Denny's Corporation

Denny's Corporation (NASDAQ: DENN) is a franchised full-service restaurant brand that owns and operates both the Denny's and Keke's Breakfast Cafe brands. It functions through two segments: Denny's and Keke's.

Recent Business and Financial Updates

- Total Operating Revenue: In the second quarter of 2024, total operating revenue reached USD 115.9 million, slightly down from USD 116.9 million in the same quarter of the previous year.

- Franchise and License Revenue: Franchise and license revenue amounted to USD 61.6 million, a minor decrease from USD 62.0 million year-over-year. This decline was primarily due to reductions in franchise occupancy revenue and franchise sales. However, this was partially mitigated by an increase in franchise advertising revenue, mainly driven by higher local advertising co-op contributions for the current quarter.

- Company Restaurant Sales: Company restaurant sales were recorded at USD 54.3 million, down from USD 54.9 million in the prior year. This decline was mainly influenced by a decrease in same-restaurant sales, although it was partially offset by the addition of three more Keke's equivalent units during the quarter.

- Adjusted Franchise Operating Margin: The adjusted franchise operating margin was USD 30.8 million, representing 50.0% of franchise and license revenue, compared to USD 31.6 million or 50.9% in the same quarter last year. The margin decline was primarily due to lower sales impacting royalty and advertising revenues, along with lease terminations.

- Capital Allocation: The company invested USD 5.0 million in cash capital expenditures, primarily focused on the development of Keke's restaurants. Additionally, USD 4.7 million was allocated for share repurchases during the quarter, leaving approximately USD 91.0 million available under the existing repurchase authorization.

- Business Outlook: For the full year of 2024, management's expectations suggest that the current consumer and economic conditions are unlikely to change significantly. Denny's anticipates domestic system-wide same-restaurant sales to be between -1% and 1%, adjusted from the previous forecast of 0% to 3%. The company expects to open 30 to 40 new restaurants, including 12 to 16 new Keke's locations, revised down from the earlier target of 40 to 50. Additionally, a consolidated net decline of 20 to 30 restaurants is expected, compared to the prior estimate of 10 to 20. Commodity inflation is projected to be between 0% and 2%, while labor inflation is expected to be between 3% and 4%, revised from a previous range of 4% to 5%. Total general and administrative expenses are anticipated to be between USD 82 million and USD 85 million, slightly adjusted from the previous estimate of USD 83 million to USD 86 million. Finally, adjusted EBITDA is expected to fall between USD 83 million and USD 87 million, compared to the earlier range of USD 87 million to USD 91 million.

- Earnings Announcement for Third Quarter: Denny's Corporation will release its financial and operating results for the third quarter on Tuesday, October 22, 2024, before the market opens. Senior management will host a webcast at 9:00 a.m. Eastern Time on the same day.

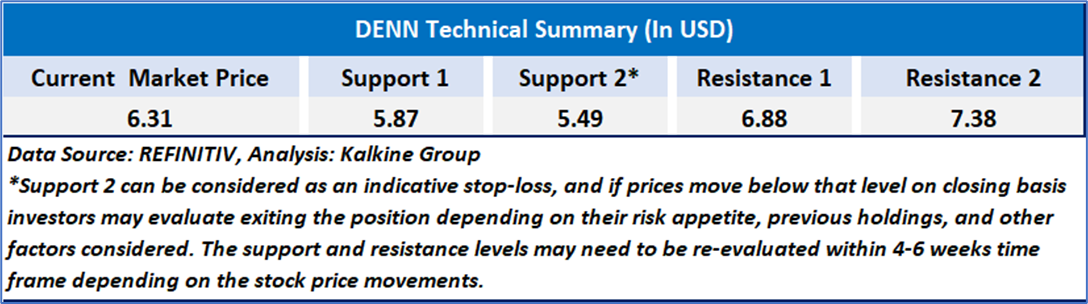

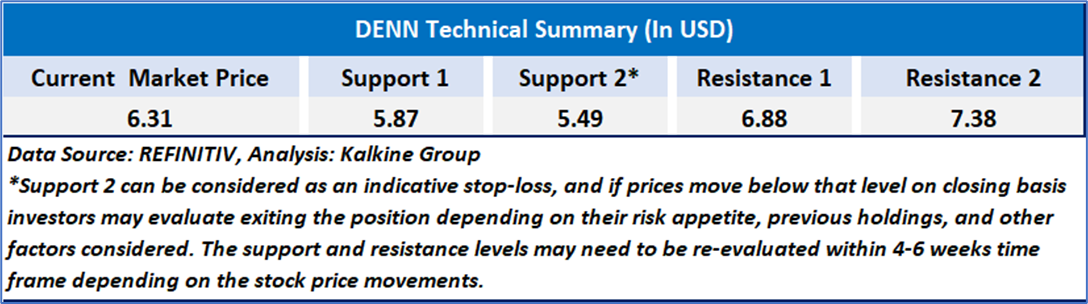

Technical Observation (on the daily chart):

DENN's stock price is near important support levels, suggesting a potential upward reversal soon, as it has been trading sideways for an extended period. The rising 14-day Relative Strength Index (RSI) supports the likelihood of upward momentum. Additionally, the stock price is close to reclaiming its key moving averages; once this occurs, it could attract more buying interest.

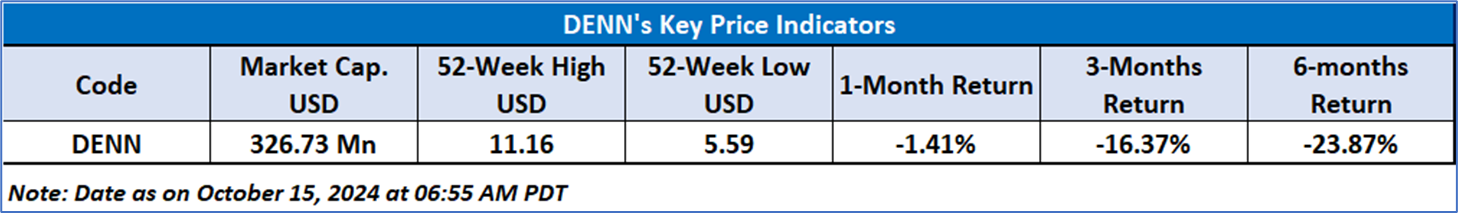

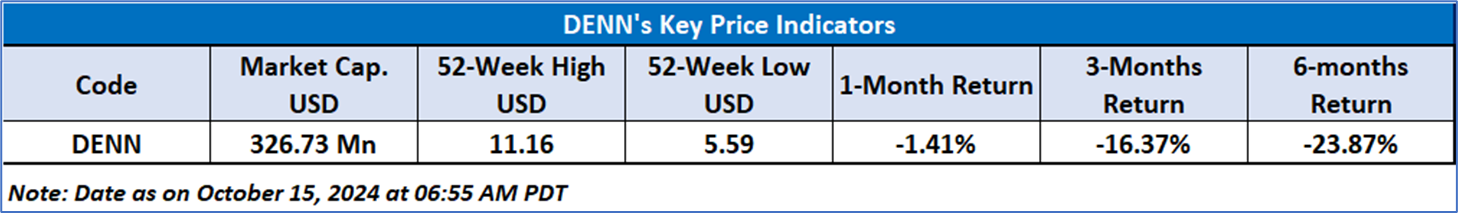

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Denny's Corporation (NASDAQ: DENN) at the current market price of USD 6.31 as of October 15, 2024, at 06:55 AM PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 15,2024 at 06:55 AM PDT. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...