Sana Biotechnology Inc

Sana Biotechnology, Inc. (NASDAQ: SANA) is a biotechnology company focusing on utilizing engineered cells as medicines. It is engaged in developing cell engineering programs to revolutionize treatment across an array of therapeutic areas with unmet treatment needs, including oncology, diabetes, B-cell-mediated autoimmune and central nervous system disorders.

Recent Business and Financial Updates

- Advancing Hypoimmune Technology Across Multiple Therapeutic Areas: Sana Biotechnology continues to push forward with the development of its hypoimmune technology, conducting four trials across seven indications in the fields of oncology, B-cell mediated autoimmune diseases, and type 1 diabetes. One notable trial is the GLEAM study, which focuses on SC291 in B-cell mediated autoimmune diseases, with initial clinical data expected in 2024. Additionally, two oncology trials—ARDENT and VIVID—are enrolling patients to evaluate SC291 and SC262 for B-cell malignancies, with further clinical data anticipated in 2024. In the type 1 diabetes space, Sana is conducting an investigator-sponsored trial with hypoimmune-modified primary islet cells and expects to release preliminary data in 2024.

- Publication and Preclinical Developments: Sana's research has garnered significant attention, with a recent publication in Nature Biotechnology demonstrating the successful replacement of diseased glial cells with healthy human glial progenitor cells in a preclinical model. This achievement not only validates Sana's approach but also advances the potential development of SC379, a pluripotent stem cell-derived glial progenitor cell product, aimed at treating certain central nervous system disorders.

- Corporate and Financial Highlights: As of June 30, 2024, Sana Biotechnology reported a strong cash position of USD 251.6 million, reflecting an increase from USD 205.2 million at the end of 2023, primarily due to proceeds from equity financing and other cash inflows. The company expects its 2024 operating cash burn to remain below USD 200 million. During the second quarter of 2024, Sana recognized decreased research and development expenses compared to the prior year, driven by lower personnel and laboratory costs and reduced third-party manufacturing expenditures. General and administrative expenses also decreased slightly, reflecting cost-cutting measures, including reductions in headcount.

- Strategic Initiatives and Future Outlook: Sana remains focused on accelerating investments in its supply chain and reducing reliance on external manufacturing amidst ongoing geopolitical uncertainties. The company is expanding its global clinical trial footprint and continues to progress through the dose-escalation phases of its studies, with clinical data expected later in 2024. Although challenges remain in predicting patient numbers and data release timelines, Sana's commitment to advancing its therapeutic programs highlights the potential impact of its hypoimmune platform across various disease areas.

Technical Observation (on the daily chart):

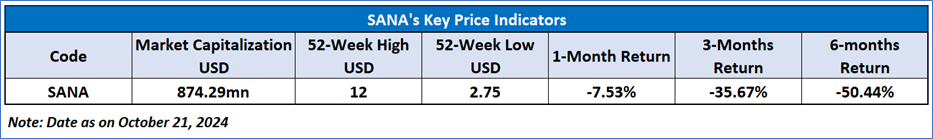

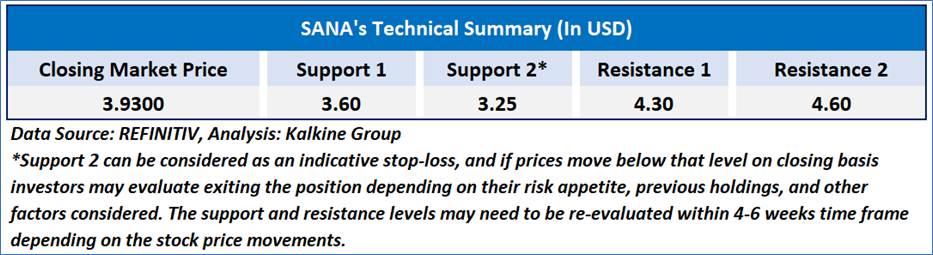

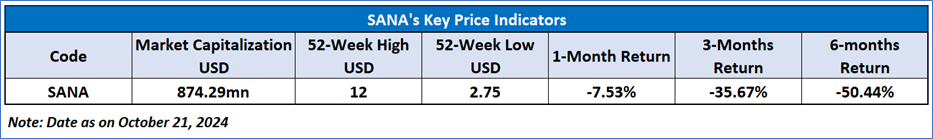

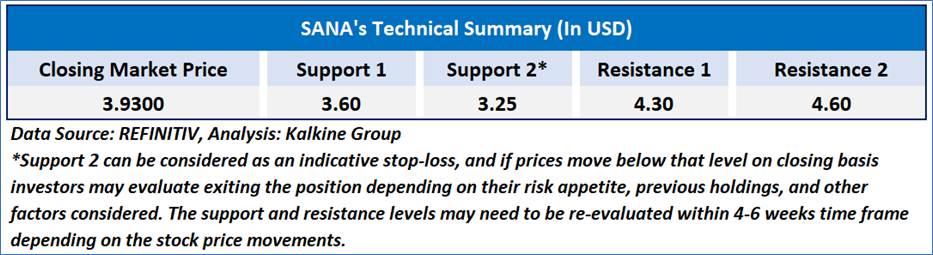

The Relative Strength Index (RSI) over a 14-day period stands at a value of 40.52, currently recovering from oversold zone, with expectations of a consolidation or a downward momentum if an important support of USD 3.50 - USD 3.80 is broken. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘WATCH’ rating has been given to Sana Biotechnology, Inc. (NASDAQ: SANA) at the closing market price of USD 3.93 as of October 21, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 21, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...