Pangea Logistics Solutions Ltd

Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) is a provider of seaborne drybulk logistics and transportation services as well as terminal and stevedoring services. The Company offers services to a base of industrial customers who require the transportation of a variety of drybulk cargoes, including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone.

Recent Business and Financial Updates

- Second Quarter 2024 Financial Results: For the second quarter of 2024, Pangaea reported a net income attributable to the company of USD 3.7 million, translating to USD 0.08 per diluted share. The adjusted net income amounted to USD 4.6 million, or USD 0.10 per diluted share. Operating cash flow during the quarter reached USD 9.0 million, while the adjusted EBITDA stood at USD 15.9 million. Pangaea's Time Charter Equivalent ("TCE") rate averaged USD 16,223 per day, surpassing the average Baltic Panamax and Supramax indices by 7%. The company's net debt-to-trailing-twelve-month adjusted EBITDA ratio remained at 2.1x. Additionally, the company expanded its owned vessel fleet to 26 with the acquisition of two vessels, Bulk Brenton and Bulk Patience, during the third quarter.

- Key Operational Metrics: Pangaea's total revenue for the second quarter of 2024 was USD 131.5 million. The company's TCE rate increased by 4% on a year-over-year basis, supported by long-term contracts of affreightment (COAs), a specialized fleet, and a cargo-centric strategy. Total shipping days, including both voyage and time charter days, rose by 2% to 4,117 days, compared to the same period last year. Pangaea's TCE performance, at USD 16,223 per day, exceeded the previous year's average of USD 15,558 per day.

- Cash and Debt Position: As of June 30, 2024, the company reported USD 77.9 million in cash and cash equivalents, with total debt, including lease finance obligations, amounting to USD 252.6 million. During the quarter, Pangaea made debt repayments of USD 3.6 million in finance leases, USD 4.6 million in long-term debt following a refinancing, and disbursed USD 4.5 million in cash dividends. The net debt-to-adjusted EBITDA ratio remained unchanged at 2.1x from the prior year. On August 8, 2024, the Board of Directors declared a quarterly dividend of USD 0.10 per common share, payable on September 16, 2024, to shareholders of record on September 2, 2024.

- Management Insights: Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions, emphasized the company's consistent execution amid a stable dry-bulk market, which contributed to premium TCE returns. He highlighted the strong utilization of the fleet in executing long-term contracts across key Atlantic trade routes. As the company enters the peak demand period for its ice-class fleet operating in the Canadian Arctic, the stable market environment and expanded fleet position the company for robust performance in the second half of 2024. Filanowski further remarked on the resilience of the global dry bulk market, which has stabilized following disruptions in global trade, resulting in a more normalized pricing environment. He noted that second-hand vessel values have risen significantly due to weak dry bulk newbuilding orders, increased newbuilding prices, higher interest rates, and uncertainty surrounding emissions regulations. As a result, the limited number of newbuild vessels entering the market is expected to be a systemic driver of higher market rates in 2025.

- Strategic Focus on Capital Deployment: Filanowski also highlighted the company's capital deployment strategy. During the quarter, Pangaea entered into agreements to acquire Bulk Brenton and Bulk Patience, which will join the fleet in the third quarter. Simultaneously, the company refinanced two of its owned vessels with new lenders and repaid over USD 8 million in debt, enhancing the flexibility of its balance sheet. Moving forward, the company aims to maximize fleet utilization, invest in profitable growth, and deliver consistent shareholder returns.

- Strategic Update and Fleet Expansion: Pangaea remains committed to its goal of becoming a leading dry bulk logistics and transportation services company. With a specialized focus on commodity and niche markets, the company seeks to drive premium returns measured by TCE per day. In addition to operating the largest high ice-class dry bulk fleet of Panamax and post-Panamax vessels globally, Pangaea provides stevedoring services and manages port and terminal operations. Over the past year, the company has expanded its marine port terminal operations in multiple locations and continues to invest in organic growth. A key development is the ongoing expansion of its terminal operations in the Port of Tampa, set for completion in the second half of 2025.

- Fleet Utilization and Upgrading Strategy: In the second quarter of 2024, Pangaea's 24 owned vessels were fully utilized, supplemented by an average of 22 chartered-in vessels to meet cargo and COA commitments. The company continues to upgrade its fleet while divesting older, non-core assets. Pangaea acquired Bulk Brenton and Bulk Patience for a combined price of USD 56.6 million, both built in 2016. These vessels will enhance the company's environmentally compliant fleet and support client demand. Looking ahead, the company intends to manage its fleet opportunistically, optimizing TCE rates, adhering to regulatory requirements, and serving evolving client needs.

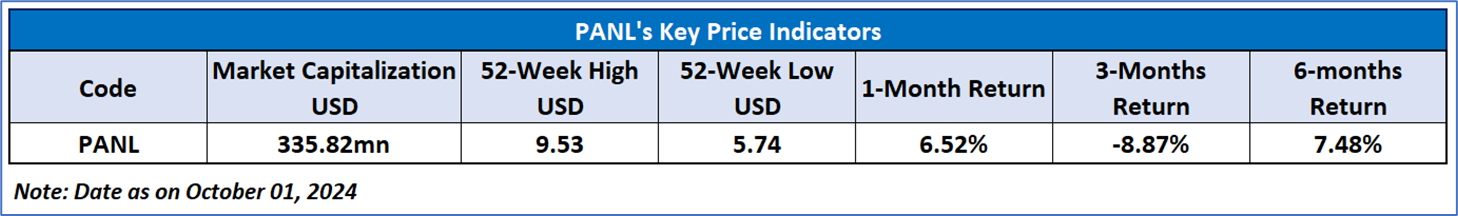

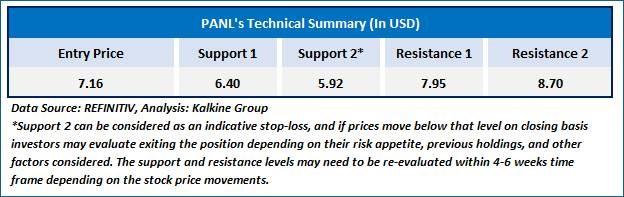

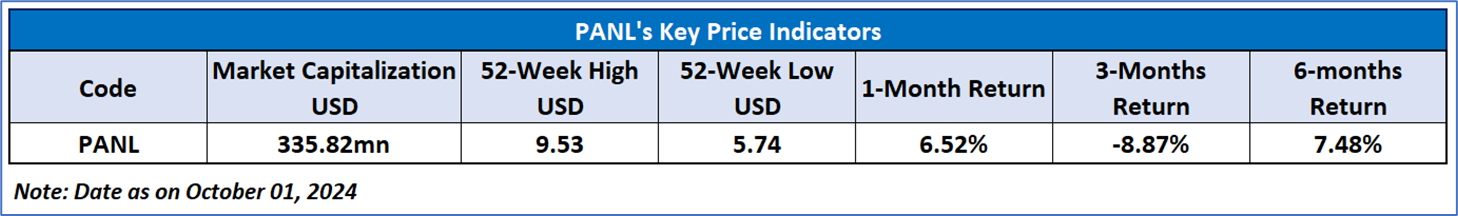

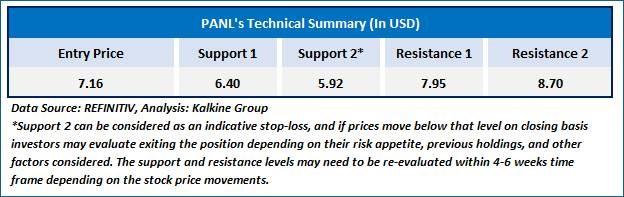

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 60.63, currently upward trending, with expectations of a consolidation or an upward momentum in case of the current support levels of USD 6.50-USD 7.00 holds. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support and resistance levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) at the closing market price of USD 7.16 as of October 01, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 01, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...