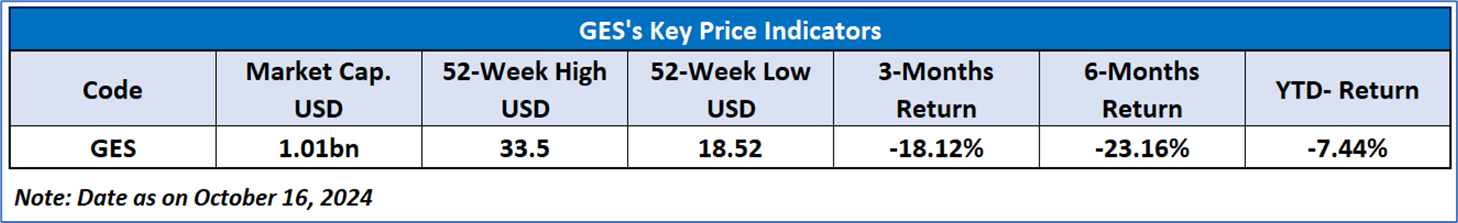

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 49.53, up trending, with expectations of a consolidation or an upward momentum. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels. The current price is near an important support zone of USD 18- USD19.00, with expectations of trend reversal once this support levels sustains.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Guess? Inc. (NYSE: GES) at the current market price of USD 19.63 as of October 16, 2024, at 08:40 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 16, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...