Devon Energy Corporation

Devon Energy Corporation (NYSE: DVN) is an oil and gas producer in the United States with a multi-basin portfolio. The Company is primarily engaged in the exploration, development and production of oil, natural gas and natural gas liquids (NGLs). Its oil and gas properties include Delaware Basin, Eagle Ford, Anadarko Basin, Williston Basin and Powder River Basin.

Recent Business and Financial Updates

- Key Financial and Operational Highlights: Devon Energy reported net earnings of USD 844 million, or USD 1.34 per diluted share, for the second quarter of 2024, with core earnings amounting to USD 885 million, or USD 1.41 per diluted share. The company achieved record oil production of 335,000 barrels per day, exceeding guidance by 3%, and generated operating cash flow of USD 1.5 billion, alongside free cash flow of USD 587 million. Strengthening its balance sheet, Devon's cash balances reached USD 1.2 billion. The company declared a fixed-plus-variable dividend payout of USD 0.44 per share and repurchased 5.2 million shares of common stock at a total cost of USD 256 million. Additionally, Devon raised its full-year 2024 production outlook for the second consecutive quarter and increased its share-repurchase authorization by 67% to USD 5 billion. The company also announced a strategic acquisition on July 8, which is expected to enhance its scale and transform its Williston Basin business.

- Financial Results: In the second quarter of 2024, Devon reported net earnings of USD 844 million, or USD 1.34 per diluted share. After adjusting for items typically excluded by analysts, core earnings were USD 885 million, or USD 1.41 per diluted share. Operating cash flow increased by 9% year-over-year to USD 1.5 billion, allowing the company to fund its capital requirements and generate USD 587 million in free cash flow. Devon's financial position continued to strengthen, with cash balances reaching USD 1.2 billion by the end of the quarter. The company exited the quarter with outstanding debt of USD 6.1 billion and a net debt-to-EBITDAX ratio of 0.6 times.

- Return of Capital: Based on its second quarter financial performance, Devon declared a fixed-plus-variable dividend of USD 0.44 per share, payable on September 30, 2024, to shareholders of record as of September 13, 2024. This dividend includes a fixed component of USD 0.22 per share and a variable distribution of USD 0.22 per share. In addition to dividend payouts, Devon continued its share repurchase program, buying back 5.2 million shares at a total cost of USD 256 million during the second quarter. Since the program's inception in late 2021, the company has repurchased 54.7 million shares at a total cost of USD 2.7 billion. Following this progress and the anticipated free cash flow from the recent Grayson Mill acquisition, Devon increased its share-repurchase authorization by 67% to USD 5 billion, extending through mid-2026.

- Operating Results:

- Devon’s capital activity in the second quarter involved an average of 22 operated drilling rigs and 6 completion crews across its asset portfolio, resulting in 114 gross operated wells being placed online with an average lateral length of 9,300 feet. Upstream capital spending for the quarter totaled USD 828 million, below guidance expectations and representing a 14% decrease compared to the second quarter of 2023. The company also invested USD 62 million in midstream, carbon, and corporate capital, and executed USD 81 million in multiple leasehold transactions, including in the Delaware Basin.

- Devon’s oil production reached a record high of 335,000 barrels per day in the second quarter, exceeding guidance by 3%. The companywide production averaged 707,000 oil-equivalent barrels (Boe) per day, a 7% increase from the previous year. Growth was largely driven by the Delaware Basin asset, which accounted for 65% of total volumes at 461,000 Boe per day. This represents a 5% quarter-over-quarter growth, supported by 62 gross operated wells coming online during the quarter. Additionally, Devon achieved significant operational efficiencies, with metrics for drilled and completed feet per day improving by 12% and 6% year-to-date, respectively, compared to 2023. Production costs, including taxes, averaged USD 12.25 per Boe, a 1% decline from the previous period. This low-cost structure, combined with higher commodity prices, expanded field-level cash margins by 6% year-over-year to USD 31.19 per Boe.

- 2024 Outlook: Devon has raised its full-year 2024 production forecast for the second consecutive quarter to a range of 677,000 to 688,000 Boe per day, driven by better-than-expected well performance and improving cycle times. The company maintains its full-year capital expenditure range of USD 3.3 billion to USD 3.6 billion but expects to be in the upper half of this range due to efficiency gains that are accelerating activity. For the third quarter, Devon anticipates capital spending of approximately USD 900 million, with oil production expected to average between 319,000 and 325,000 barrels per day.

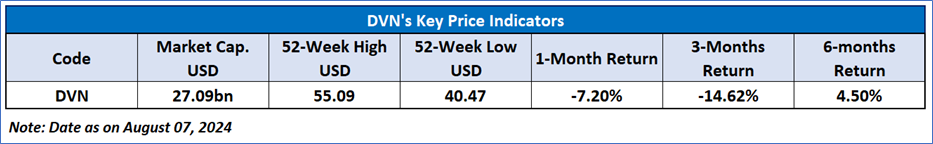

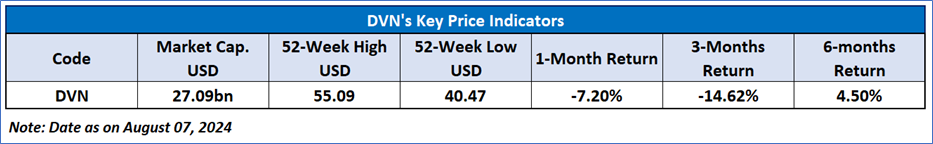

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 38.21, recovering from oversold zone, with the price near an important range of USD 40-USD 42, with expectations of momentum on the upper side if these support level sustains. Additionally, the stock's current positioning is below both 50-Day SMA and 200-Day SMA, which can act as a short to medium term resistance levels. The price has a resistance range around USD 46-USD 47, if broken will lead price to further higher levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Devon Energy Corporation (NYSE: DVN) at the closing market price of USD 43.17 as of August 08, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 08, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...