Company Overview: The Goodyear Tire & Rubber Company is a manufacturer of tires. The Company operates through three segments. The Americas segment develops, manufactures, distributes and sells tires and related products and services in North, Central and South America, and sells tires to various export markets. The Americas segment manufactures and sells tires for automobiles, trucks, buses, earthmoving, mining andindustrial equipment, aircraft and for various other applications. The Europe, the Middle East and Africa (EMEA) segment develops, manufactures, distributes and sells tires for automobiles, trucks, buses, aircraft, motorcycles, and earthmoving, mining and industrial equipment throughout EMEA under the Goodyear, Dunlop, Debica, Sava and Fulda brands. The Asia Pacific segment develops, manufactures, distributes and sells tires for automobiles, trucks, aircraft, farm, and earthmoving, mining and industrial equipment throughout the Asia Pacific region, and sells tires to various export markets.

.png)

GT Details

Post some overreactions by the market, Goodyear Tire & Rubber Co (NASDAQ: GT) seems to be poised for a better future while adopting strategies to mitigate the industry challenges. The group has also been able to maintain the stream of dividends despite the trading difficulties and is considered a decent value pick.

Better than expected third quarter performance: Goodyear in the third quarter of FY 17 continued to face tough industry conditions, which were seen in the second quarter. Lower consumer replacement volumes, production cuts by automakers and rising of more than 30 percent in the raw material input costs is hurting the performance. However, the group delivered a better than expected results, with adjusted earnings per share of 70 cents, and adjusted revenue growth of 1.9 percent to $3.92 billion in the third quarter of FY 17. The revenue performance was driven by the better price/mix, which boosted the revenue per tire up 5 percent over the 2016 quarter, excluding the impact of foreign currency translation. However, the tire unit volumes fell 5 percent to 39.8 million below 2016. The replacement tire shipments were down 4 percent and the original equipment unit volume was down 9 percent. Overall, in the third quarter 2017, the adjusted net income was $177 million down from $310 million in 2016. Additionally, the high raw material costs and the impact of lower volume led to the fall in the segment operating income of $357 million in 2017, down from $556 million a year ago. These were however, partially offset by improved price/mix and net cost savings.

.png)

Third quarter of FY 17 performance (Source: Company reports)

Hurricane impact in the third quarter: The Company’s American business was impacted by hurricanes during the third quarter. GT operates three chemical plants in Texas and has tire distribution and retail operations in the affected areas that were damaged or had experienced shutdowns. Therefore, the sales were negatively impacted in the company-owned locations by over $23 million, which resulted in lost profits of about $5 million in segment operating income. In addition, approximately $12 million in hurricane-related costs were incurred during the quarter. Overall, GT predicted that the negative impact of the hurricanes on the United States consumer replacement industry overall was approximately one percent in the third quarter.

Renewed, multi-year sponsorship agreement with NASCAR: Goodyear Tire & Rubber and the National Association for Stock Car Auto Racing, Inc. (NASCAR) have renewed, multi-year sponsorship agreement that ensures Goodyear is the exclusive tire of NASCAR’s top three national series. The agreement continues GT’s designation as the “Official Tire of NASCAR” and extends an uninterrupted relationship, which had started in 1954. GT’s and NASCAR’s six decade-long relationship is one of the longest-running sponsor programs in any major sport. Moreover, GT produces more than 100,000 tires for NASCAR’s top three series every year.

Acquired Ventech Systems GmbH: The group has completed acquisition of Ventech Systems GmbH (a leader in automated tire inspection technology), from Grenzebach Maschinenbau GmbH to support its fleet services in Europe and other geographies of the world. Ventech Systems, which is based in Dorsten, Germany, would be integrated into the Goodyear Proactive Solutions business in the Europe, Middle East and Africa region. Moreover, the acquisition would strengthen GT’s one stop value proposition towards fleets, including premium tires, advanced technology and mobile fleet solutions as well as a complete service package to allow it to optimize the total cost of ownership and efficiency.

Geographic performance: In the third quarter 2017, GT in America has reported 1 percent fall in the sales to $2.0 billion due to an 8 percent decrease in tire unit volume, primarily in the consumer tire business. The replacement tire shipments fell 6 percent, due to rising competition and weak industry demand. The original equipment unit volume fell 11 percent, on the back of decreased auto production in the United States. However, the third quarter revenue per tire increased 4 percent in 2017 compared to 2016, excluding the impact of foreign currency translation. Further, during the third quarter, several company-owned locations were directly impacted by hurricanes, which negatively impacted segment operating income by about $5 million. On the other hand, main market for America is Brazil which performed well with Brazil's consumer OE business rising 25% and consumer replacement growing in the high single digit range. The group continued to witness growth in replacement and OE which drove unit volume. With the region coming out of its two-year recession, the group is well positioned to leverage the opportunities as the market recovers. In Europe, Middle East and Africa, the third quarter sales grew 6 percent from last year to $1.3 billion. This is due to an improved price/mix and favorable foreign currency translation, partially offset by a 4 percent decrease in tire unit volume, primarily in the consumer OE tire business. Additionally, in Asia Pacific, the third quarter 2017 sales had increased 5 percent from last year to $569 million, due to an improved price/mix.

Capital Management: GT has paid a quarterly dividend of 10 cents per share of common stock in September 2017. The company has declared a quarterly dividend of 14 cents per share payable in December 2017, to shareholders with record on November 01, 2017, which is a 40 percent increase per share. Moreover, as a part of its previously announced $2.1 billion share repurchase program, GT had repurchased 5.6 million shares of its common stock for $175 million during the third quarter. Since its inception, the purchases under the program have totaled 37.6 million shares for $1.1 billion.

Outlook: GT expects its full-year 2017 segment operating income to be approximately $1.5 billion. The group’s pricing strategy has been impacted by the weaker markets, mainly the smaller rim size segments. Accordingly, the group adjusted the volume or price mix. Moreover, the group’s Raw material headwinds are starting to subside, and these competitive dynamics should normalize over the coming quarters. The group continues to expect multiple sources of rising earnings in 2018, boosted by better volume, price mix, net of raw materials and the cost savings initiatives.

.png)

Outlook (Source: Company reports)

Improving trends for the business: The group launched new product, the Goodyear Assurance WeatherReady, which is their new premium traction tire for CUVs and passenger vehicles. The WeatherReady excels in all weather conditions without sacrificing other premium features, like ride durability and noise. The market opportunity for Assurance WeatherReady is over 80 million tires. Their line-up features 40 sizes and comprises more than 80% of the market, which is more than the competitive offerings. Assurance WeatherReady is focusing on the 17 inch and larger sizes. Going forward, the group sees that the underlying trends supporting the U.S. replacement industry are improving. It is worth noting that miles driven enhanced eight tenth of a percent to a record of 284 billion miles in July. At the same time, miles driven for the trailing 12 months enhanced 1.6%.

.png)

2018 Segment Operating Income (SOI) Drivers (Source: Company reports)

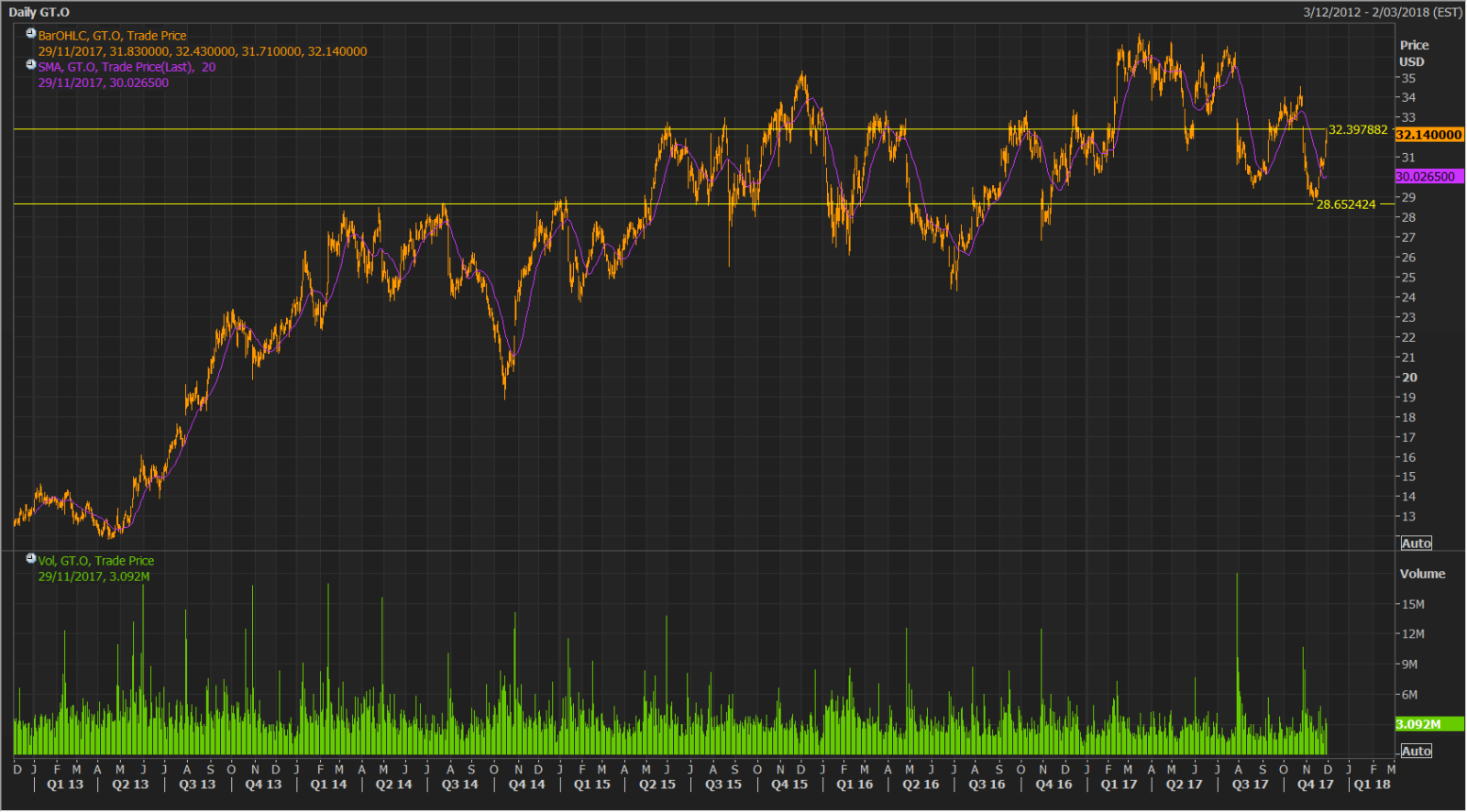

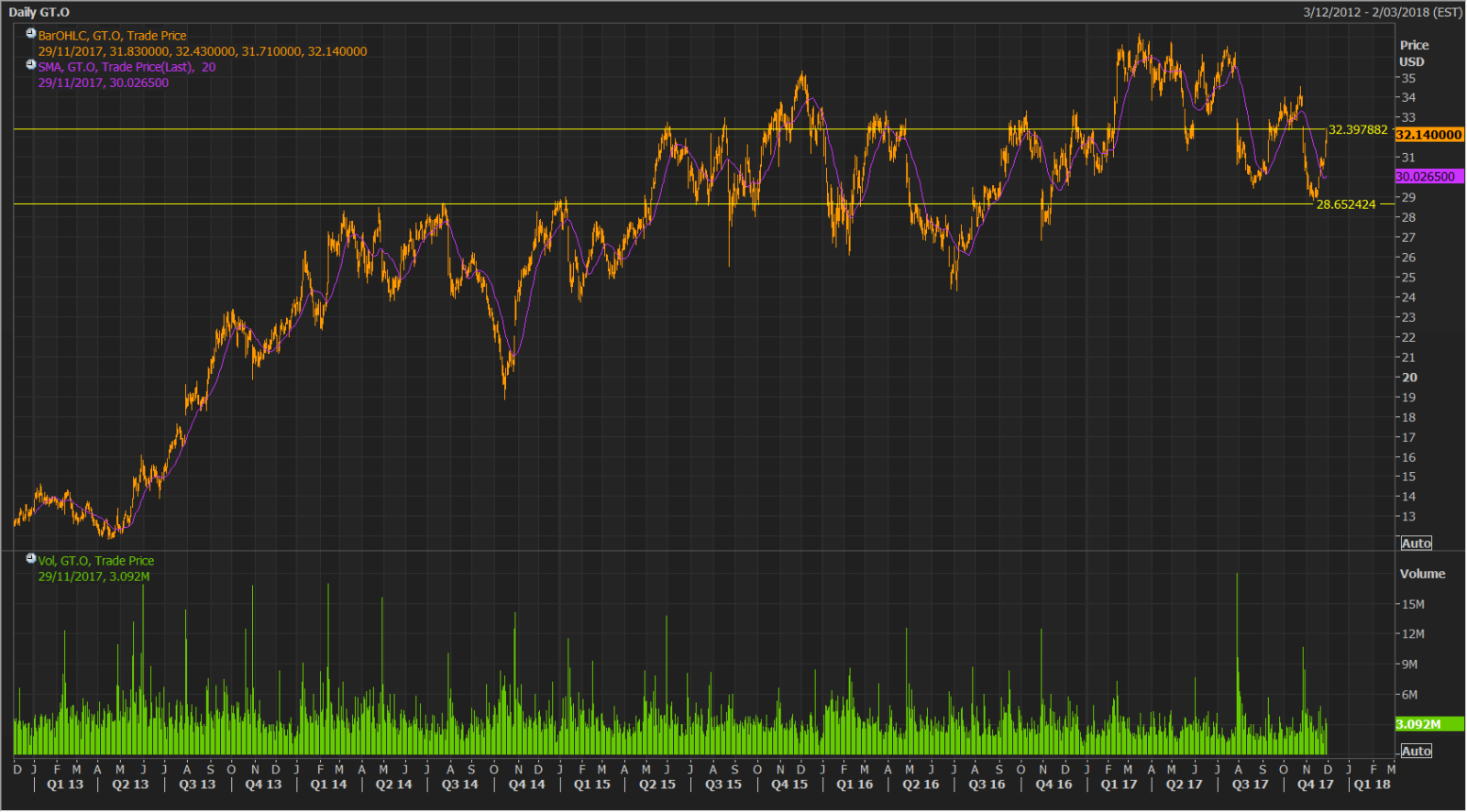

Stock Recommendation: The group continues to focus on profitable regions and the sell-out trends in major key markets, excluding hurricanes impact in the U.S., have started to turn positive. GT forecasts the U.S. and European channel inventories to be more balanced heading into the fourth quarter. Given the challenging industry environment in the U.S. during the third quarter, the group already adjusted the volume and price mix expectations. In China, the group witnessed double digit volume growth in third quarter as consumer replacement segment balanced out weak consumer OE volume. China’s OE sales increased for the fourth consecutive month in September. Further, China's auto inventories have stabilized indicating a positive China OE business heading into the fourth quarter. The region won multiple new OE platform in the 17 inch and larger rim sizes, and continued expansion opportunities for consumer replacement in tier 3 and tier 4 cities. The shares of GT stock have risen 3.2% in a year (as of November 29, 2017) and we believe there is more potential to the stock. We give a “Buy” recommendation on the stock at the current price of USD32.14

GT Daily Chart (Source: Thomson Reuters)

Disclaimer

is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

CA

.png)

.png)

.png)

.png)

Please wait processing your request...

Please wait processing your request...