Opthea Limited

Opthea Limited (NASDAQ: OPT) is an Australia-based clinical-stage biopharmaceutical company. The Company is engaged in developing novel therapies to address the unmet need in the treatment of prevalent and progressive retinal diseases, including wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME). Its lead product candidate, sozinibercept (OPT-302), is being evaluated in two pivotal Phase 3 clinical trials for use in combination with standard-of-care anti-VEGF-A monotherapies for the treatment of wet AMD and DME.

Recent Business and Financial Updates

- Completion of Patient Enrollment in COAST and ShORe Trials: Opthea has successfully completed patient enrollment for the pivotal COAST and ShORe clinical trials, both aimed at assessing the efficacy of sozinibercept in treating wet age-related macular degeneration (wet AMD). These trials, which are part of Opthea's Phase 3 program, involve evaluating the combination therapy of sozinibercept and represent a significant step forward in their wet AMD research efforts.

- Financial Stability and Extended Cash Runway: The company has fortified its financial position by securing nearly USD 300 million in financing. This capital is expected to support the company through the topline data readouts for both the COAST and ShORe trials in the calendar year 2025. The funds will also facilitate the progression of Chemistry, Manufacturing, and Controls (CMC) activities, as well as preparations for the Biologics License Application (BLA) with the FDA, and operational readiness for the potential launch of sozinibercept.

- Strategic Leadership Appointments: To ensure preparedness for regulatory filing and the eventual launch of sozinibercept, Opthea has made several strategic leadership appointments. Key additions include Frederic Guerard as Chief Executive Officer and Peter Lang as Chief Financial Officer. Arshad M. Khanani joined as Chief Medical Advisor, bringing valuable experience to the clinical development and launch preparations. Julie Clark, MD, and Fang Li, PhD, were appointed as Senior Vice Presidents for Clinical Development and Regulatory Affairs, respectively. These appointments are designed to strengthen the company’s leadership team and advance their strategic objectives.

- Corporate and Clinical Highlights: Opthea has achieved several key milestones in recent months. In addition to completing patient enrollment in one of the largest Phase 3 wet AMD programs, the company has raised a total of USD 295.1 million through various financings. Furthermore, Opthea has assembled a world-class Medical Advisory Board comprising leading experts in retinal diseases to guide the company’s clinical and market strategies for sozinibercept. These actions underscore the company’s commitment to developing innovative therapies for retinal diseases and advancing toward market readiness.

- Financial Performance and Projections: For the fiscal year ending June 30, 2024, Opthea reported a net loss of USD 220.2 million, a 55% increase from the previous year. This was primarily attributed to the ongoing development of sozinibercept and related clinical activities. The company's operating expenses, including research and administrative costs, totaled USD 192.1 million, reflecting significant investments in its Phase 3 program. As of June 30, 2024, Opthea held USD 172.5 million in cash and cash equivalents, ensuring liquidity to support continued operations.

Technical Observation (on the daily chart):

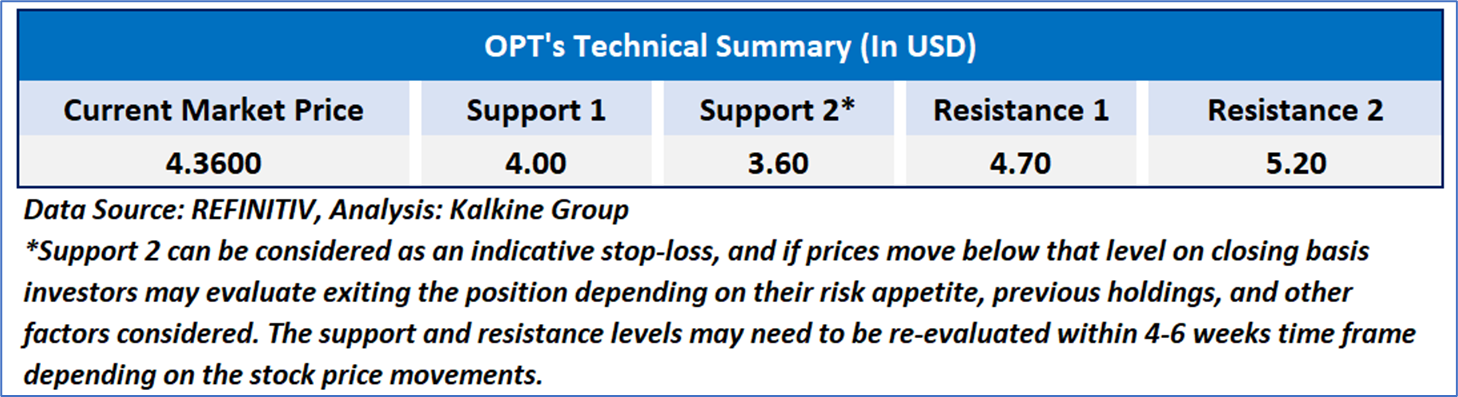

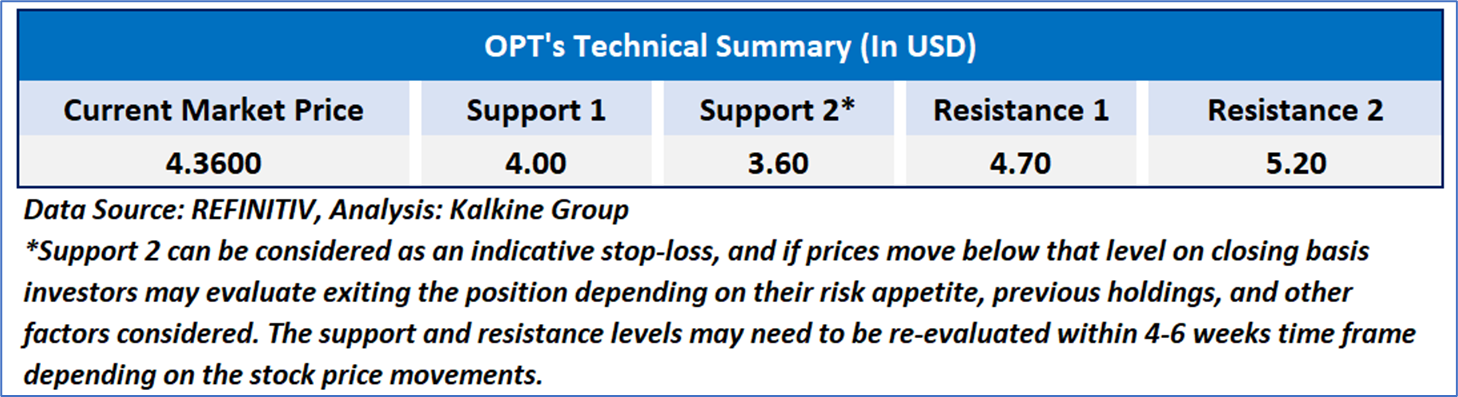

The Relative Strength Index (RSI) over a 14-day period stands at a value of 49.64, currently recovering from overbought zone, with expectations of a consolidation or a downward momentum if an important support of USD 3.80 - USD 4.20 is broken. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

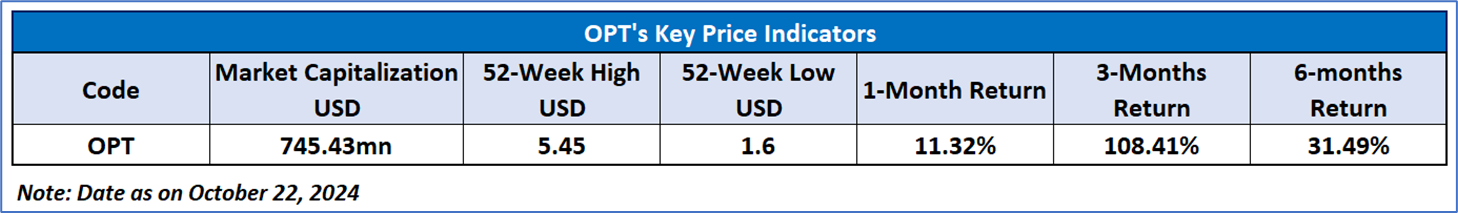

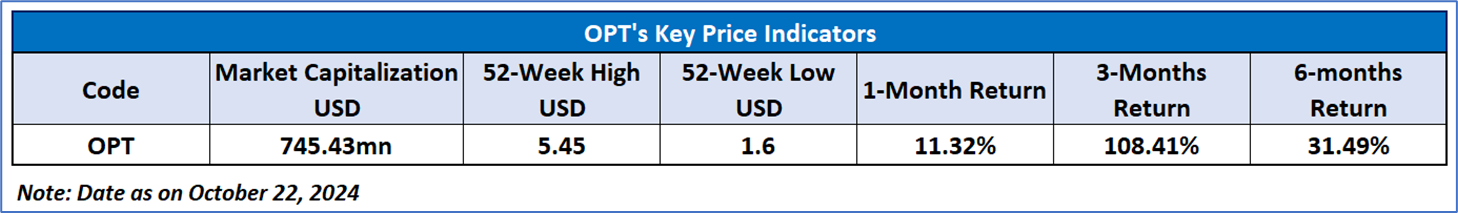

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Opthea Limited (NASDAQ: OPT) at the current market price of USD 4.36 as of October 22, 2024, at 09:20 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 22, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...