This report is an updated version of the report published on the 20 May 2024 at 11:08 PM PT.

Northwest Natural Holding Company (NYSE: NWN)

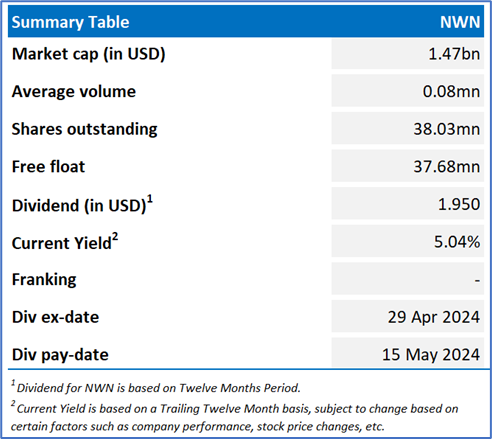

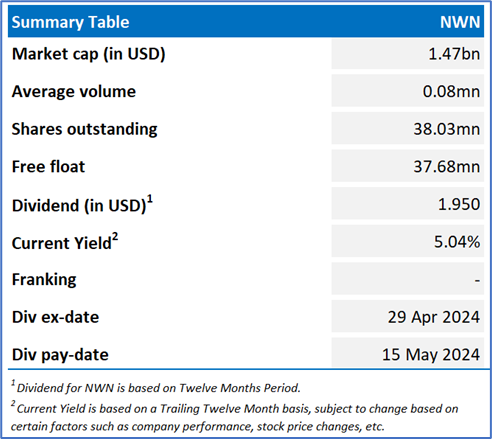

NWN is a provider of natural gas services via its subsidiaries. The company distributes natural gas to commercial, residential, and industrial customers in southwest Washington and Oregon.

Recommendation Rationale – SELL at USD 38.54

- Financial Performance: NWN’s operating revenues declined by nearly 6% YoY to USD 433.47mn in 1QFY24 vs USD 462.42mn in 1QFY23, due to lower revenue across segments during the period. The company’s net income declined by nearly 11% to USD 63.82mn in 1QFY24 vs USD 71.67mn in 1QFY23.

- Outlook: NWN has reconfirmed its long-term earnings per share growth target, setting a goal for a compounded annual growth rate of 4% to 6% from 2022 to 2027.

- Emerging Risks: Gas utilities companies could encompass potential losses due to adverse market conditions, such as forging currency fluctuation, geopolitical events, technology changes, and macroeconomics changes, etc.

NWN Daily Chart

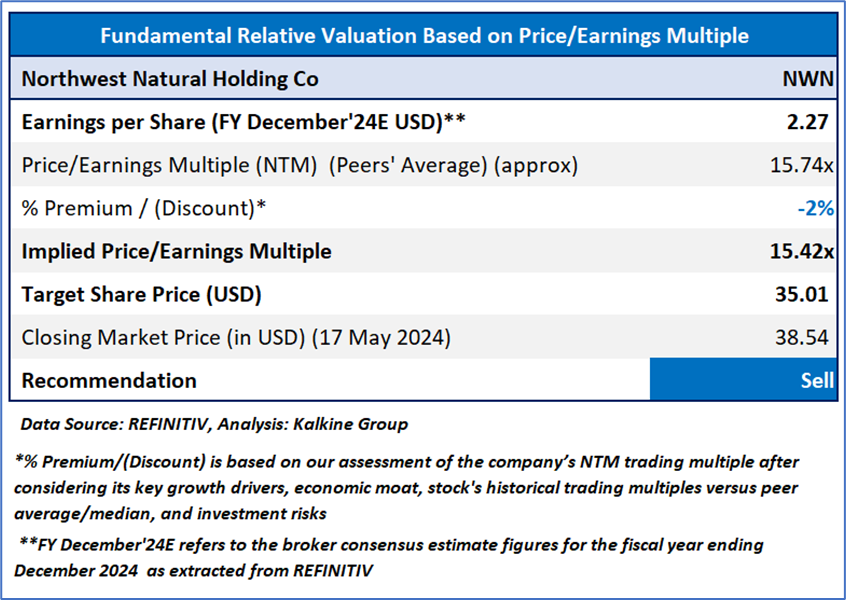

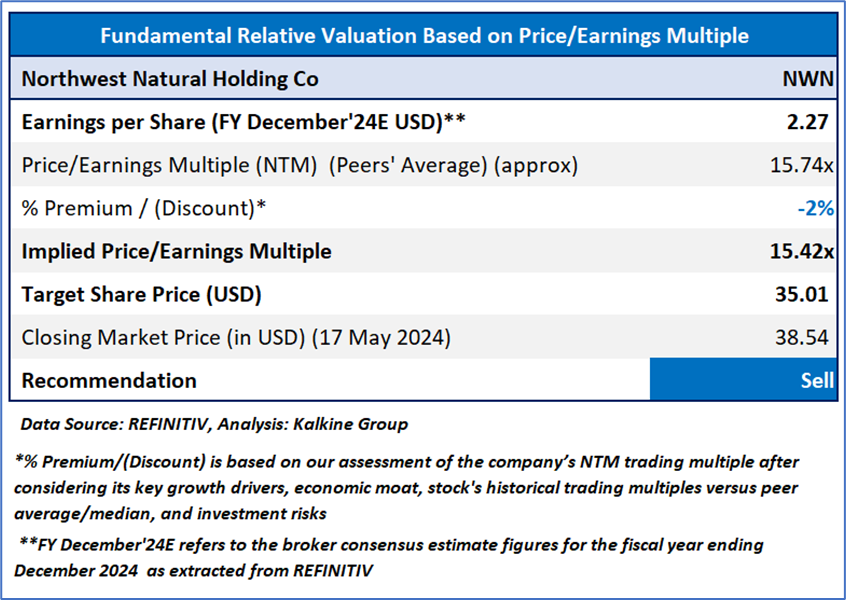

Valuation Methodology: Price/Earnings Approach (FY December’24E) (Illustrative)

Considering the commodity price fluctuation, reduction operating revenues in 1QFY24, intense competition in market, and lower net income in 1QFY24, the company might trade at a slight discount to its peers. For valuation, few peers such as ONE Gas Inc (NYSE: OGS), Sempra (NYSE: SRE), New Jersey Resources Corp (NYSE: NJR), and others have been considered. Given its current trading levels, recent rally in the share price, and risks associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the closing market price of USD 38.54, up by 0.13%, as of 17 May 2024.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 17 May 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

CA

Please wait processing your request...

Please wait processing your request...