Kering SA

Kering SA (OTC: PPRUF) is a France-based company that mainly active in fashion group on luxurious branded products. The Group manages the development of a series of renowned Houses in Fashion, Leather Goods and Jewellery: Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Ginori 1735, as well as Kering Eyewear and Kering Beaute.

Recent Business and Financial Updates

- Group Revenue and Operational Performance: In the first half of 2024, Kering reported group revenue of EUR 9.0 billion, representing an 11% decline both as reported and on a comparable basis. The second quarter mirrored this trend, with revenue amounting to EUR 4.5 billion, marking a consistent 11% reduction. The revenue decrease included a negative 1% currency effect and a positive 1% scope effect following the consolidation of Creed. Sales from Kering’s directly operated retail network fell by 12%, impacted by lower store traffic, although there was a notable improvement in Japan and a slowdown in the Asia-Pacific region. Wholesale and other revenue declined by 6%, largely due to Kering’s strategic efforts to enhance exclusivity in the distribution of its Houses.

- Recurring Operating Income and Margin Decline: Kering’s recurring operating income for the first half of 2024 stood at EUR 1.6 billion, a 42% decrease, in line with the company’s prior guidance. The recurring operating margin fell to 17.5%, significantly lower than in the first half of 2023, a result of negative operational leverage. Despite the revenue challenges, Kering remained committed to investing in its luxury Houses, focusing on enhancing their desirability. Simultaneously, the Group implemented strict control over operating expenses, ensuring that its long-term strategic initiatives continued. Net income attributable to the Group was EUR 878 million, and free cash flow from operations, excluding real estate acquisitions, reached EUR 1.9 billion. Including a significant acquisition on Fifth Avenue, New York, free cash flow totaled EUR 1.1 billion.

- Gucci’s Performance and Strategic Focus: Gucci, Kering’s flagship brand, saw its revenue decline to EUR 4.1 billion in the first half of 2024, a 20% decrease as reported and an 18% drop on a comparable basis. The brand's sales through its directly operated retail network fell by 20%, while wholesale revenue decreased by 9%. In the second quarter, Gucci’s sales declined by 19%, with significant underperformance in the Asia-Pacific region. Despite these challenges, the brand’s new product offerings received favorable feedback. Gucci’s recurring operating income totaled EUR 1.0 billion for the first half of the year, with a recurring operating margin of 24.7%, reflecting ongoing investments in long-term strategic initiatives to enhance the brand’s market presence.

- Yves Saint Laurent’s Market Adjustments: Yves Saint Laurent recorded revenue of EUR 1.4 billion, down 9% as reported and 7% on a comparable basis in the first half of 2024. Sales from its directly operated retail network dropped by 6%, while wholesale revenue experienced a sharp 25% decrease. In the second quarter, the brand’s sales fell by 9%, with an 8% decline in its retail network. While Asia-Pacific underperformed, Japan showed an improvement. The House’s new collections were well-received, and it continued its efforts to attract local customers. Yves Saint Laurent’s recurring operating income was EUR 316 million, with a recurring operating margin of 22.0%, reflecting its sustained investments in communication and customer engagement initiatives.

- Bottega Veneta’s Strong Retail Growth: Bottega Veneta delivered a stable performance in the first half of 2024, with revenue of EUR 836 million, unchanged as reported but up 3% on a comparable basis. The brand’s directly operated retail network saw an 8% increase in sales, while wholesale revenue declined by 19%. In the second quarter, Bottega Veneta’s revenue rose by 4%, supported by double-digit growth in Western Europe and North America and strong performance in the Middle East. Resilience in the Asia-Pacific region further bolstered the brand’s results. The brand’s recurring operating income was EUR 121 million, with a recurring operating margin of 14.5%, underscoring its investment in exclusive client events and significant communication expenditure.

- Other Houses and Kering Eyewear Performance: Kering’s Other Houses posted revenue of EUR 1.7 billion, a 7% decline as reported and 6% on a comparable basis. While sales from directly operated retail networks grew by 1%, wholesale revenue fell by 21%. Second-quarter performance varied across Houses, with Jewelry Houses like Boucheron and Pomellato recording double-digit growth, while Balenciaga and Alexander McQueen experienced contrasting results. The Other Houses' recurring operating income was EUR 44 million, with a 2.6% recurring operating margin. Kering Eyewear, along with Kering Beauté, generated EUR 1.1 billion in revenue in H1 2024, with recurring operating income reaching EUR 196 million.

- Financial Position and Outlook: Kering’s net financial expense for the first half of 2024 amounted to EUR 288 million, with a recurring income tax rate of 26.9%. At the end of June 2024, Kering’s net debt was EUR 9.9 billion. Despite the economic challenges faced in the luxury sector, Kering remains focused on its long-term strategy, which includes enhancing the desirability of its Houses, maintaining the exclusivity of their distribution, and balancing creative innovation with sustainability. Given the uncertain economic and geopolitical environment, Kering anticipates that recurring operating income for the second half of 2024 may decline by approximately 30% compared to the second half of 2023. The Group continues to prioritize investments in creative innovation and customer experience, while also optimizing its cost structure in response to market conditions.

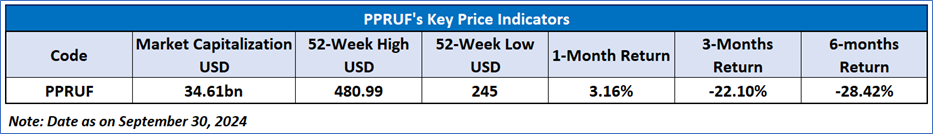

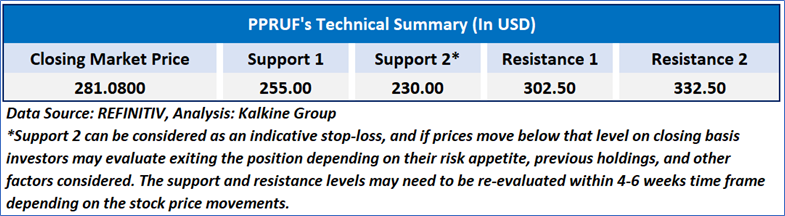

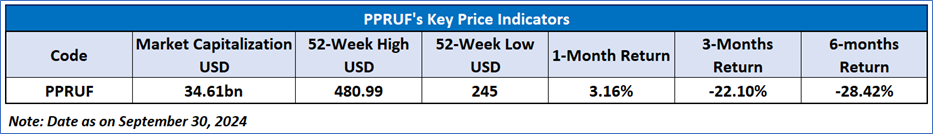

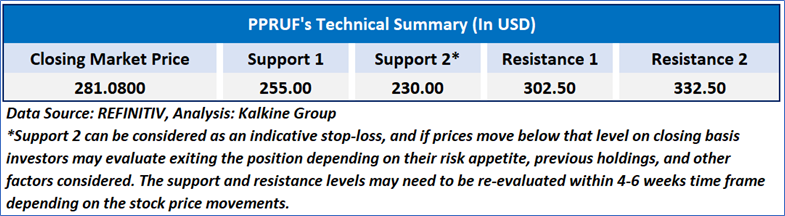

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 54.20, currently upward trending, with expectations of a consolidation or an upward momentum in case of the current support levels of USD 250-USD 270 holds. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Kering SA (OTC: PPRUF) at the closing market price of USD 281.08 as of September 30, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 30, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...