Sunnova Energy International Inc

Sunnova Energy International Inc (NYSE: NOVA) is an energy services provider that collaborates with local dealers and contractors to develop, design, and install solar energy and energy storage systems for its customers. The company also offers various sustainable home solutions, including home security, smart home technology, modern HVAC systems, upgraded roofing, water systems, water heaters, main panel enhancements, and electric vehicle chargers. Its services encompass operations and maintenance, monitoring, repairs, equipment upgrades, on-site power optimization, and the ability to switch between solar, grid, and energy storage sources as needed. Sunnova serves about 419,000 customers across more than 45 states and territories, including commercial, industrial, agricultural, nonprofit, and public sector clients.

Recent Business and Financial Updates

- Financial Highlights: NOVA reported strong financial results for the second quarter of 2024, highlighting a significant increase in unrestricted cash, which rose by USD 21.5 million. The company achieved 161 megawatts of solar power generation and 284 megawatt hours of energy storage added during this period. As of June 30, 2024, total cumulative solar power generation under management reached 2.8 gigawatts, while energy storage under management increased to 1,439 megawatt hours.

- Cash Generation: In response to robust performance and market dynamics, Sunnova raised its cash generation guidance for the coming years. The company anticipates generating USD 100 million in 2024, USD 350 million in 2025, and USD 400 million in 2026. This optimism reflects a sustained commitment to improving cash generation and maintaining healthy margins.

- Macroeconomic Influences: Berger pointed to several macroeconomic factors driving the company's success, including rising utility rates, increasing grid instability, and declining equipment costs. These elements, combined with a growing preference among customers for leases and power purchase agreements (PPAs) over traditional loans, enhance Sunnova's value proposition and create a competitive edge.

- Top Line Growth: NOVA reported a revenue increase to USD 219.6 million for the second quarter of 2024, up by USD 53.2 million from the previous year. The growth was primarily driven by a USD 55.9 million increase in revenue from core adaptive energy customers, encompassing PPAs, leases, and cash sales. This growth was slightly offset by a decrease of USD 5.4 million in direct sales revenue.

- Operating Expenses Analysis: Total operating expenses netted an increase to USD 278.5 million, a rise of USD 52.4 million compared to the same quarter in 2023. The uptick was largely due to heightened losses on sales of customer notes receivable, an increase in the number of solar energy systems in service, and higher general and administrative costs. However, some expenses were mitigated by favorable changes in the fair value of certain financial instruments.

- Net Loss and Adjusted EBITDA: NOVA reported a net loss of USD 79.7 million for the second quarter, an improvement from a loss of USD 100.8 million in the same period last year. The reduction in net loss was attributed to income tax benefits from investment tax credit sales and increased interest income. Adjusted EBITDA soared to USD 216.7 million, compared to USD 28.1 million the previous year, reflecting the benefits of investment tax credit sales and growth from lease and PPA customers.

- Strong Liquidity: As of June 30, 2024, Sunnova had a total cash balance of USD 630.4 million, comprising USD 253.2 million in unrestricted cash and USD 377.1 million in restricted cash. This strong liquidity positions the company favorably for continued investments in growth and operational efficiency.

- Full Year 2024 Guidance: Looking ahead, Sunnova expects to add between 110,000 and 120,000 customers for the full year of 2024. The company anticipates adjusted EBITDA between USD 650 million and USD 750 million, reflecting higher contributions from investment tax credits and lease revenues. Interest income and principal proceeds from customer notes receivable are expected to fall between USD 115 million and USD 125 million and USD 180 million to USD 190 million, respectively.

- Q3 FY24 Results Announcement: Sunnova Energy International Inc. will release its third quarter 2024 results after market close on October 30, 2024.

- New Independent Directors Appointed: Sunnova Energy International Inc. has appointed Corbin J. Robertson, III, and Jeremy Thigpen as independent directors to its Board of Directors, effective September 23, 2024.

Technical Observation (on the daily chart):

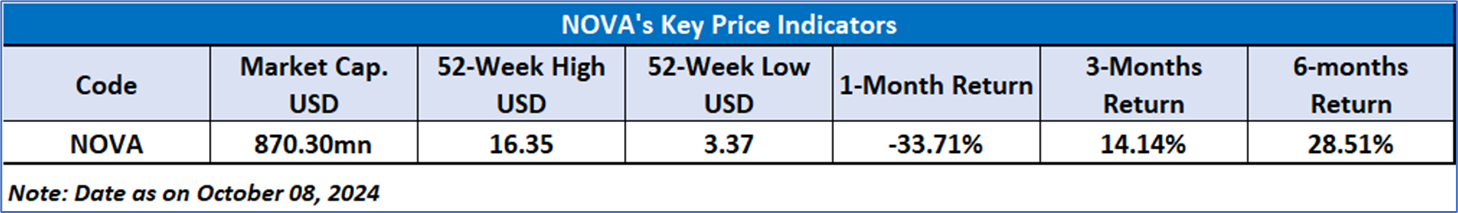

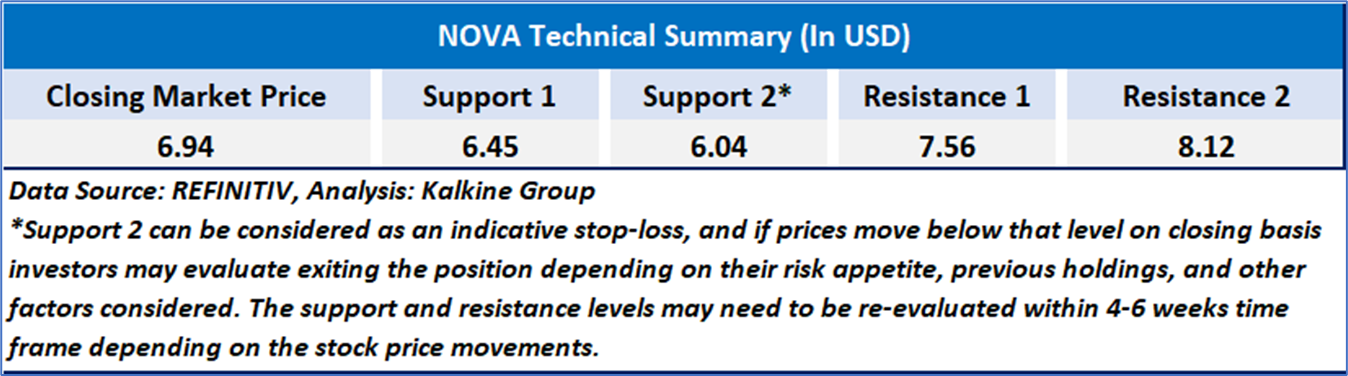

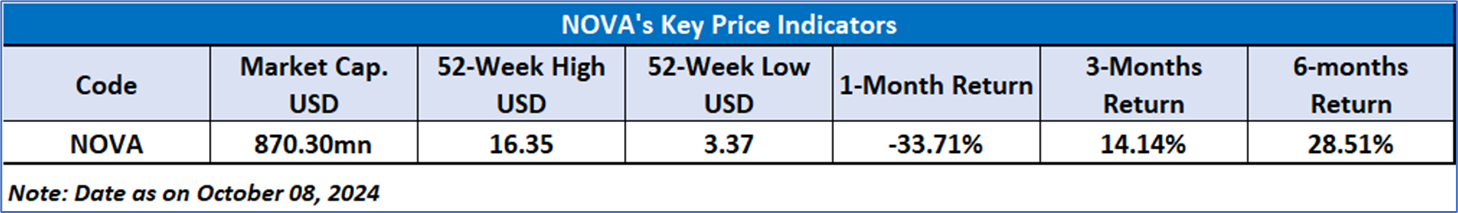

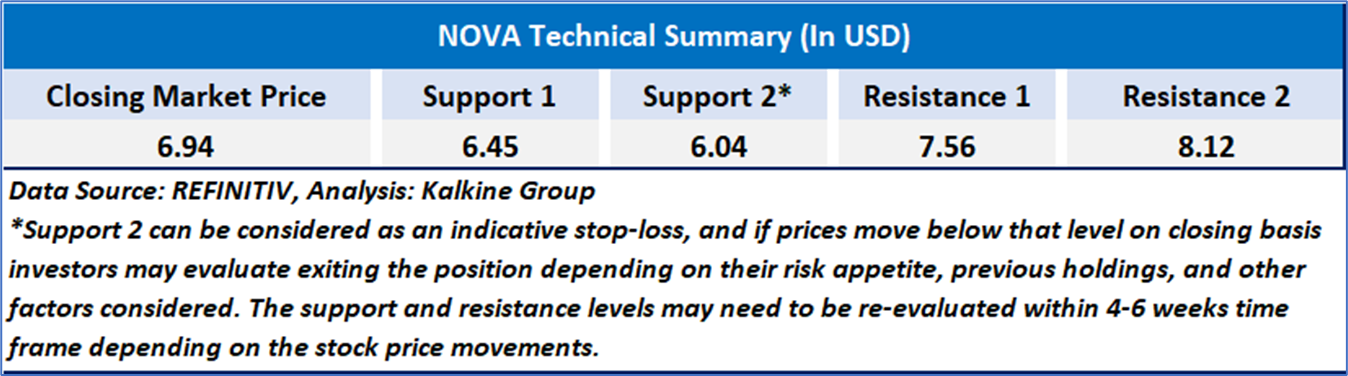

NOVA's stock price has encountered resistance at critical levels and has since drifted lower, exhibiting strong momentum that suggests the possibility of consolidation with a bearish undertone. The rising 14-day Relative Strength Index (RSI) is currently positioned below the midpoint, further reinforcing this negative outlook. Moreover, the stock price remains below its short-term and medium-term moving averages, indicating that these levels could present significant resistance in the bear term.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Sunnova Energy International Inc (NYSE: NOVA) at the closing market price of USD 6.94 as of October 08, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 08, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...