ZoomInfo Technologies Inc

ZoomInfo Technologies Inc., (NASDAQ: ZI) through its subsidiaries, provides a go-to-market intelligence and engagement platform for sales and marketing teams. The Company’s cloud-based platform provides workflow tools with integrated, accurate, and comprehensive information on organizations and professionals to help users identify target customers and decision makers.

Recent Business and Financial Updates

- Financial Performance Overview: company recorded GAAP revenue of USD 291.5 million, marking a 6% year-over-year decrease. Despite this, ZoomInfo achieved an adjusted operating income of USD 81.6 million, representing an adjusted operating income margin of 28%. GAAP operating loss stood at USD 20.0 million, with a GAAP operating loss margin of 7%. The company generated GAAP cash flow from operations amounting to USD 126.3 million and unlevered free cash flow of USD 120.0 million.

- Strategic Initiatives and Market Positioning: ZoomInfo undertook several strategic initiatives during the second quarter to ensure long-term success. Key among these was the launch of ZoomInfo Copilot, an AI-powered platform designed to enhance sales team performance by targeting qualified leads with precise timing and messaging. Additionally, the company focused on expanding its upmarket presence, increasing the USD 100k ACV customer cohort and achieving strong new business performance in the mid-market and enterprise sectors. This strategy also involved stabilizing net revenue retention and implementing a new business risk model to minimize write-offs.

- Operational Changes and Financial Adjustments: The company implemented operational changes to address the collectibility of receivables from customers. This included requiring pre-payments from smaller customers and recording incremental charges of USD 33 million due to changes in estimates. The charges were allocated as follows: USD 15 million against revenue, USD 14 million as bad debt expense, and USD 4 million related to other discrete items. These adjustments are expected to strengthen ZoomInfo's financial position and enhance its ability to generate strong and growing free cash flow.

- Recent Business Highlights: ZoomInfo achieved several significant milestones in the second quarter. The company closed the period with 1,797 customers holding annual contract values of USD 100,000 or more, an increase of 37 from the prior quarter. It also partnered with Google Cloud to enhance generative AI models with specialized third-party datasets and became the first data company to earn TrustArc’s AI certification for data protection and privacy. Moreover, ZoomInfo received the TrustRadius Top Rated Award for customer satisfaction across multiple categories and successfully repriced its First Lien Credit Agreement, reducing its interest expense by approximately USD 3 million annually. The company also repurchased 10,799,791 shares of Common Stock for USD 147.4 million.

- Business Outlook and Guidance: Looking ahead, ZoomInfo provided its guidance for the third quarter and full year 2024. For Q3 2024, GAAP revenue is expected to range between USD 298 million and USD 301 million, with non-GAAP adjusted operating income between USD 107 million and USD 109 million. For FY 2024, the company anticipates GAAP revenue of USD 1.190 billion to USD 1.205 billion, non-GAAP adjusted operating income of USD 412 million to USD 418 million, and non-GAAP adjusted net income per share of USD 0.86 to USD 0.88. Additionally, ZoomInfo projects non-GAAP unlevered free cash flow between USD 420 million and USD 430 million for the full year.

Technical Observation (on the daily chart):

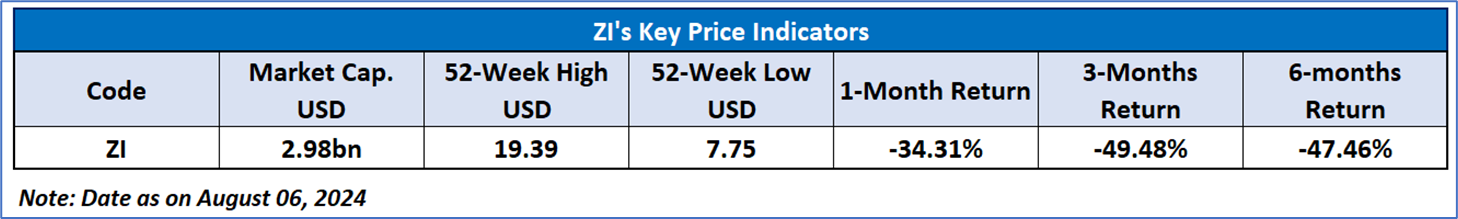

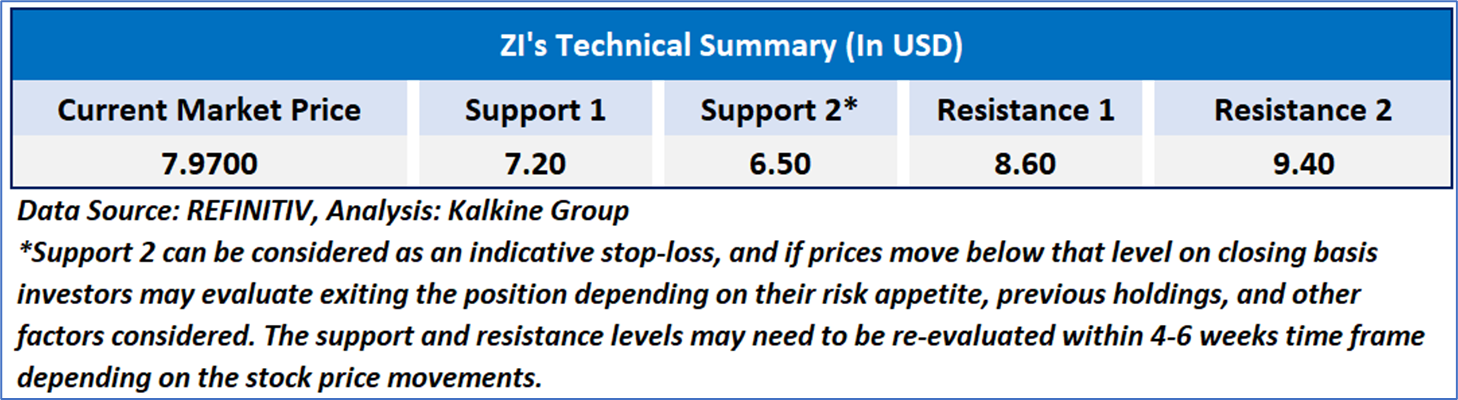

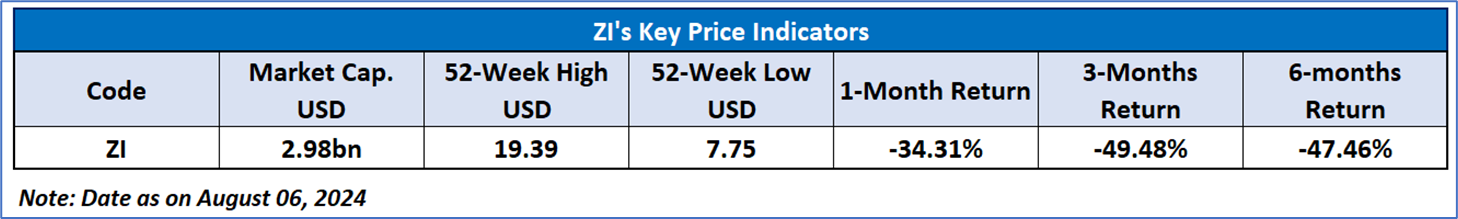

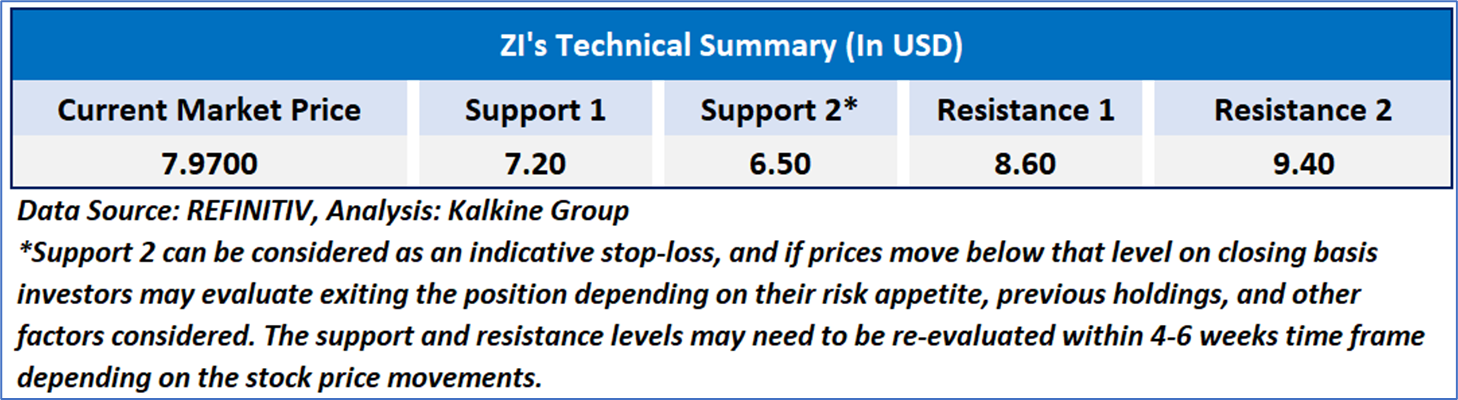

The Relative Strength Index (RSI) over a 14-day period stands at a value of 21.17, downward trending, with the expectations consolidation. Additionally, the stock's current positioning is below both 50-Day SMA and 200-Day SMA, which can act as a short to medium term resistance levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 06, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...