Autolus Therapeutics PLC

Autolus Therapeutics PLC (NASDAQ: AUTL) is a UK-based clinical-stage biopharmaceutical firm focused on developing programmed T cell therapies for cancer and autoimmune diseases, particularly through chimeric antigen receptor (CAR)-T cell therapy. The company employs a range of proprietary T cell programming technologies to create targeted and highly effective T cell therapy candidates that can identify and destroy target cells.

Recent Business and Financial Updates

- Operational Updates: During the recent quarter, Autolus Therapeutics announced several promotions to Senior Vice President, recognizing the leadership of Andrea Braun (Regulatory Affairs), Markus Gruell (Corporate Quality), Claudia Mercedes Mayer (Manufacturing Strategy and Technology), Chris Gray (Technical Operations and Facilities), and Dilip Patel (Market Access and Pricing Strategy). These appointments are aimed at enhancing Autolus’ regulatory efforts and preparations for the anticipated commercialization and launch of obe-cel. In April 2024, Autolus reported that the European Medicines Agency (EMA) accepted its Marketing Authorization Application (MAA) for obe-cel, specifically targeting patients with relapsed or refractory adult B-cell acute lymphoblastic leukemia (r/r B-ALL). This milestone is crucial for advancing the company's therapeutic offerings in the oncology space. Additionally, Autolus entered into a distribution services agreement with a Cardinal Health subsidiary to facilitate the ordering and distribution of obe-cel in the United States, contingent on receiving the necessary regulatory approval. This agreement is expected to streamline the logistics associated with bringing obe-cel to market. In a strategic leadership change, Autolus appointed Mike Bonney as Chairman of the Board and Ravi Rao, M.D., as Non-Executive Director. These appointments follow the resignation of John H. Johnson from his roles as Chairman and Non-Executive Director, effective April 1, 2024.

- Financial Highlights: For the quarter ending June 30, 2024, Autolus reported cash and cash equivalents totaling $705.9 million, a significant increase from $239.6 million as of December 31, 2023. This robust financial position positions the company favorably for future operational and development endeavors. Total operating expenses for the second quarter of 2024 reached $58.9 million, up from $44.4 million during the same period in 2023. This rise reflects increased investment in various operational activities, primarily in research and development.

- Outlook for 2024: Looking ahead, Autolus has outlined key upcoming milestones. The U.S. FDA has set a PDUFA target action date for obe-cel on November 16, 2024. Moreover, data from the FELIX trial will be presented at the American Society of Hematology (ASH) meeting in December 2024. The company also anticipates releasing initial data from its Phase 1 study on obe-cel for autoimmune disease, specifically systemic lupus erythematosus (SLE), by late 2024. Autolus remains well-capitalized with its current cash and equivalents, positioning the company to advance the launch and commercialization of obe-cel for r/r adult B-ALL and to further its pipeline development initiatives.

- Research and Development Costs: Research and development expenses climbed from $33.2 million to $36.6 million for the quarter ending June 30, 2024. This increase is attributed to heightened operating costs associated with the new manufacturing facility, employee salaries, and clinical trial expenses related to obe-cel. However, this was partially mitigated by an increase in U.K. reimbursable R&D tax credits. In contrast, general and administrative expenses surged from $11.1 million to $21.9 million during the same period. This rise is mainly due to increased salaries and employment-related costs stemming from a larger workforce focused on pre-commercialization activities.

- Clinical Update: Autolus Therapeutics presented findings at the 2024 Congress showing that adult patients with relapsed/refractory B-Cell Acute Lymphoblastic Leukemia experience similar outcomes regardless of stem cell transplant timing. Additionally, obe-cel treatment yielded better results for patients with lower tumor burden.

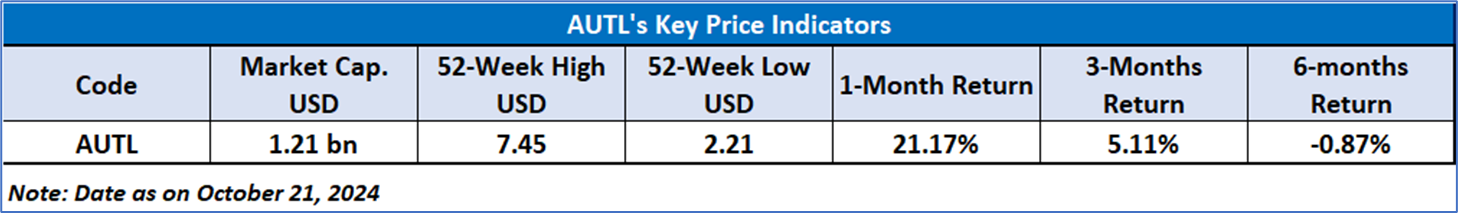

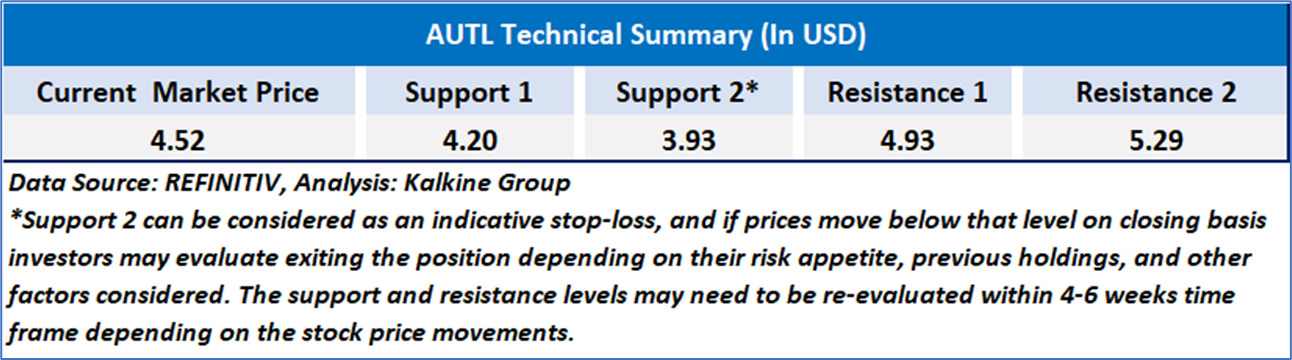

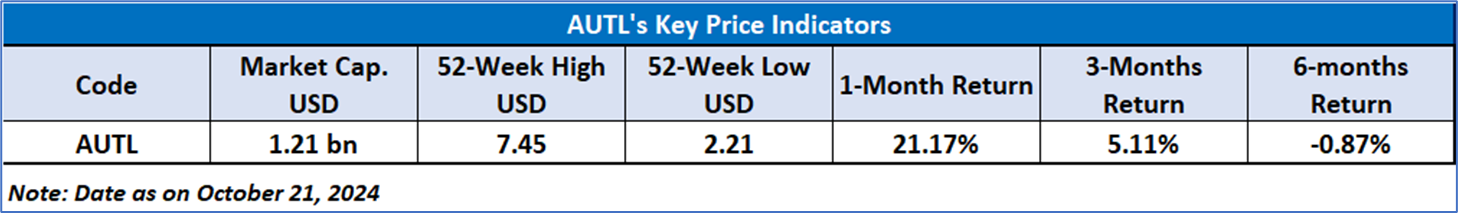

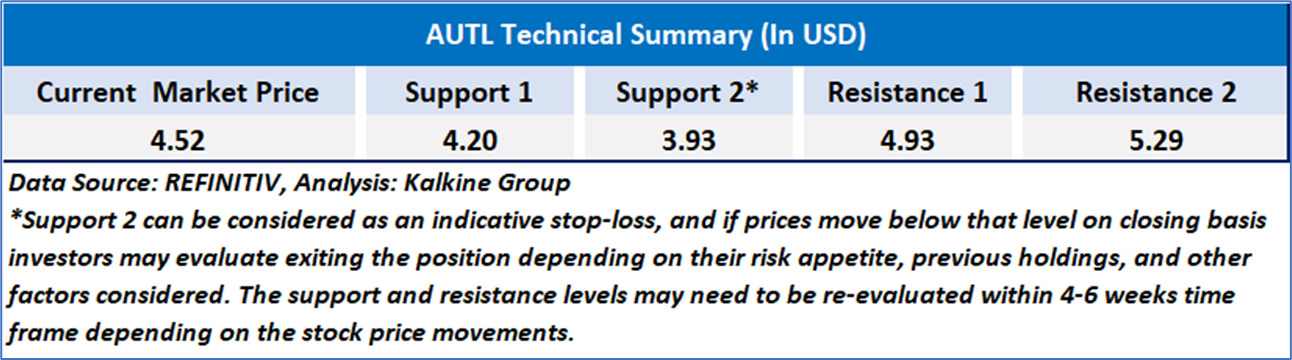

Technical Observation (on the daily chart):

AUTL's stock price is currently near a crucial trendline resistance that has previously served as a significant supply zone. Unless the price manages to regain its key moving averages and reach new highs, the stock is likely to remain in a consolidation phase. Additionally, the 14-day Relative Strength Index (RSI) is situated near its midpoint, indicating a lack of bullish momentum. On a positive note, AUTL is trading above both its 50-day simple moving averages, providing immediate support. However, if the stock falls below these levels, it may trigger increased selling pressure.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Autolus Therapeutics PLC (NASDAQ: AUTL) at the closing market price of USD 4.52 as of October 21, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 21,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...