RY 174.39 2.4016% SHOP 149.115 2.5974% TD-PFM 24.63 -0.0811% TD-PFL 24.7 0.2028% TD 78.325 0.1214% ENB 60.6 1.3039% BN 80.4 1.9787% TRI 226.27 0.7525% CNQ 48.285 2.2771% CP 104.53 1.6038% CNR 151.74 1.5459% BMO 132.69 0.9203% BNS 78.845 0.1715% CSU 4600.2002 2.157% CM 91.15 0.474% MFC 45.79 1.6878% ATD 78.38 1.5285% NGT 60.14 0.0499% TRP 70.15 1.977% SU 57.44 0.5954%

Star Bulk Carriers Corp

Company Overview: Star Bulk Carriers Corp (NASDAQ: SBLK) is a Greece-based global shipping company. It owns and operates a fleet of dry bulk carrier vessels. The Company’s vessels transport major bulks, which include iron ore, coal, and grain, and minor bulks, which include bauxite, fertilizers, and steel products. Its fleet consists of 128 vessels with carrying capacities between 52,247 and 209,537 dwt.

As per our previous US Diversified Opportunities published on ‘SBLK’ on 06th July 2023, Kalkine provided a ‘Buy’ stance on the stock at USD 17.34 based on “decent fundamentals, a correction in the stock price, industry above margins, upside indicated by the valuation, and key risks associated with the business” and the stock price has now moved by ~25.20% since then and the price has crossed resistance 1 and resistance 2.

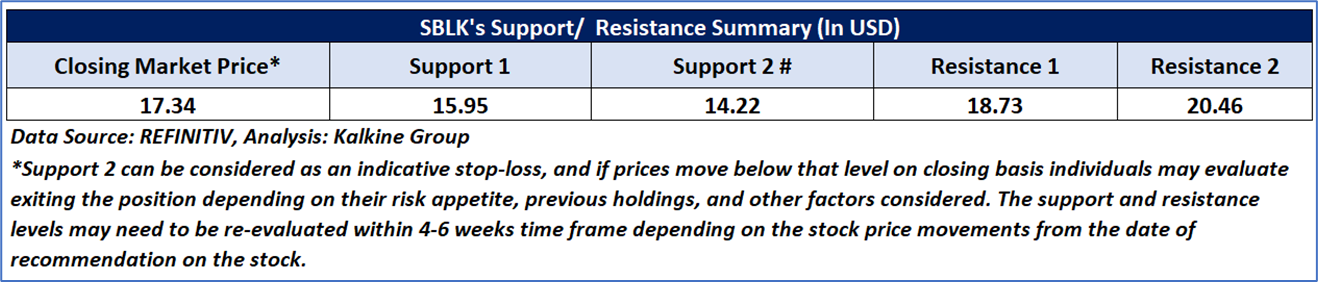

Noted below are the details of support and resistance levels provided in our previous report:

SBLK’s Daily Chart

Considering the resistance around the range of USD 20.00 – USD 22.00, attainment of resistance 1 and resistance 2 levels, current trading levels, risks associated, and volatile market conditions on the back of higher interest rates, a ‘Sell’ rating is assigned to the “SBLK” at the current market price of USD21.06 (as of 08 January 2024, at 07:10am PST).

Note: This report may be updated with details around fundamental and technical analysis, price/ chart in due course, as appropriate

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 08, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.