3M Company

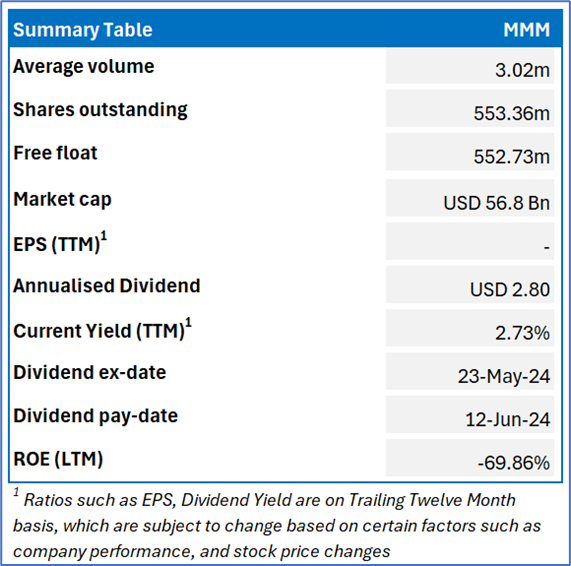

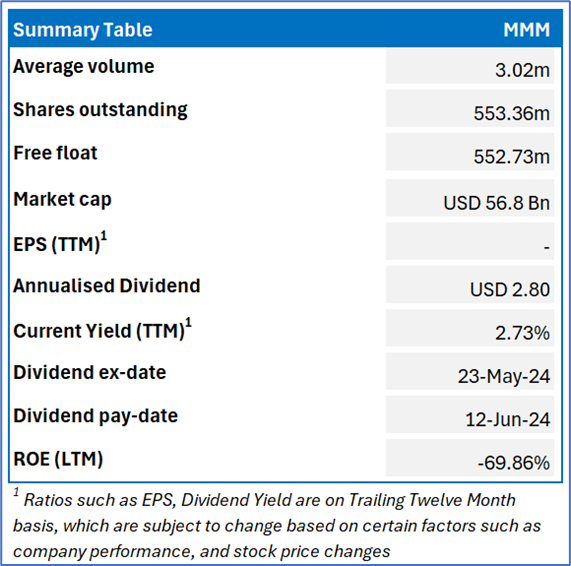

MMM Details

3M Company (NYSE: MMM) is a diversified technology company. It is a manufacturer as well as marketer of a variety of products and services. The segments include Safety and Industrial, Transportation and Electronics, and Consumer.

Financial Results

- The company reported first-quarter results, wherein, its GAAP earnings per share stood at $1.67 and operating margin was 18.8%. In Q1 FY 2024, its adjusted EPS amounted to $2.39, reflecting a rise of 21% YoY.

- Its operating cash flow was $0.8 Bn and adjusted free cash flow amounted to $0.8 Bn.

- For the first quarter of 2024, in the Americas geographic area, the US total sales were flat which included decreased organic sales of 1%.

Key Update:

The company announced the resignation of Monish Patolawala, President and Chief Financial Officer, effective July 31, 2024, in order to pursue another opportunity.

Outlook

On March 26, the company announced that, as of the final registration date for the Combat Arms Earplug settlement agreement, over 99% of claimants are participating in the settlement. MMM would be paying a total amount of up to $6.0 Bn, between 2023 and 2029, in order to resolve the litigation, provided all participation thresholds are met. This reflects the total pre-tax present value of $5.3 Bn.

Key Risks

The company’s results are impacted by the effects of, and changes in, worldwide economic, political, regulatory, international trade, geopolitical as well as other external conditions.

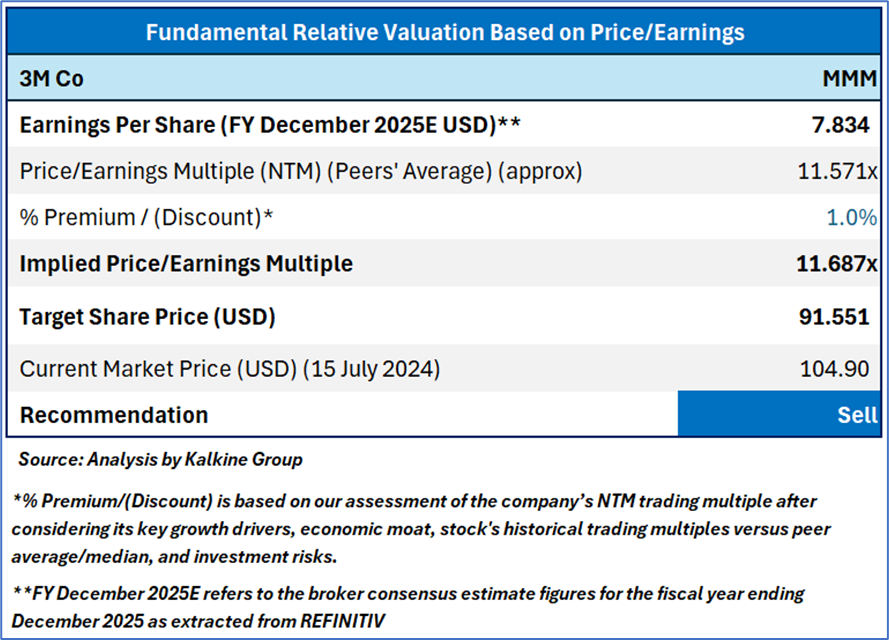

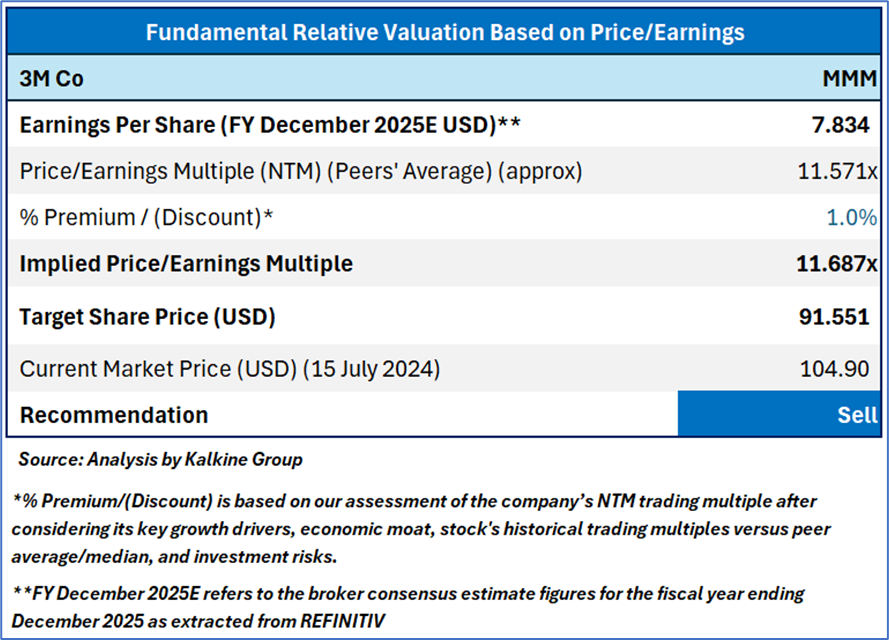

Fundamental Valuation

P/E Based Relative Valuation

Stock Recommendation

Over the last three months, the stock has given a return of ~12.5%. The stock has made a 52-week low and high of USD 71.35 and USD 106.040, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Also, the company’s results are impacted by competitive conditions and customer preferences.

Also, MMM is subject to risks related to its Aearo Entities and CAE Settlement. Any sort of changes in tax rates, laws, or regulations could adversely impact its financial results. Therefore, investors should exit this stock.

Considering the current trading levels, risks associated, and volatile market conditions on the back of higher interest rates, an ‘Sell’ rating is assigned to the “MMM” at the current market price of USD 104.90 as of July 15, 2024 (7:25 am PDT).

Technical Overview:

Daily Price Chart

MMM Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on July 15, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

-Copy_07_15_2024_16_38_35_027604.jpg)

Please wait processing your request...

Please wait processing your request...