Adicet Bio Inc

Adicet Bio, Inc. (NASDAQ: ACET) is a clinical stage biotechnology company. The Company is engaged in advancing a pipeline of off-the-shelf gamma delta T cells, engineered with chimeric antigen receptors (CARs), to facilitate durable activity in patients. Its lead product candidate, ADI-001, a first-in-class allogeneic gamma delta T cell therapy expressing a CAR targeting CD20, is being developed for the potential treatment of autoimmune diseases and relapsed or refractory aggressive B cell non-Hodgkin's lymphoma (NHL).

Recent Business and Financial Updates

- Financial and Operational Overview for Q3 2024: Adicet Bio, Inc., a clinical-stage biotechnology company specializing in allogeneic gamma delta T cell therapies, reported robust financial and operational outcomes for the third quarter ended September 30, 2024. The company’s financial position remains strong, with USD 202.1 million in cash, cash equivalents, and short-term investments, ensuring sufficient liquidity to fund operations through the second half of 2026. Total research and development (R&D) expenses stood at USD 26.3 million, reflecting a slight increase from the previous year, attributed to laboratory and personnel costs. General and administrative (G&A) expenses also rose modestly to USD 6.9 million. The company’s net loss narrowed to USD 30.5 million compared to USD 49.9 million in the same period in 2023, driven by reduced non-cash goodwill impairment expenses.

- Expanding Clinical Pipeline for Autoimmune Diseases: Adicet made significant progress in its ADI-001 Phase 1 trial for autoimmune diseases, which now encompasses six indications, including lupus nephritis (LN) and systemic lupus erythematosus (SLE). The company activated clinical sites for LN and plans to expand enrollment to other indications in 2025. Preliminary data from the LN study is anticipated in the first half of 2025, with additional autoimmune indications expected in the second half of the year. Furthermore, the U.S. Food and Drug Administration (FDA) cleared an Investigational New Drug (IND) amendment, enabling the evaluation of ADI-001 in idiopathic inflammatory myopathy (IIM) and stiff person syndrome (SPS), reinforcing Adicet’s commitment to broadening its impact in autoimmune therapeutics.

- Advancements in Hematologic Malignancies and Solid Tumor Therapies: The company continues to make strides in its solid tumor programs, with the ADI-270 candidate receiving FDA Fast Track Designation for treating metastatic/advanced clear cell renal cell carcinoma (ccRCC). This milestone underscores the therapeutic potential of gamma delta T cell therapies in addressing solid tumors. Additionally, Adicet plans to initiate a Phase 1 trial for ADI-270 in metastatic ccRCC by the end of 2024, with preliminary data expected in 2025. Recent presentations at prominent conferences, including the American Society of Gene & Cell Therapy (ASGCT) and the American College of Rheumatology (ACR), highlighted promising clinical data demonstrating robust tissue trafficking and therapeutic efficacy, further validating the company’s platform.

- Corporate Updates and Strategic Appointments: Adicet strengthened its leadership by appointing Dr. Lloyd Klickstein to its Board of Directors. Dr. Klickstein brings over 20 years of expertise in rheumatology, immunology, and biopharmaceutical leadership, which will significantly enhance Adicet’s strategic direction. His extensive background in biomedical research and board-level leadership aligns with the company’s vision of advancing gamma delta T cell therapies for complex diseases.

- Future Outlook and Strategic Initiatives: Looking ahead, Adicet is focused on advancing its clinical trials and expanding its therapeutic pipeline. The company aims to drive patient enrollment across its autoimmune and solid tumor indications while leveraging its gamma delta T cell platform to develop transformative therapies. Preliminary data from ADI-001 in lupus nephritis and ADI-270 in metastatic ccRCC are expected in the first half of 2025, marking key milestones in the company’s journey to address unmet medical needs in autoimmune diseases and oncology.

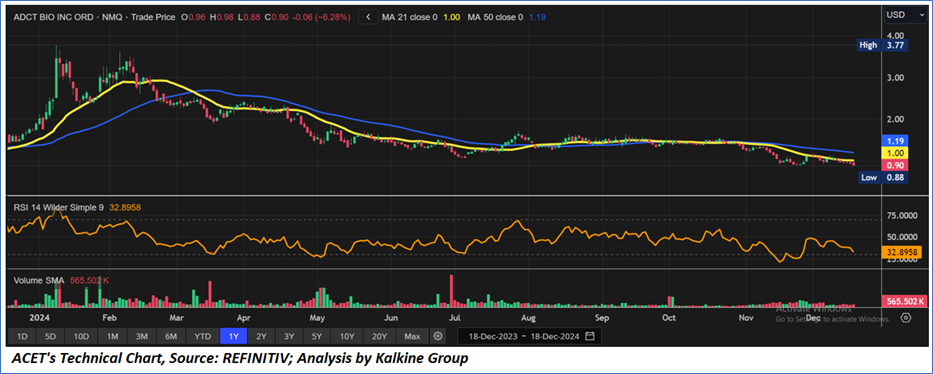

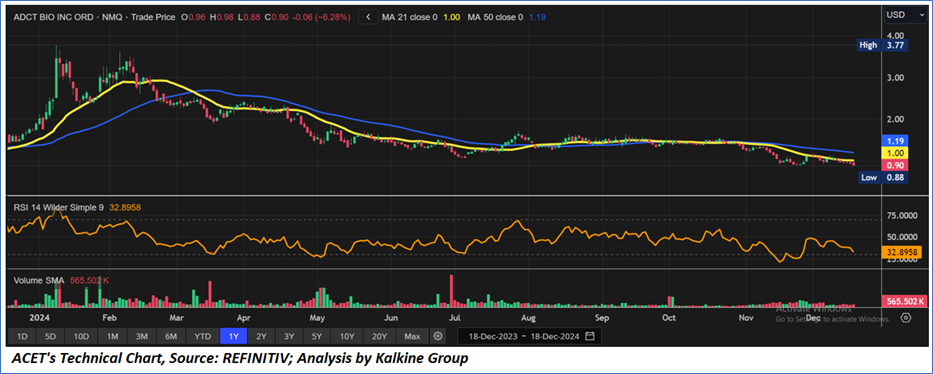

Technical Observation (on the daily chart):

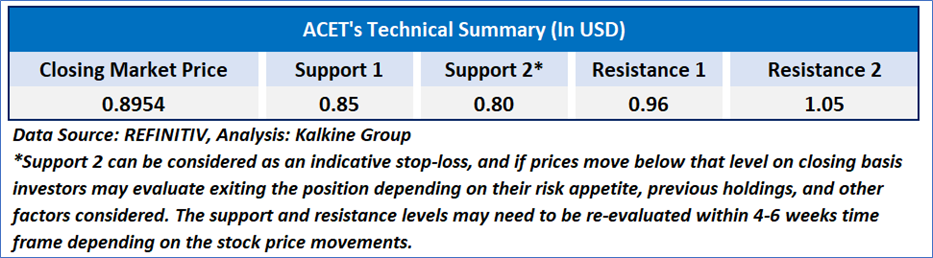

The Relative Strength Index (RSI) over a 14-day period stands at a value of 32.89, near oversold zone, with expectations of a bullish divergence and upward momentum from the near important support zone of USD 0.85-USD 0.90. Additionally, the stock's current positioning is below both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term support levels.

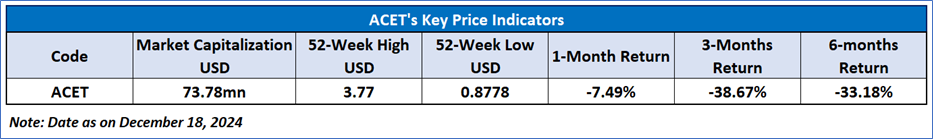

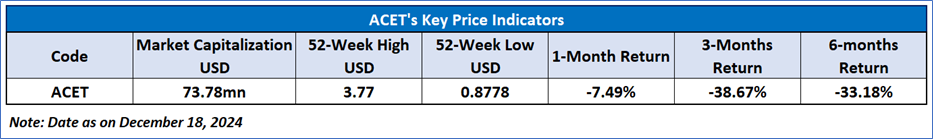

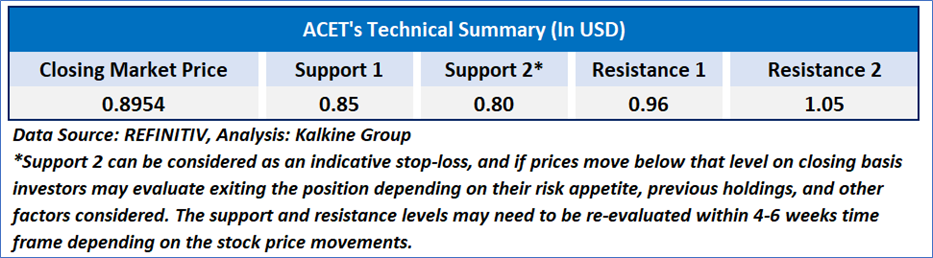

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given for Adicet Bio, Inc. (NASDAQ: ACET) at the closing market price of USD 0.8954 as of December 18, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

CA

Please wait processing your request...

Please wait processing your request...