Jiayin Group Inc

Jiayin Group Inc (NASDAQ: JFIN) is a China-based company engaged in providing a fintech platform to facilitate connections between underserved individual borrowers and financial institutions funding partners. The Company's businesses include loan facilitation services, post-origination services and other businesses.

Recent Business and Financial Updates

- Second Quarter 2024 Operational Highlights: During the second quarter of 2024, loan facilitation volume amounted to RMB 24.0 billion (USD 3.3 billion), mirroring the same figure from the corresponding period in 2023. The average borrowing amount per transaction was RMB 9,080 (USD 1,249), indicating a 12.4% decrease compared to the previous year. Additionally, the repeat borrowing rate stood at 67.1%, down from 70.1% in the same quarter of 2023. Despite these changes in operational metrics, the Company saw a 15.5% year-over-year increase in net revenue, reaching RMB 1,476.3 million (USD 203.1 million). However, income from operations fell by 38.5% to RMB 227.1 million (USD 31.3 million), and net income experienced a 27.0% decline, amounting to RMB 238.3 million (USD 32.8 million).

- CEO's Remarks on Market Stability and Strategic Focus: Yan Dinggui, the Founder, Director, and Chief Executive Officer, expressed confidence in the Company’s strategic direction and risk management efforts. He highlighted the organization's resilience and adaptability in navigating evolving market conditions. Mr. Dinggui emphasized that key risk indicators in the market have stabilized and are showing signs of improvement, which creates an optimistic environment for the Company to accelerate its business growth in the coming quarters. The strategic focus remains on sustainable development through continuous innovation and targeted market expansion.

- Financial Results for the Second Quarter of 2024: Net revenue for the quarter reached RMB 1,476.3 million (USD 203.1 million), reflecting a 15.5% increase year-over-year. The loan facilitation services contributed RMB 951.1 million (USD 130.9 million), up by 2.8%, driven by optimized service fees. Revenues from the release of guarantee liabilities saw a significant rise to RMB 424.8 million (USD 58.5 million), a marked increase from RMB 197.2 million in the prior year, attributed to the growth in average outstanding loan balances for which the Company provided guarantee services. On the other hand, other revenue decreased by 35.5%, amounting to RMB 100.4 million (USD 13.7 million), due to lower revenue from individual investor referral services.

- Expense Overview and Operating Income Decline: Facilitation and servicing expenses surged by 70.9% year-over-year, reaching RMB 608.2 million (USD 83.7 million), primarily due to higher guarantee costs. The reversal of uncollectible receivables, contract assets, and loans receivable resulted in a net reversal of RMB 3.3 million (USD 0.5 million), compared to a RMB 13.8 million allowance recorded in the same period in 2023. Sales and marketing expenses increased by 15.7%, totaling RMB 486.6 million (USD 67.0 million), driven by higher borrower acquisition costs. General and administrative expenses rose by 29.8% to RMB 65.0 million (USD 8.9 million), while research and development expenses grew by 36.3% to RMB 92.8 million (USD 12.8 million), both largely due to increased personnel costs.

- Profitability and Cash Position: Income from operations declined by 38.5% year-over-year to RMB 227.1 million (USD 31.3 million), while net income fell by 27.0%, amounting to RMB 238.3 million (USD 32.8 million). Basic and diluted net income per share were both RMB 1.12 (USD 0.15), compared to RMB 1.52 in the second quarter of 2023. Similarly, basic and diluted net income per American Depositary Share (ADS) were both RMB 4.48 (USD 0.60), compared to RMB 6.08 in the same period of 2023. As of June 30, 2024, the Company held RMB 880.2 million (USD 121.1 million) in cash and cash equivalents, a significant increase from RMB 568.2 million as of March 31, 2024.

- Business Outlook and Dividend Announcement: For the third quarter of 2024, the Company expects to facilitate approximately RMB 25 billion in loans, reflecting confidence in both the improving economic environment and its operational capabilities. Furthermore, on August 16, 2024, the Board of Directors approved a cash dividend of USD 0.125 per ordinary share, or USD 0.50 per ADS, with shareholders on record by August 27, 2024, eligible for the payout. The aggregate distribution is anticipated to be approximately USD 26.6 million, and dividends will be disbursed by early September 2024.

- Share Repurchase Plan and ESG Commitment: In March 2024, the Board of Directors adjusted the Company’s share repurchase plan, authorizing repurchases of up to USD 30 million in ordinary shares. On June 4, 2024, the Board extended the repurchase plan for 12 months, with the period now running through June 2025. As of August 27, 2024, the Company had repurchased approximately 3.3 million ADSs at a total cost of USD 13.9 million. Additionally, on August 7, 2024, the Company released its 2023 Environmental, Social, and Governance (ESG) report, emphasizing its commitment to sustainability, ethical business practices, and transparent governance. The report highlights the Company’s efforts in digital transformation, enhancing service quality, and promoting low-carbon practices aimed at supporting the circular economy.

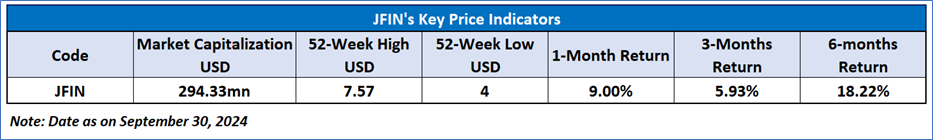

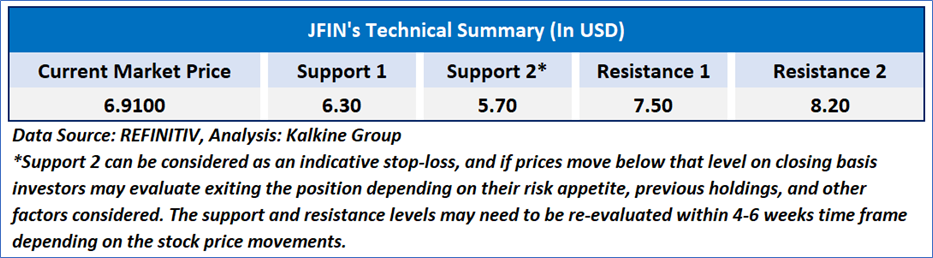

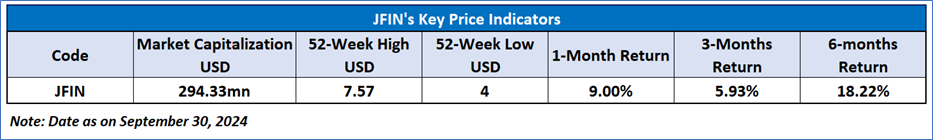

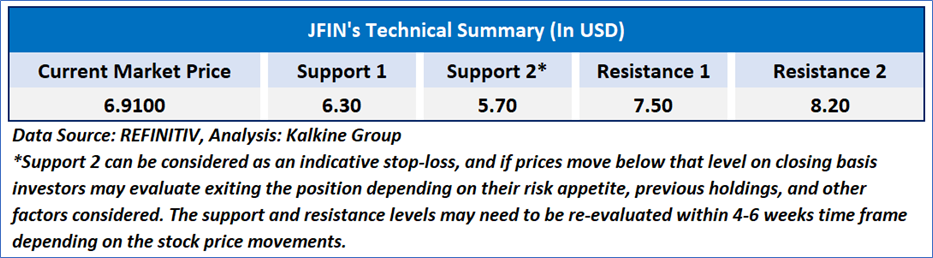

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 74.88, currently upward trending, with expectations of a consolidation or an upward momentum as an important resistance of USD6.00 is broken. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to Jiayin Group Inc (NASDAQ: JFIN) at the current market price of USD 6.91 as of September 30, 2024, at 06:40 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 30, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...