Byrna Technologies, Inc

Byrna Technologies, Inc (NASDAQ: BYRN) is a technology firm focused on developing, manufacturing, and selling advanced less-lethal personal security solutions. Its product range includes handheld security devices and shoulder-fired launchers for both consumers and professional security users. The portfolio also features various projectiles compatible with Byrna devices, including chemical irritants and kinetic rounds, as well as self-defense aerosol products like Byrna Bad Guy Repellent.

Recent Business and Financial Updates

- Advertising Strategy: In the Q# FY24, Byrna Technologies achieved an impressive return on ad spend (ROAS) of 5.0X through its celebrity endorsement program. This success occurred alongside an increase in advertising expenditures, which rose from USD 800,000 per month in Q2 to USD 1.0 million per month in Q3. These efforts resulted in record quarterly results and significant year-over-year growth.

- Expansion of Celebrity Endorsement Roster: The company has broadened its celebrity endorsement roster, recently adding Mike Huckabee, the former Governor of Arkansas. Additionally, agreements have been signed with two more prominent celebrities, set to commence in December, further enhancing Byrna's visibility and brand awareness.

- Earned Media and Brand Awareness: Byrna has secured extensive earned media placements, featuring on over two dozen news programs, including ABC, Fox, Newsmax, and NewsNation. This substantial media coverage, bolstered by the celebrity endorsement program, plays a critical role in enhancing brand recognition and promoting the normalization of the less-lethal industry.

- Growth in Retail Partnerships: Byrna has achieved national account status with Bass Pro Shops and Cabela’s, expanding its retail presence from 42 stores to 137 across the United States. This growth underscores the increasing awareness and acceptance of Byrna’s products in the market.

- International Market Expansion: In addition to domestic growth, Byrna has expanded its sales reach into Mexico through a successful partnership with the Secretaría de Trabajo y Previsión Social (STPS), establishing a federally certified training program for civilians to carry Byrna products. Furthermore, Byrna secured an initial order from the Ministry of the Interior of Uruguay for 400 Byrna launchers and over 100,000 rounds of less-lethal ammunition for the national police, demonstrating its international growth trajectory.

- Financial Performance Highlights: For Q3 2024, Byrna reported net revenue of USD 20.9 million, a remarkable increase of 194% compared to the same quarter in 2023. This surge in revenue is largely attributed to the company’s transformative advertising strategy implemented in September of the previous year. For the first nine months of 2024, total revenue reached USD 57.8 million, reflecting a 114% increase year-over-year.

- Profit Analysis: The gross profit for Q3 2024 stood at USD 13.0 million, representing 62.4% of net revenue, up from USD 3.2 million (44.6%) in Q3 2023. This improvement is driven by a higher proportion of sales through direct-to-consumer channels, cost reductions in component sourcing, and increased production efficiency. The gross margin for the first nine months of 2024 was 60.9%, compared to 54.1% for the prior year.

- Operating Expenses and Net Income: Operating expenses for Q3 2024 totaled USD 12.2 million, an increase from USD 7.3 million in Q3 2023, primarily due to higher selling costs, marketing expenses, and increased payroll. Despite this rise in expenses, Byrna achieved net income of USD 1.0 million for Q3 2024, a significant turnaround from a loss of USD (4.1) million in the same period last year. For the first nine months of 2024, net income amounted to USD 3.1 million, compared to a loss of USD (7.4) million in 2023.

- Guidance: Looking ahead, Byrna is focused on scaling production to meet growing demand. Plans include introducing a partial second shift in the fourth fiscal quarter and adding a third production line dedicated to the upcoming Byrna Compact Launcher, scheduled for release in Summer 2025. Additionally, Byrna is investing in expanding its retail footprint with new stores in key markets, further supporting revenue growth and brand visibility.

Technical Observation (on the daily chart):

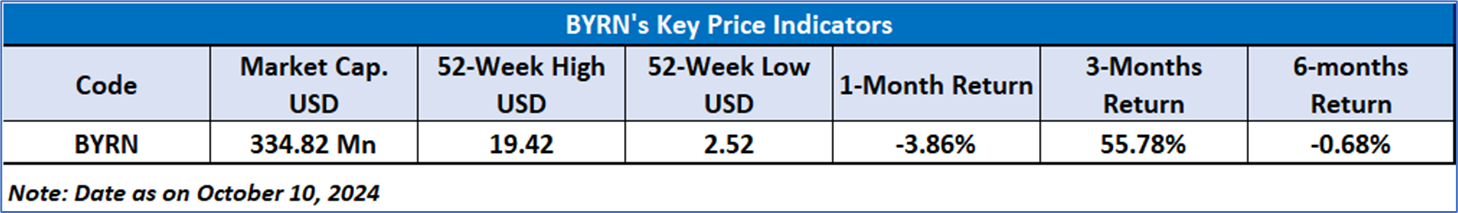

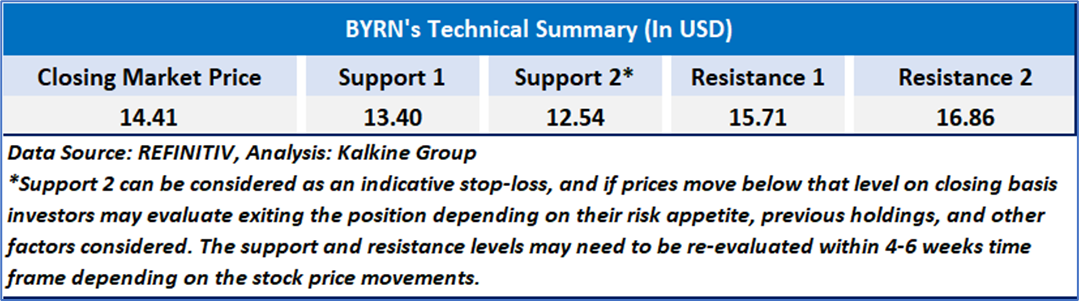

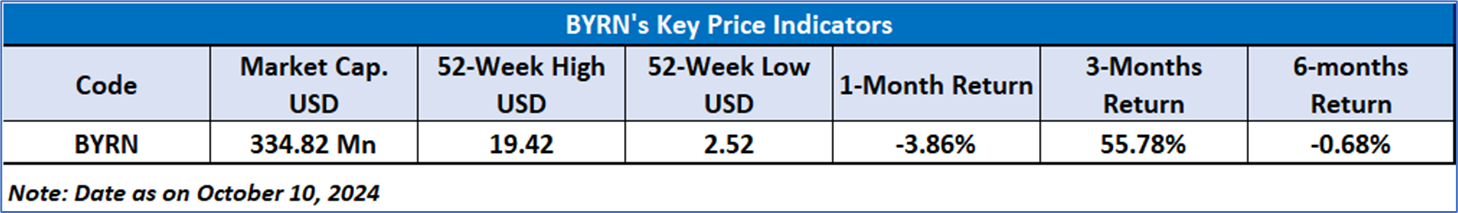

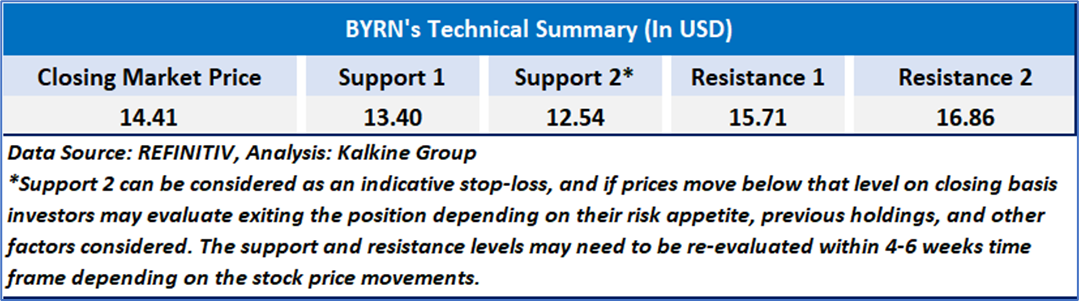

BYRN stock is currently hovering near its key support levels, indicating strong potential for further growth. The 14-day Relative Strength Index (RSI), which recently dipped toward the midpoint, suggests a temporary easing in momentum but may indicate a possible pullback to the upside soon. Furthermore, the stock's position above its 50-period simple moving average reinforces the strength of the trend, increasing the likelihood that it will continue its upward trajectory.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Byrna Technologies, Inc (NASDAQ: BYRN) at the closing market price of USD 14.41 as of October 09,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 09,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

_10_10_2024_13_59_16_122150.jpg)

Please wait processing your request...

Please wait processing your request...