Bentley Systems Incorporated

Bentley Systems, Incorporated (NASDAQ: BSY) is an infrastructure engineering software company. The Company offers solutions for enterprises and professionals across the infrastructure lifecycle. Its software enables digital workflows across engineering disciplines, across distributed project teams, and from offices to the field.

Key Business & Financial Updates

Second Quarter 2024 Financial Performance: In the second quarter of 2024, total revenues reached USD 330.3 million, marking an 11.3% increase year-over-year, or 11.9% on a constant currency basis. Subscription revenues contributed USD 297.4 million, reflecting a 14.7% growth, or 15.3% on a constant currency basis. Annualized Recurring Revenues (ARR) as of June 30, 2024, stood at USD 1,215.9 million, an 11% increase compared to USD 1,105.9 million the previous year. The dollar-based net retention rate for recurring revenues over the last twelve months was 108%, slightly lower than the 110% recorded for the same period last year.

Operating and Income Margins: The company's operating income margin improved to 24.3% in Q2 2024, compared to 18.0% for the same quarter in 2023. The adjusted operating income margin, which includes stock-based compensation expenses, also saw an increase, reaching 28.8%, up from 24.7% in the prior year. Net income per diluted share rose to USD 0.22, up from USD 0.15 last year, while adjusted net income per diluted share (Adjusted EPS) improved to USD 0.31, compared to USD 0.24 for the same period last year.

Cash Flow and Operational Efficiency: Cash flows from operations for Q2 2024 amounted to USD 62.6 million, a decrease from USD 80.6 million during the same quarter in 2023. However, for the six months ending June 30, 2024, total revenues were USD 668.1 million, reflecting a year-over-year increase of 9.3%, or 9.5% on a constant currency basis. Subscription revenues for this period totaled USD 604.5 million, representing a 12.6% increase.

Profitability for the Six-Month Period: The operating income margin for the first half of 2024 was 25.8%, compared to 19.5% in the prior year period. The adjusted operating income margin, inclusive of stock-based compensation, rose to 31.1% from 26.8% in 2023. Net income per diluted share for the six months reached USD 0.44, compared to USD 0.29 the previous year, while Adjusted EPS improved to USD 0.62, up from USD 0.49 in the same period. Cash flows from operations for this period were USD 267.6 million, compared to USD 256.8 million the previous year.

Leadership Transition: Effective July 1, 2024, Greg Bentley transitioned from his role as Chief Executive Officer to Executive Chair of the Board of Directors. Simultaneously, Nicholas Cumins was promoted from Chief Operating Officer to Chief Executive Officer, marking a key development in the company's leadership structure.

Technical Observation (on the daily chart):

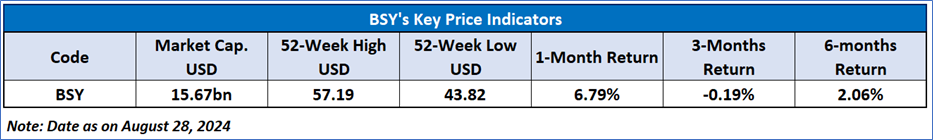

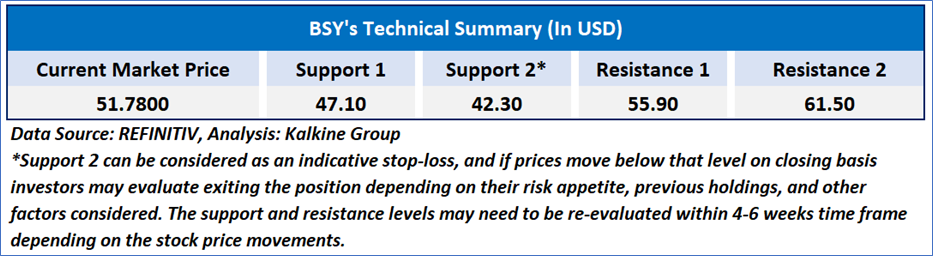

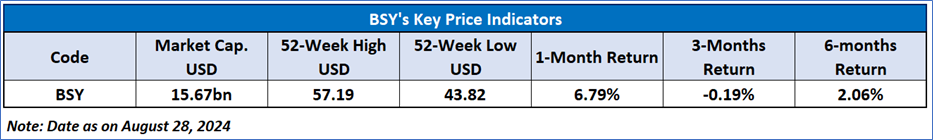

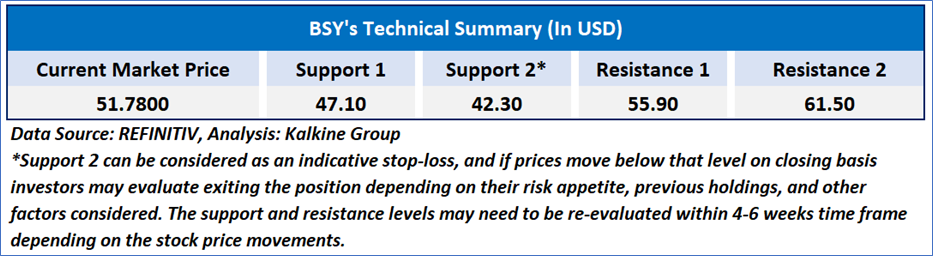

The Relative Strength Index (RSI) over a 14-day period stands at a value of 62.08, upward trending, with an expectation of upward continuation if the current resistance levels of USD 50.00 -USD 55.00 are broken on the upside. Additionally, the stock's current positioning is above both 50-Day SMA and 200-Day SMA, which can act as a short to medium term support levels.

As per the above-mentioned price action, momentum in the stock over the last month, current macroeconomic scenarios, recent business & financial updates, and technical indicators analysis, a ‘WATCH’ rating has been given to Bentley Systems, Incorporated (NASDAQ: BSY) at the current market price of USD 51.78 as of August 28, 2024, at 07:05 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is August 28, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.s

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Please wait processing your request...

Please wait processing your request...