Sirius XM Holdings Inc

Sirius XM Holdings Inc. (NASDAQ: SIRI) is an audio entertainment company. The Company has a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM; the ad-supported and premium music streaming services of Pandora; an expansive podcast network, and a suite of business and advertising solutions. The Company operates in two segments: Sirius XM and Pandora and Off-platform.

Recent Business and Financial Updates

- Financial Overview for Second Quarter 2024: SiriusXM announced its financial results for the second quarter of 2024, reporting a revenue of USD 2.18 billion, which represents a 3% decline compared to the same quarter in 2023. The company recorded a net income of USD 316 million, slightly higher than the USD 310 million reported in the second quarter of 2023. The earnings per diluted share remained steady at USD 0.08. Additionally, SiriusXM reported an adjusted EBITDA of USD 702 million, reflecting an 8% growth from the first quarter of 2024, while free cash flow for the quarter amounted to USD 343 million. The company has reiterated its full-year financial guidance for 2024, maintaining expectations for revenue, adjusted EBITDA, and free cash flow.

- SiriusXM Segment Performance: SiriusXM reported a total subscriber base of 33 million for the second quarter of 2024. Self-pay subscribers decreased by 100,000, driven by higher vehicle-related churn and lower vehicle conversion rates. However, this decline was mitigated by lower voluntary churn and increased automaker volumes. Paid promotional subscribers also saw a reduction of 73,000, largely due to a shift toward unpaid trial subscriptions. Total revenue for the SiriusXM segment stood at USD 1.6 billion, a 5% decrease from the prior year. The decline was attributed to a smaller self-pay subscriber base and a USD 0.42 year-over-year decrease in average revenue per user (ARPU).

- Pandora and Off-Platform Segment Results: The Pandora and Off-Platform segment reported revenue of USD 538 million for the second quarter of 2024, representing a 2% increase compared to the same period in 2023. Self-pay subscribers for Pandora Plus and Pandora Premium decreased by 41,000, ending the quarter with a total of 6 million subscribers. Advertising revenue remained stable at USD 400 million, with a 10% increase compared to the first quarter of 2024. Gross profit for this segment was USD 180 million, an 18% improvement from the previous year, and gross margin rose to 33%, a 4% increase from the prior year.

- Business and Programming Initiatives: SiriusXM continued to expand its programming and product offerings, including the launch of new channels with Chris Stapleton and Avicii. The company also introduced a podcast, "Where Everybody Knows Your Name with Ted Danson and Woody Harrelson (sometimes)," and secured an exclusive podcast monetization agreement with Dale Earnhardt Jr.’s Dirty Mo Media. Additionally, SiriusXM expanded its streaming services, introducing SiriusXM Free Access in vehicles, a free, ad-supported service featuring limited music and talk channels. These initiatives reflect the company's efforts to engage potential subscribers and strengthen its content portfolio.

- Cost Optimization and Financial Highlights: The company’s subscriber acquisition costs declined to USD 92 million, while sales and marketing expenses increased by 4% to USD 217 million. Engineering, design, and development costs saw a significant decrease of 17%, amounting to USD 60 million, and general and administrative expenses dropped by 23% to USD 95 million. These reductions were part of SiriusXM’s ongoing cost optimization efforts, which are expected to result in USD 200 million in total cost savings by the end of 2024. The company also saved approximately USD 50 million in the second quarter through consolidation efforts.

- Full-Year Financial Guidance: SiriusXM has reiterated its financial guidance for the full year of 2024. The company expects total revenue to reach approximately USD 8.75 billion, with an adjusted EBITDA of around USD 2.70 billion. Free cash flow for the year is projected to be approximately USD 1.20 billion. This guidance underscores the company’s confidence in its strategic direction and commitment to delivering long-term value to its shareholders.

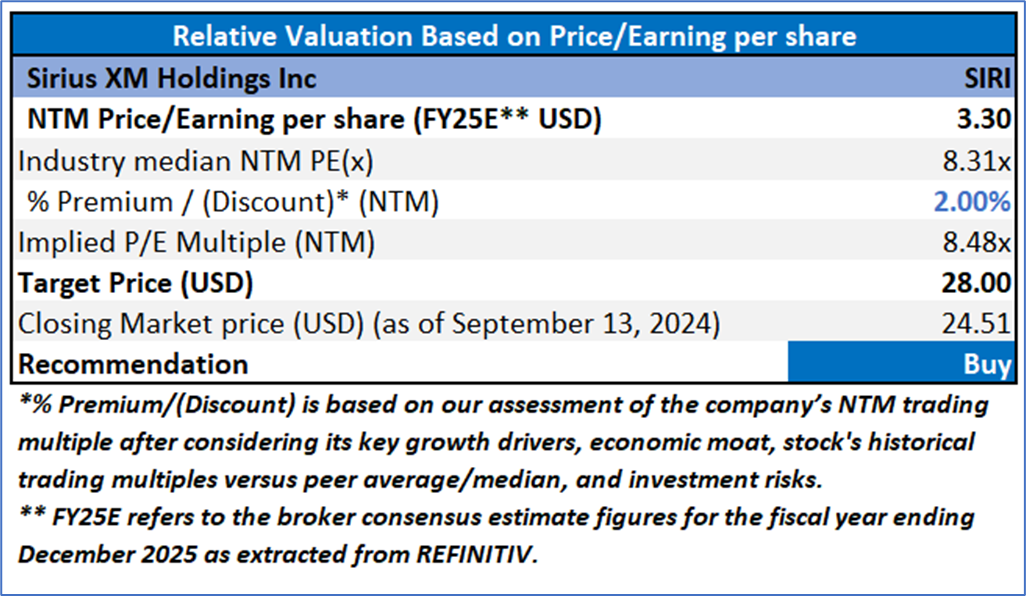

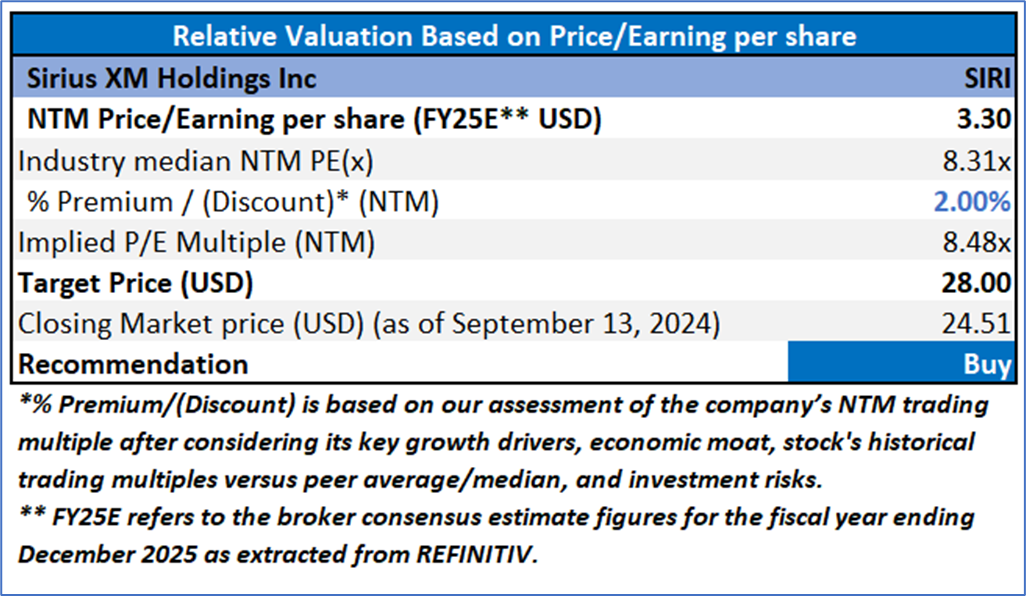

Fundamental Valuation:

Valuation Methodology: Price/Earnings Multiple Based Relative Valuation

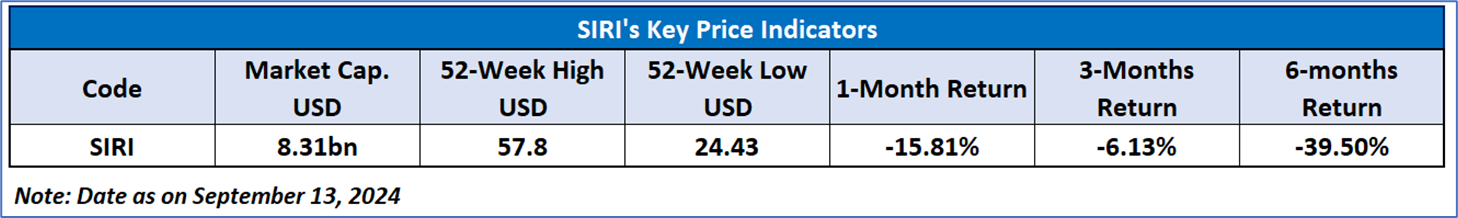

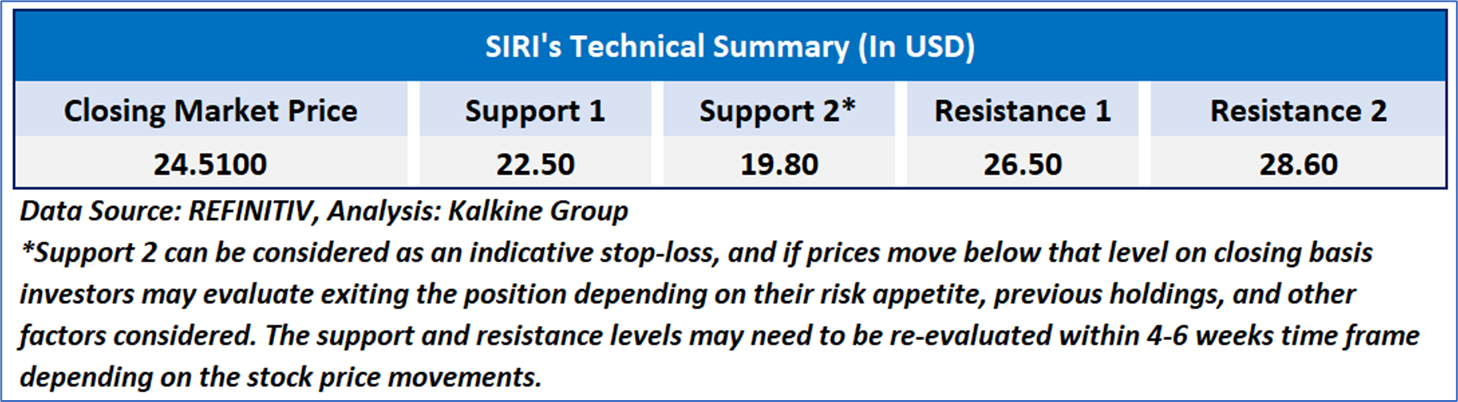

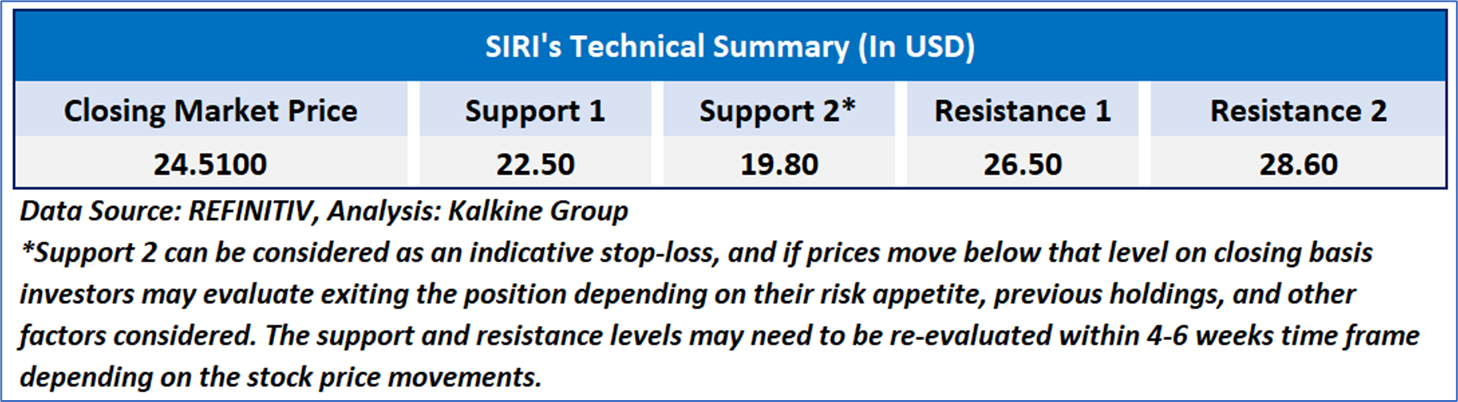

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 30.84, currently consolidating near oversold levels, with expectations of a consolidation or an upward momentum from the current support levels of USD 23.00- USD 25.00. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 13, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...