Enphase Energy Inc

Enphase Energy, Inc. (NASDAQ: ENPH) is a global energy technology company. The Company designs, develops, manufactures and sell home energy solutions that manage energy generation, energy storage and control and communications on one intelligent platform. Its Enphase Energy System brings a high-technology, networked approach to solar generation plus energy storage, by leveraging its design across power electronics, semiconductors and cloud-based software technologies.

Key Business & Financial Updates

- Q2 2024 Financial Results: Enphase Energy delivered a strong financial performance in the second quarter of 2024, reporting revenue of USD 303.5 million, a substantial increase from USD 263.3 million in the previous quarter. The rise in revenue was largely driven by a 32% increase in U.S. sales, while the European market maintained stable revenue levels. Additionally, the company’s global channel inventory returned to normal levels by the end of the quarter, contributing positively to its overall financial results.

- Profit Margins and Earnings Performance: In Q2 2024, Enphase Energy achieved a non-GAAP gross margin of 47.1%, up from 46.2% in the first quarter. Excluding the benefit from the Inflation Reduction Act (IRA), the gross margin remained at 41.0%. Non-GAAP operating income also saw a notable increase, reaching USD 61.1 million, compared to USD 39.0 million in the prior quarter. GAAP net income for the quarter stood at USD 10.8 million, while non-GAAP net income was USD 58.8 million. The company generated free cash flow of USD 117.4 million and ended the quarter with USD 1.65 billion in cash and marketable securities.

- Cash Flow Generation and Stock Buyback: Enphase Energy reported USD 127.0 million in cash flow from operations during Q2 2024. Capital expenditures for the quarter rose to USD 9.6 million. The company also repurchased 891,896 shares of common stock at an average price of USD 112.02 per share, amounting to a total of USD 99.9 million. Furthermore, USD 7.5 million was allocated to cover tax liabilities related to employee stock vesting, reducing the diluted share count by 66,126 shares.

- Increased Product Shipments and Technological Advancements: In Q2 2024, Enphase Energy significantly increased its product shipments, delivering 120.2 megawatt hours of IQ Batteries, up from 75.5 megawatt hours in the first quarter. The company continued expanding its distribution of the third-generation IQ® Battery 5P™ across key markets such as the U.S., Canada, Mexico, Europe, and Australia. Additionally, the number of certified installers for the IQ Batteries rose to over 7,400 globally, an increase from 4,900 in the previous quarter. Enphase also introduced innovative products, such as the IQ Battery 5P with FlexPhase backup and the IQ® EV Charger, which were unveiled at Intersolar Europe in June 2024 and are expected to enter the market later in the year.

- Strategic Initiatives and Market Expansion: During the second quarter of 2024, Enphase Energy made several key strategic announcements. In July 2024, the company launched the IQ Battery 5P and IQ8 Microinverters in Luxembourg and introduced the CS-100 EV Charger for commercial fleet electric vehicles in the U.S. Enphase also revealed that certain products may qualify for the Domestic Content Bonus Tax Credit under the Inflation Reduction Act (IRA). Additionally, the company expanded the deployment of its NEM 3.0 product solution in California and entered the Finnish market with its IQ8 Microinverters.

- Q3 2024 Financial Projections: Looking ahead to the third quarter of 2024, Enphase Energy anticipates revenue between USD 370.0 million and USD 410.0 million, with projected shipments of 160 to 180 megawatt hours of IQ Batteries. The company expects its GAAP gross margin to be in the range of 45.0% to 48.0%, while its non-GAAP gross margin, including the IRA benefit, is forecasted to be between 47.0% and 50.0%. GAAP operating expenses are expected to range from USD 138.0 million to USD 142.0 million, with non-GAAP operating expenses estimated between USD 79.0 million and USD 83.0 million. The company also anticipates receiving a net benefit of USD 30.0 million to USD 33.0 million from the IRA for Q3 2024.

Technical Observation (on the daily chart):

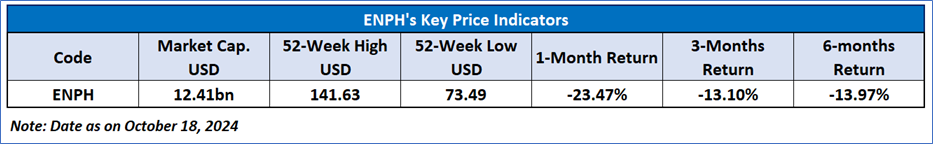

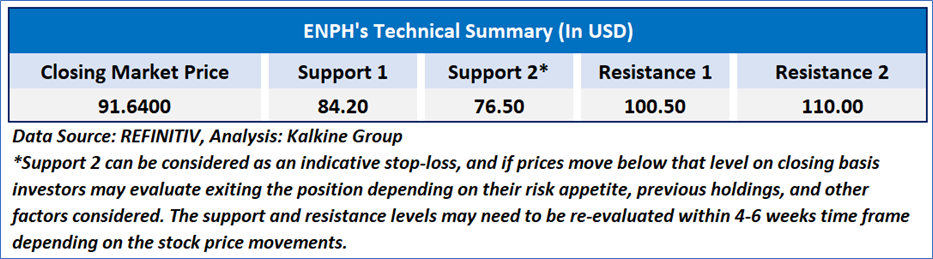

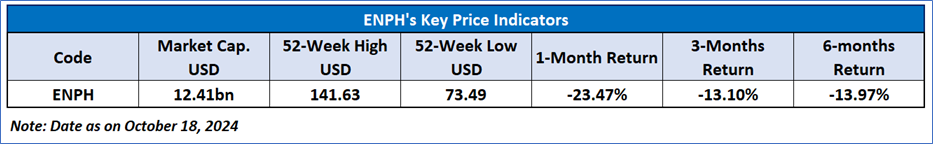

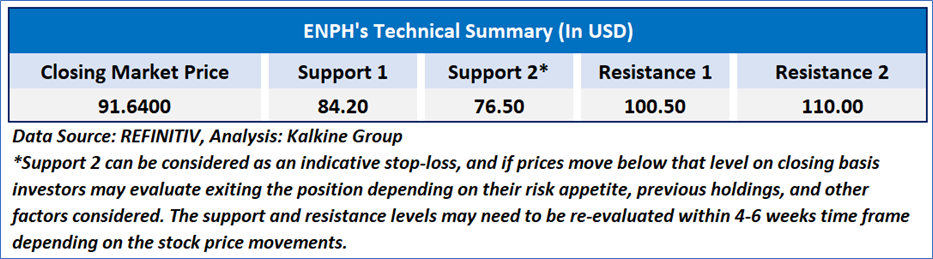

The Relative Strength Index (RSI) over a 14-day period stands at a value of 29.16, inside oversold zone, with the expectations of upward momentum if these important support levels of USD 90-USD 85 are sustained. Additionally, the stock's current positioning is below both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘Buy’ rating has been given to Enphase Energy, Inc. (NASDAQ: ENPH) at the closing market price of USD 91.64 as of October 18, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is October 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...