Daqo New Energy Corp

Daqo New Energy Corp. (NYSE: DQ) is a polysilicon manufacturer. The Company utilizes the chemical vapor deposition process, or the modified Siemens process, to produce polysilicon. The Company's segments include Polysilicon and Wafer.

Recent Business and Financial Updates

- Production and Sales Performance: In the second quarter of 2024, Daqo New Energy Corp. reported a polysilicon production volume of 64,961 metric tons (MT), representing an increase from the 62,278 MT recorded in the first quarter. However, the polysilicon sales volume declined to 43,082 MT from 53,987 MT in Q1 2024. The average total production cost for Q2 was USD 6.19 per kilogram, slightly lower than the USD 6.37/kg in the previous quarter, while the average cash cost also decreased from USD 5.61/kg to USD 5.39/kg. The company faced a significant drop in its average selling price (ASP), which fell from USD 7.66/kg in Q1 2024 to USD 5.12/kg in Q2, reflecting broader market challenges in the solar industry.

- Financial Results: Daqo's financial performance was adversely impacted in Q2 2024. Revenue declined significantly to USD 219.9 million from USD 415.3 million in the first quarter, primarily driven by lower polysilicon ASP and reduced sales volume. The company recorded a gross loss of USD 159.2 million, in contrast to a gross profit of USD 72.1 million in Q1 2024. Consequently, the gross margin fell to -72.4%, compared to 17.4% in the previous quarter. This decline was further exacerbated by a USD 108 million non-cash inventory impairment expense, which was recorded due to the fall in market value below the book value of the company’s inventory. The net loss attributable to shareholders was USD 119.8 million, compared to a net income of USD 15.5 million in Q1 2024. Loss per basic American Depositary Share (ADS) stood at USD 1.81, a sharp contrast to earnings per ADS of USD 0.24 in the previous quarter.

- Operational Highlights and Strategic Adjustments: During Q2 2024, the company commenced production at its new 100,000 MT Phase 5B polysilicon project in Inner Mongolia, contributing approximately 12% to the total production volume. Through ongoing investments in research and development (R&D) and improvements in product purity, the company's N-type product mix reached 73%, further strengthening its competitive positioning in the solar PV market. Despite these operational advancements, Daqo adjusted its production utilization rate and lowered its output to counteract pricing pressures in the polysilicon market, targeting a production volume of 43,000 MT to 46,000 MT for Q3 2024. For the full year, the company expects to produce between 210,000 MT and 220,000 MT, inclusive of the impact of annual facility maintenance.

- Market Conditions and Outlook: The second quarter of 2024 posed significant challenges for the solar industry as polysilicon prices plummeted due to oversupply and weak demand, falling below production costs. The polysilicon market saw prices drop from RMB 60/kg in early April to below RMB 40/kg by June, intensifying the sales pressure and increasing inventory levels. Despite industry-wide production cuts, supply continued to outpace wafer customer demand. Daqo anticipates further market consolidation as high-cost producers exit the industry, leading to an eventual recovery in prices and margins. In the long term, the company remains optimistic about the solar PV market, particularly given China's strong growth in new solar installations and the continued focus on reducing production costs and improving efficiency through technological innovations.

- Financial Position and Liquidity: As of June 30, 2024, Daqo maintained a strong balance sheet with a cash balance of USD 997 million and total quick assets, including short-term investments and fixed-term deposits, amounting to USD 2.5 billion. The company strategically invested USD 1.4 billion in short-term investments and fixed-term deposits during the quarter to take advantage of higher interest rates. Despite the challenging market environment, Daqo’s robust liquidity and cost-efficiency measures provide a solid foundation to weather the ongoing downturn in the solar industry.

- Future Guidance: In response to the ongoing market conditions, Daqo has adjusted its production plan for the remainder of 2024. The company expects its total polysilicon production volume for Q3 2024 to be between 43,000 MT and 46,000 MT. For the full year, production is expected to range between 210,000 MT and 220,000 MT. These projections reflect the company's current outlook but are subject to market risks and uncertainties.

Technical Observation (on the daily chart):

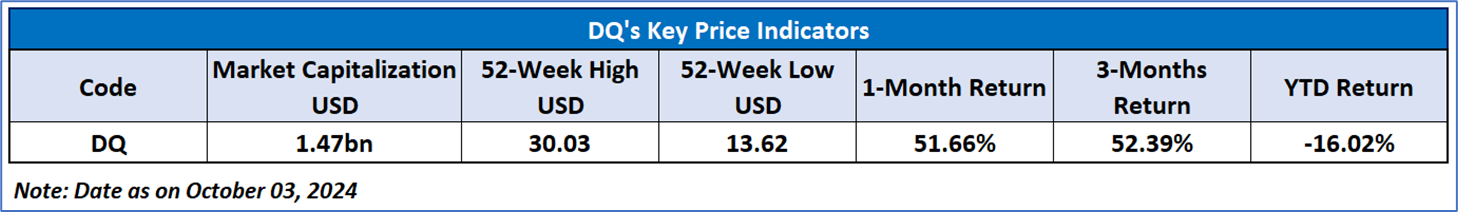

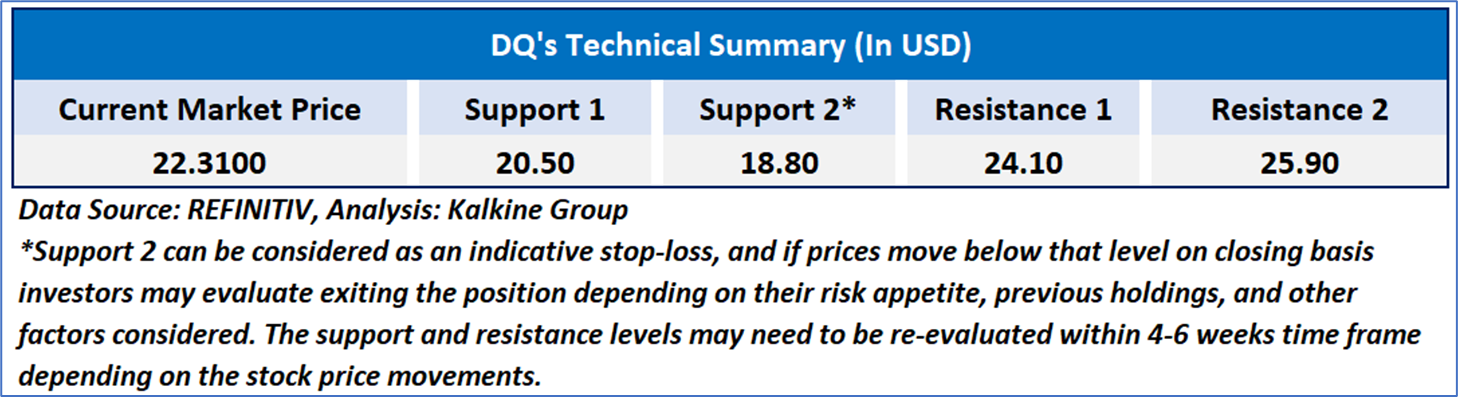

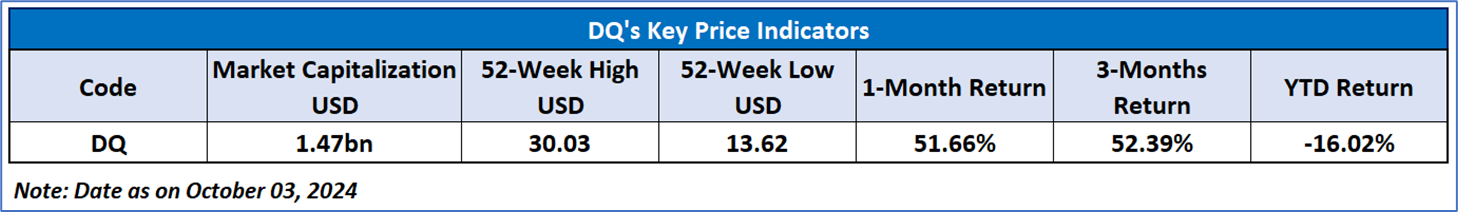

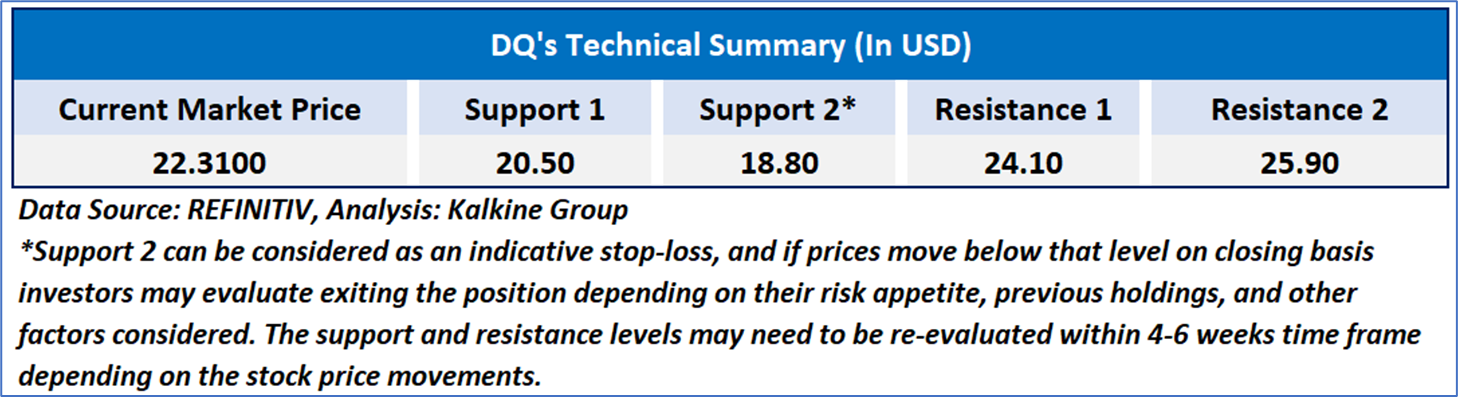

The Relative Strength Index (RSI) over a 14-day period stands at a value of 75.04, currently upward trending, with expectations of a consolidation or an upward momentum as the price has broken above an important resistance of USD 19-USD 20. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to Daqo New Energy Corp. (NYSE: DQ) at the current market price of USD 22.31 as of October 03, 2024, at 08:50 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 03, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...