AnaptysBio Inc

AnaptysBio, Inc. (NASDAQ: ANAB) is a clinical-stage biotechnology company focused on delivering immunology therapeutics. The Company is developing immune cell modulators, including two checkpoint agonists for autoimmune and inflammatory disease: rosnilimab, its PD-1 agonist, in a Phase 2b trial for the treatment of rheumatoid arthritis and in a Phase 2 trial for the treatment of ulcerative colitis; and ANB032, its BTLA agonist, in a Phase 2b trial for the treatment of atopic dermatitis.

Recent Business and Financial Updates

- Overview of Key Clinical Developments: AnaptysBio, Inc. has reported significant progress in its clinical trials. Notably, the company completed enrollment for its Phase 2b trial for treating atopic dermatitis (AD) with ANB032, a BTLA agonist, with top-line data expected in December 2024. Additionally, the Phase 2b trial for rosnilimab, a PD-1 agonist aimed at treating rheumatoid arthritis (RA), has seen accelerated enrollment, with data anticipated in Q1 2025. The Phase 2 trial of rosnilimab for ulcerative colitis (UC) is now projected to deliver top-line data in Q1 2026. Furthermore, the FDA has accepted the Investigational New Drug (IND) application for ANB033, an anti-CD122 antagonist, with the initiation of a Phase 1 trial expected in Q4 2024.

- Updates on ANB032: BTLA Agonist for Atopic Dermatitis: Enrollment has been completed for the global Phase 2b trial of ANB032, targeting moderate-to-severe atopic dermatitis. The placebo-controlled study enrolled approximately 200 patients, assessing three dose levels of subcutaneously administered ANB032 over a 14-week treatment duration, followed by a six-month off-drug follow-up period. Approximately 15% of enrolled patients had prior treatment experience with Dupixent or anti-IL-13 therapy. Top-line data from this trial is expected by December 2024. Additionally, ANB032 preclinical data, including its role in modulating dendritic cell (DC) maturation and function, was presented at various prestigious conferences in 2024.

- Rosnilimab: PD-1 Agonist for Rheumatoid Arthritis and Ulcerative Colitis: The global Phase 2b trial for rosnilimab, aimed at treating moderate-to-severe rheumatoid arthritis, is ongoing with strong enrollment. This 420-patient, placebo-controlled trial is assessing three dose levels over a 12-week treatment period. Top-line data from this trial is now expected in Q1 2025. Concurrently, the Phase 2 trial of rosnilimab for ulcerative colitis is also progressing, with data anticipated in Q1 2026. This trial involves 132 patients in a placebo-controlled setting, evaluating two dose levels over a 12-week treatment period.

- IND Approval for ANB033 and Upcoming Trials: In July 2024, the FDA accepted the IND application for ANB033, AnaptysBio’s anti-CD122 antagonist. The company is preparing to initiate a Phase 1 trial with healthy volunteers in Q4 2024. Additionally, AnaptysBio plans to submit an IND application for ANB101, a BDCA2 modulator antibody, in Q4 2024. These developments are crucial as the company expands its pipeline of immune cell modulators.

- Legacy Programs and Out-Licensing Opportunities: AnaptysBio also continues to explore out-licensing opportunities for its legacy cytokine antagonist programs. The company intends to present comprehensive data from the Phase 3 GEMINI-1 and GEMINI-2 trials in H2 2024 and is actively seeking to out-license imsidolimab, further optimizing its portfolio.

- Collaboration with GSK on Immuno-Oncology Programs: AnaptysBio’s collaboration with GSK on several immuno-oncology programs is progressing as planned. GSK anticipates top-line data from the COSTAR Lung Phase 3 trial in H1 2025, focusing on patients with advanced non-small cell lung cancer (NSCLC). Additionally, GSK has initiated the GALAXIES Lung-301 Phase 3 study, assessing belrestotug and dostarlimab in patients with PD-L1 selected NSCLC. Data from these collaborations is expected to play a significant role in advancing the company’s oncology programs.

- Financial Performance and Cash Runway: As of June 30, 2024, AnaptysBio reported cash, cash equivalents, and investments totaling USD 393.5 million, compared to USD 417.9 million as of December 31, 2023. The decrease of USD 24.4 million was primarily due to operating activities, offset by USD 50 million received from a royalty monetization transaction. The company maintains a robust financial position and reiterates its cash runway through the end of 2026.

- Second Quarter 2024 Financial Results: AnaptysBio reported collaboration revenue of USD 11 million for Q2 2024, a significant increase from USD 3.5 million in the same period of 2023. This growth was driven primarily by increased royalties from Jemperli sales. Research and development expenses increased to USD 42 million for Q2 2024, up from USD 32.9 million in Q2 2023, reflecting the company’s increased focus on developing rosnilimab, ANB032, ANB033, and ANB101. General and administrative expenses were USD 9.3 million for the same period. The net loss for Q2 2024 was USD 46.7 million, or USD 1.71 per share, compared to a net loss of USD 39.8 million in Q2 2023.

Technical Observation (on the daily chart):

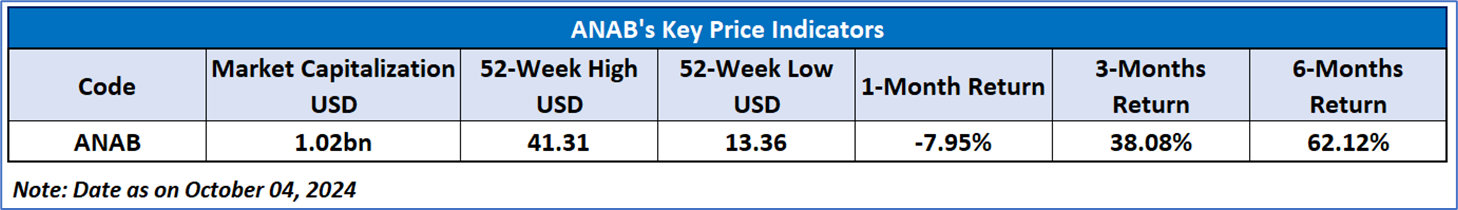

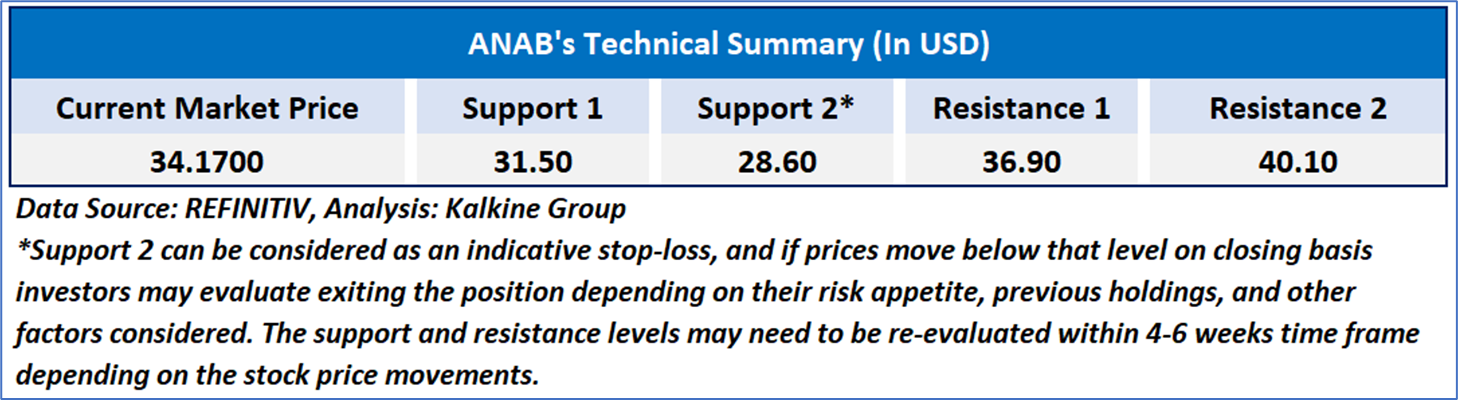

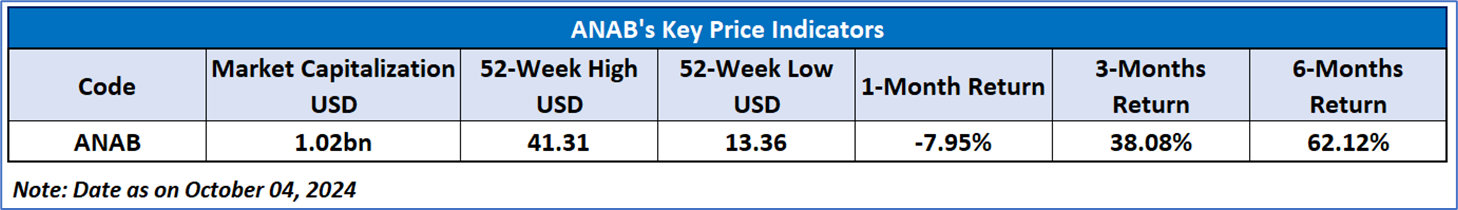

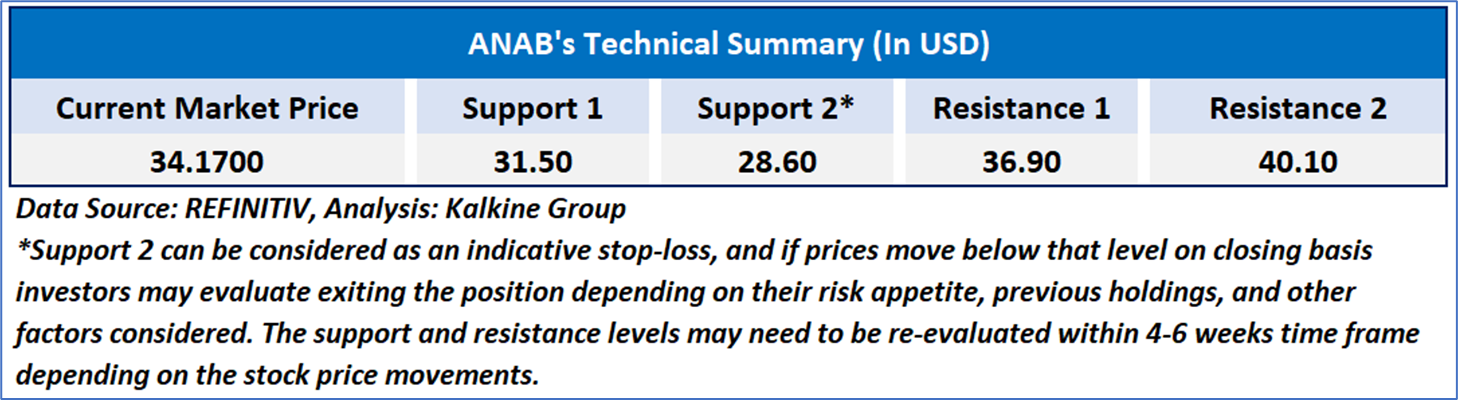

The Relative Strength Index (RSI) over a 14-day period stands at a value of 46.13, currently downward trending, with expectations of a consolidation or an upward momentum in case the price breaks an important resistance of USD 38.00-USD 42.00. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance and support levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to AnaptysBio, Inc. (NASDAQ: ANAB) at the current market price of USD 34.17 as of October 04, 2024, at 08:50 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 04, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...