Ironwood Pharmaceuticals Inc

Ironwood Pharmaceuticals, Inc. (NASDAQ: IRWD) is a gastrointestinal (GI) healthcare company engaged in advancing the treatment of GI diseases and redefining the standard of care for GI patients. It is engaged in the development of LINZESS (linaclotide) for adults with irritable bowel syndrome with constipation (IBS-C) or chronic idiopathic constipation (CIC). Linaclotide is also approved for the treatment of functional constipation in pediatric patients ages 6-17 years old.

Recent Business and Financial Updates

- Prescription Growth and Strategic Advancements: Ironwood Pharmaceuticals reported significant progress in the second quarter of 2024, with a notable 11% year-over-year growth in prescription demand for LINZESS® (linaclotide). Despite ongoing pricing pressures from higher-than-expected Medicaid utilization, the company remains optimistic about its financial position, driven by strong cash flow generation and a capital structure that supports its strategic objectives. CEO Tom McCourt highlighted the robust demand for LINZESS and reiterated confidence in apraglutide's clinical potential as a leading treatment for short bowel syndrome (SBS). Additionally, Ironwood expects to release topline results for CNP-104 in the third quarter of 2024.

- Financial Performance: In the second quarter of 2024, Ironwood's total revenue was USD 94.4 million, a decrease from USD 107.4 million in the same period in 2023. The decline in revenue is primarily attributed to a decrease in collaborative arrangements. LINZESS U.S. net sales, reported by Ironwood’s partner AbbVie, reflected adjustments to gross-to-net estimates related to 2023, which impacted Ironwood’s collaboration revenue. Operating expenses were USD 69.4 million, a significant reduction from USD 1,190.5 million in the second quarter of 2023, which included a one-time charge related to the acquisition of VectivBio. Ironwood recorded a GAAP net loss of USD 0.9 million for Q2 2024, compared to a USD 1,062.2 million loss in the same period of the previous year.

- S. LINZESS Collaboration and Revenue Adjustments: LINZESS prescription demand reached 52 million capsules in the second quarter, marking an 11% year-over-year increase. However, LINZESS U.S. net sales, as provided by AbbVie, were down 22% compared to Q2 2023. This decrease was largely driven by adjustments to the gross-to-net estimate for the year ended December 2023. Despite this, Ironwood recorded USD 91.4 million in collaboration revenue related to LINZESS sales, including a USD 17 million adjustment reflecting changes in estimates from prior periods.

- Pipeline Developments:

- Apraglutide: Ironwood is advancing apraglutide, a next-generation synthetic GLP-2 analog for SBS patients reliant on parenteral support. Following promising data from the STARS Phase III trial presented at the 2024 Digestive Disease Week®, Ironwood aims to submit a new drug application to the U.S. FDA in early 2025.

- CNP-104: Ironwood continues to explore its partnership with COUR Pharmaceuticals for CNP-104, a nanoparticle therapy for primary biliary cholangitis (PBC), a rare autoimmune disease. Topline data from COUR’s clinical study is expected in the third quarter of 2024.

- IW-3300: Ironwood is progressing the development of IW-3300, a guanylate cyclase-C agonist being studied for conditions related to visceral pain, including interstitial cystitis and endometriosis. The drug is currently in a Phase II proof-of-concept study.

- Cash Flow and Financial Outlook: Ironwood closed the second quarter with USD 105.5 million in cash and cash equivalents, an increase from USD 92.2 million at the end of 2023. The company utilized USD 50 million in cash on hand and drew USD 150 million from its revolving credit facility to repay USD 200 million of its 2024 Convertible Notes upon maturity. Ironwood continues to generate positive cash flow, recording USD 33.5 million in cash from operations in Q2 2024. Looking ahead, the company revised its full-year 2024 financial guidance due to continued LINZESS pricing pressures driven by Medicaid utilization trends.

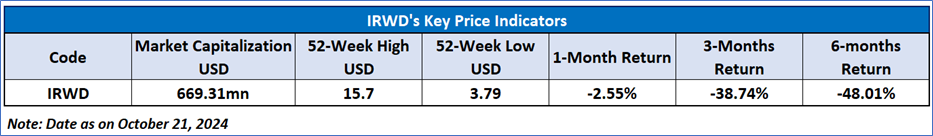

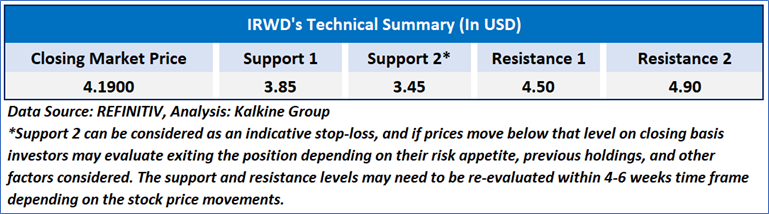

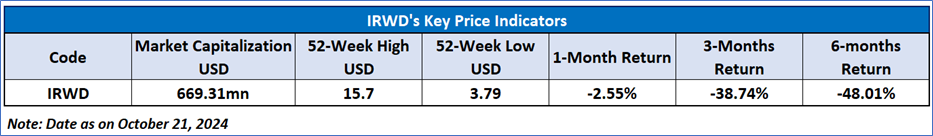

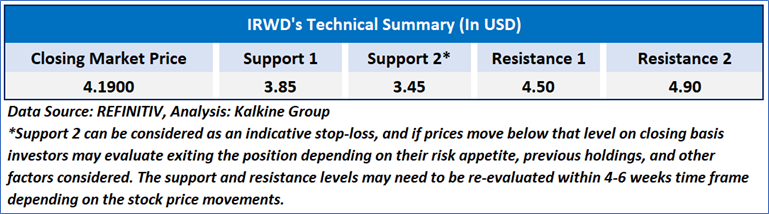

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 44.44, currently recovering from oversold zone, with expectations of a consolidation or a downward momentum if an important support of USD 3.80 - USD 4.00 is broken. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Ironwood Pharmaceuticals, Inc. (NASDAQ: IRWD) at the closing market price of USD 4.19 as of October 21, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 21, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...