Section 1: Company Overview and Fundamentals

1.1 Company Overview:

Payoneer Global Inc. (NASDAQ: PAYO) is a financial technology company, which enables small and medium-sized businesses (SMBs) to transact and do business globally. The Company empowers global commerce by connecting businesses, professionals, countries, and currencies with its cross-border payments platform. It enables businesses and professionals around the globe to reach new audiences while reducing the complexity involved in enabling overseas and cross-border trade, by facilitating cross-border payments.

Kalkine’s American Tech Report covers the Company Overview, Key positives & negatives, Investment summary, Key investment metrics, Top 10 shareholding, Business updates and insights into company recent financial results, Key Risks & Outlook, Price performance and technical summary, Target Price, and Recommendation on the stock.

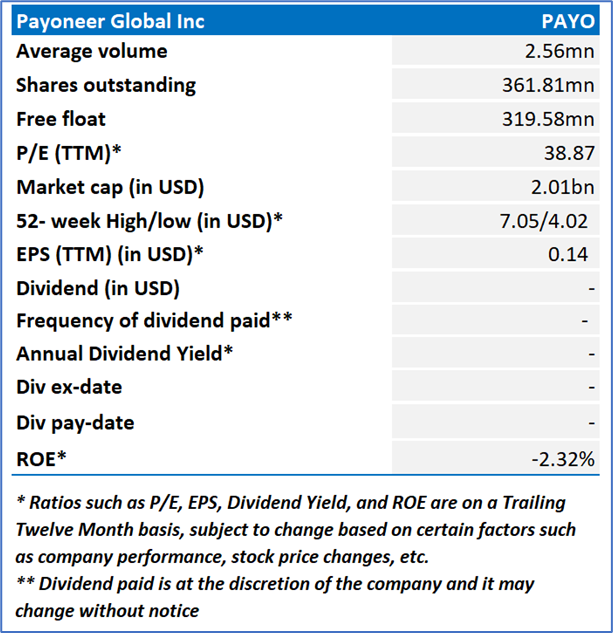

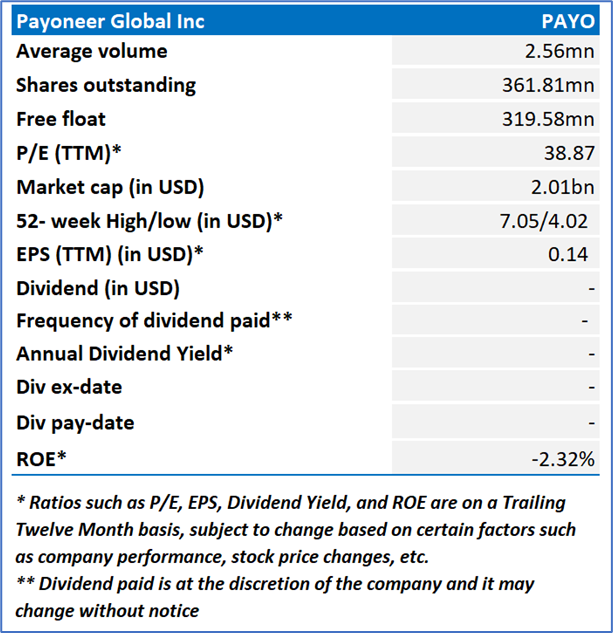

Stock Performance:

- The stock has corrected by 9.42% in the last three months as well as by 23.37% in the past six months.

- The stock is leaning towards its lower band of its 52-week range of USD 7.05 and 52-week low price of USD 4.02. Post the announcement of FY23 results the stock has corrected by 17.63%, with currently price is currently near an important support zone of USD 4-USD 4.50.

- The price is currently trading below its long-term (200-day) SMA and its short-term (50-day) SMA , with the current RSI of around 34.87.

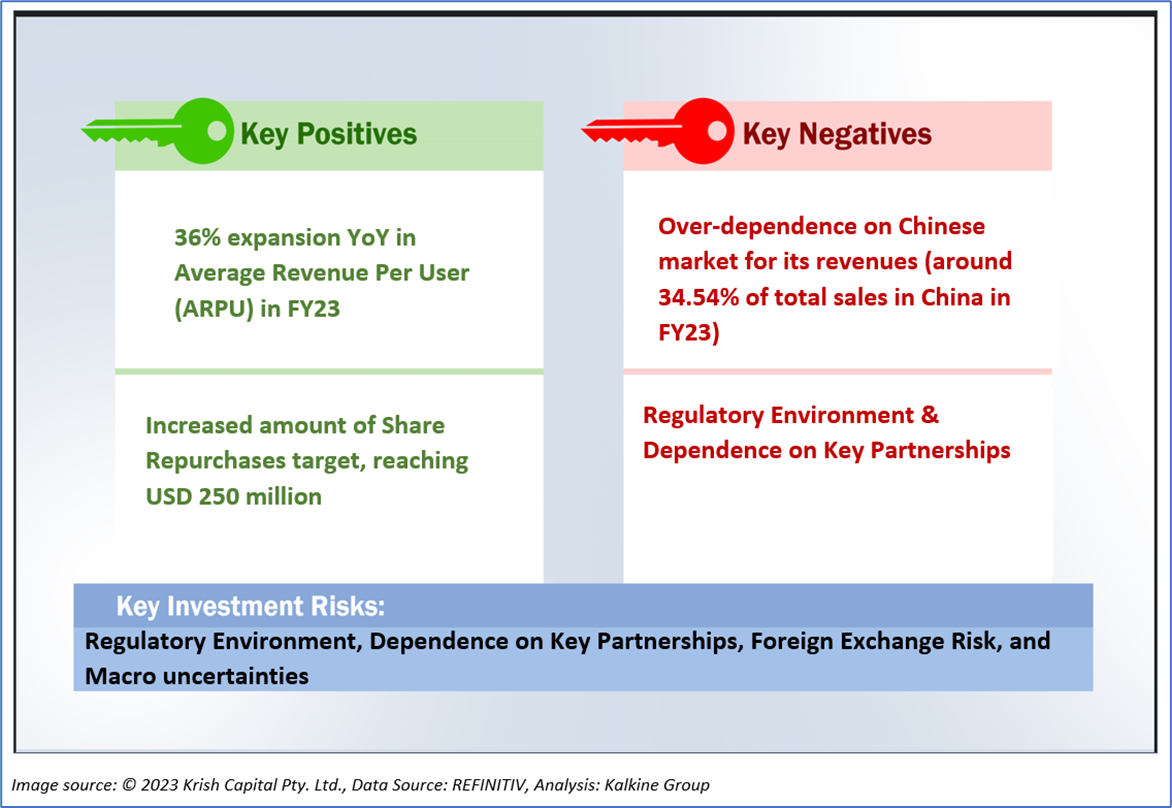

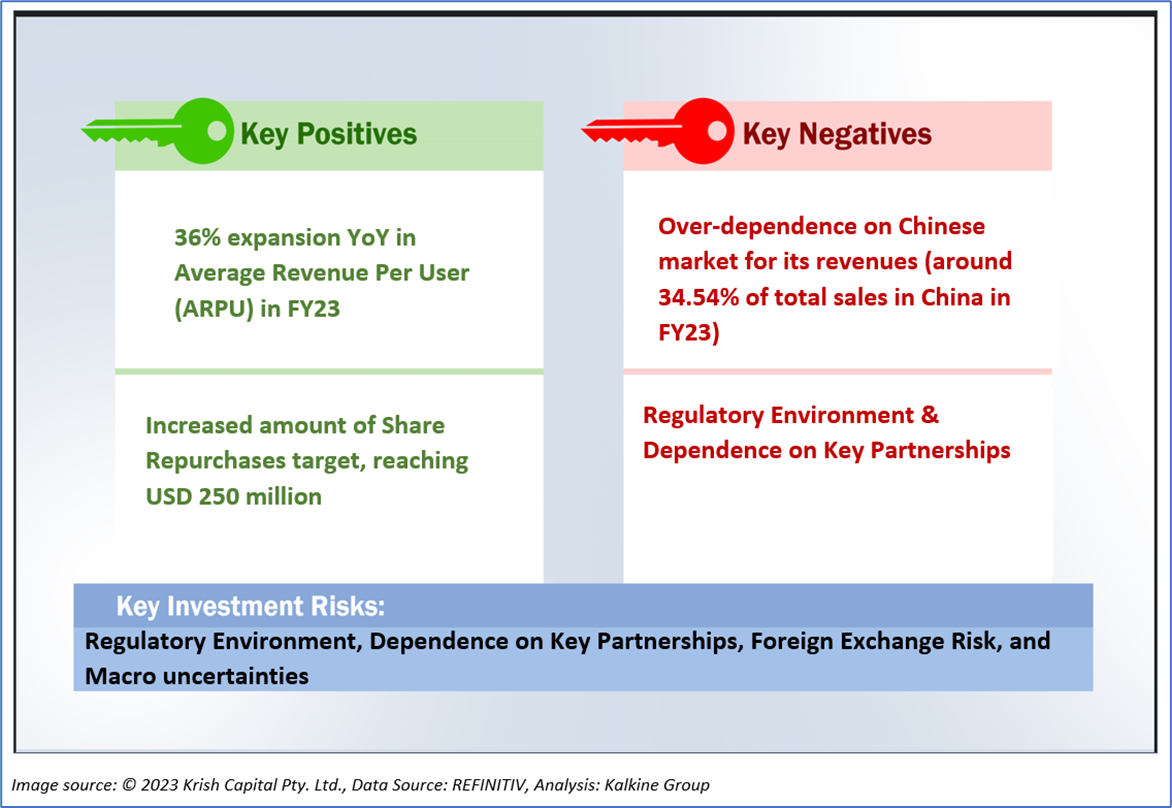

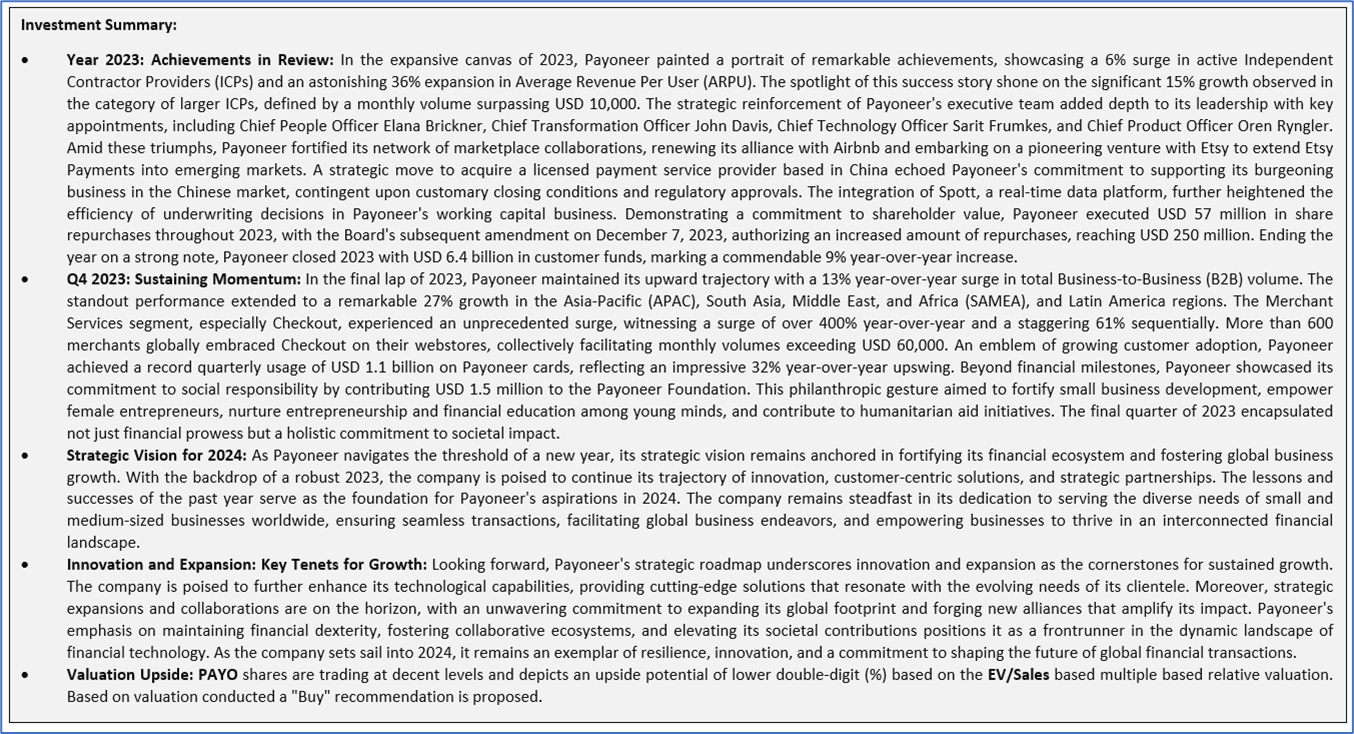

1.2 The Key Positives, Negatives, and Investment summary

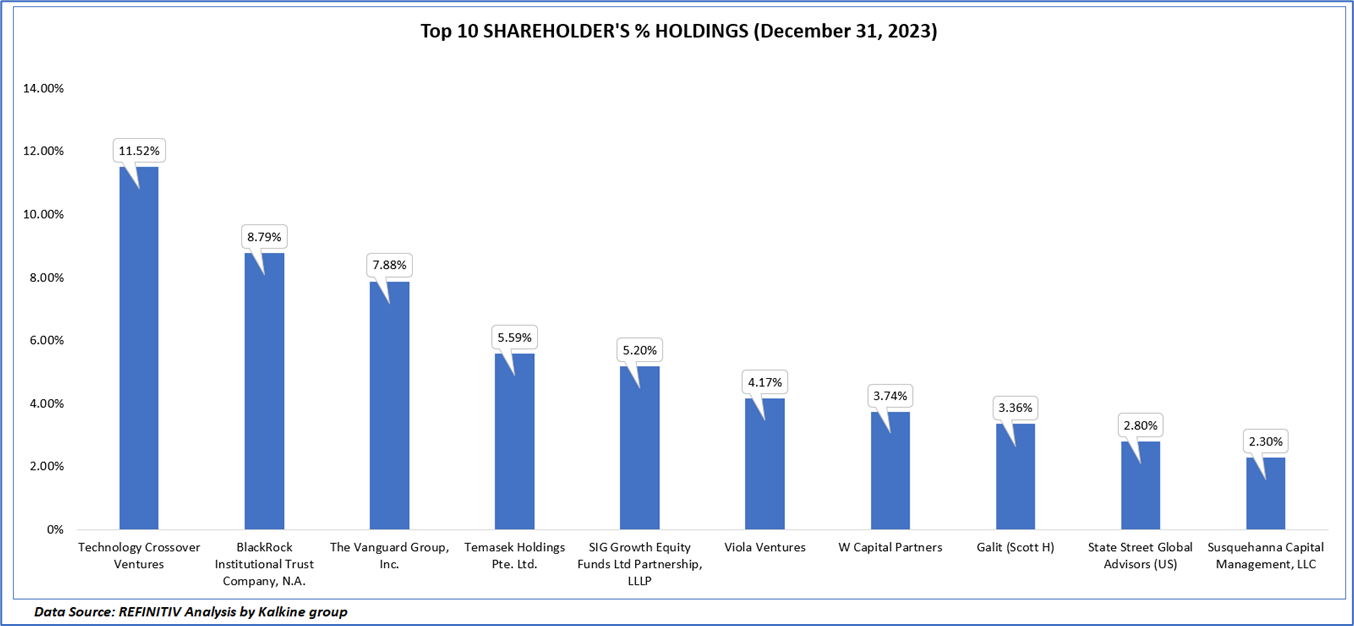

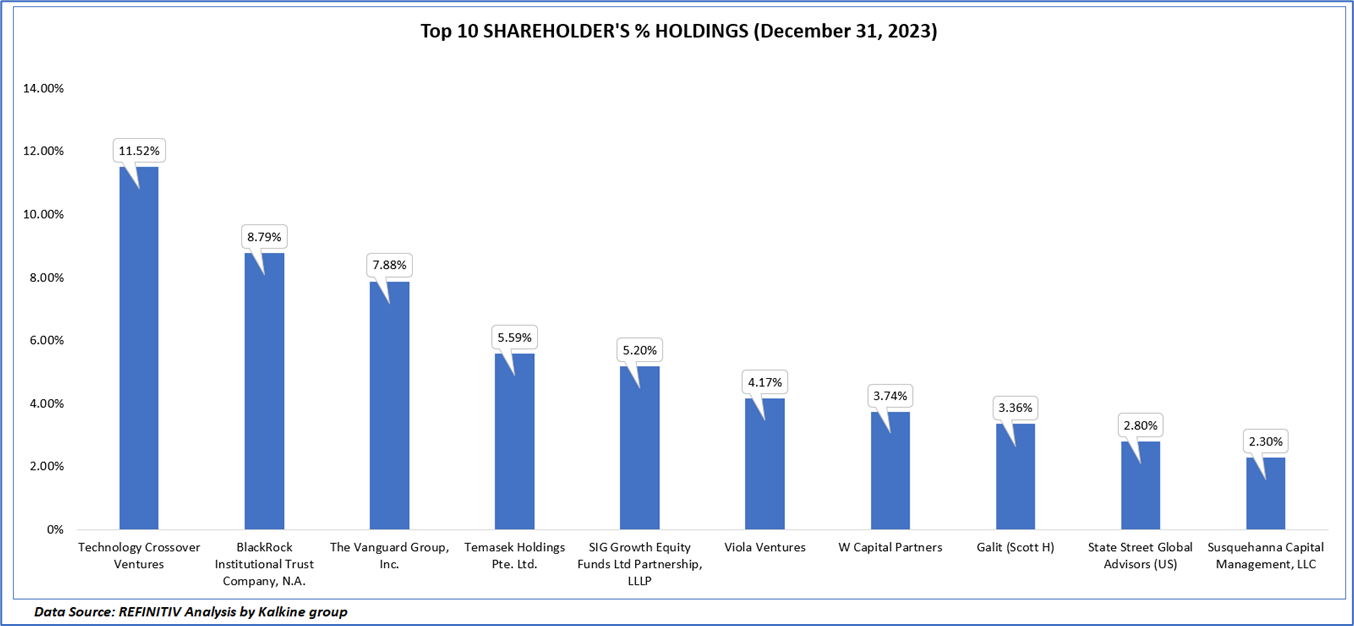

1.3 Top 10 shareholders:

The top 10 shareholders together form ~55.35% of the total shareholding, signifying concentrated shareholding. Technology Crossover Ventures and The Vanguard Group, Inc. are the biggest shareholders, holding the maximum stake in the company at ~11.52% and ~8.79%, respectively.

Section 2: Business Updates and Financial Highlights

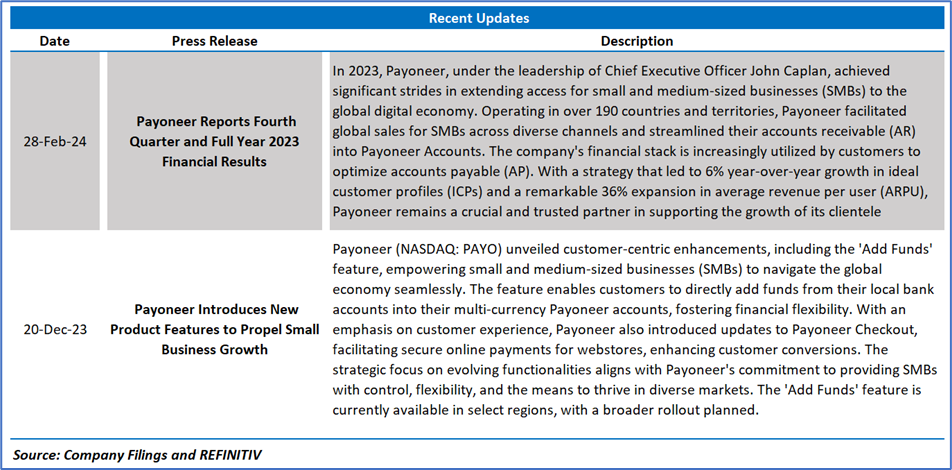

2.1 Recent Updates:

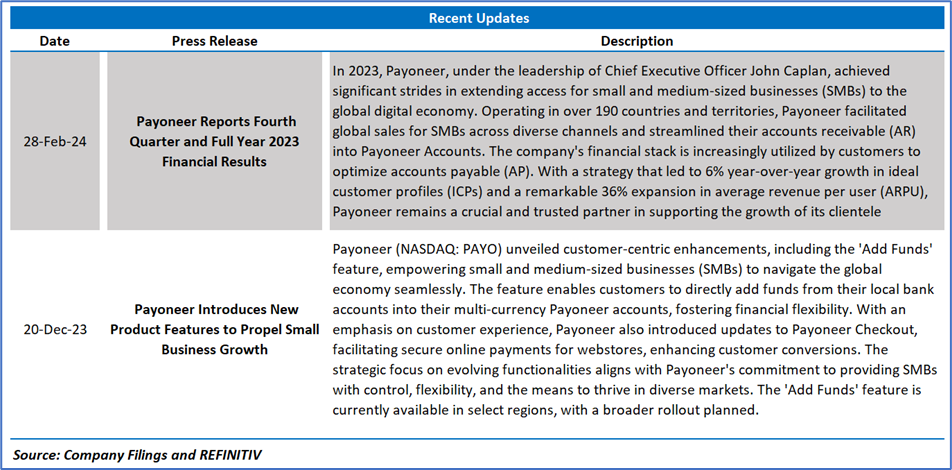

The below picture gives an overview of the recent updates:

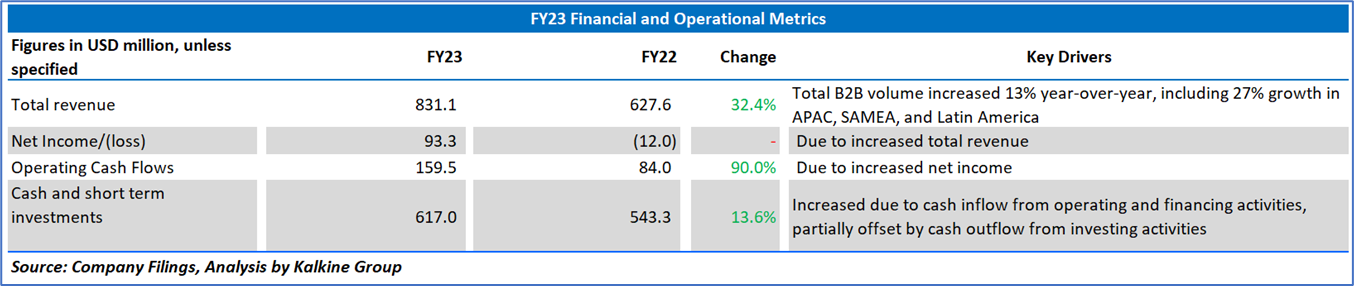

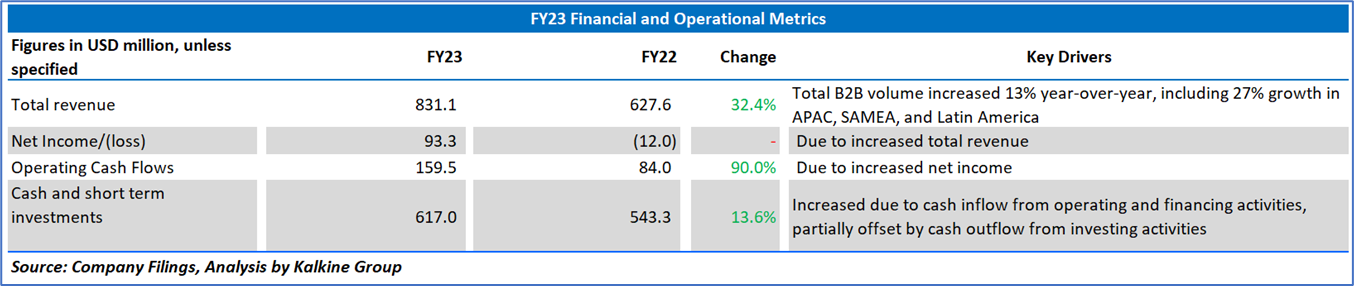

2.2 Insights of FY23:

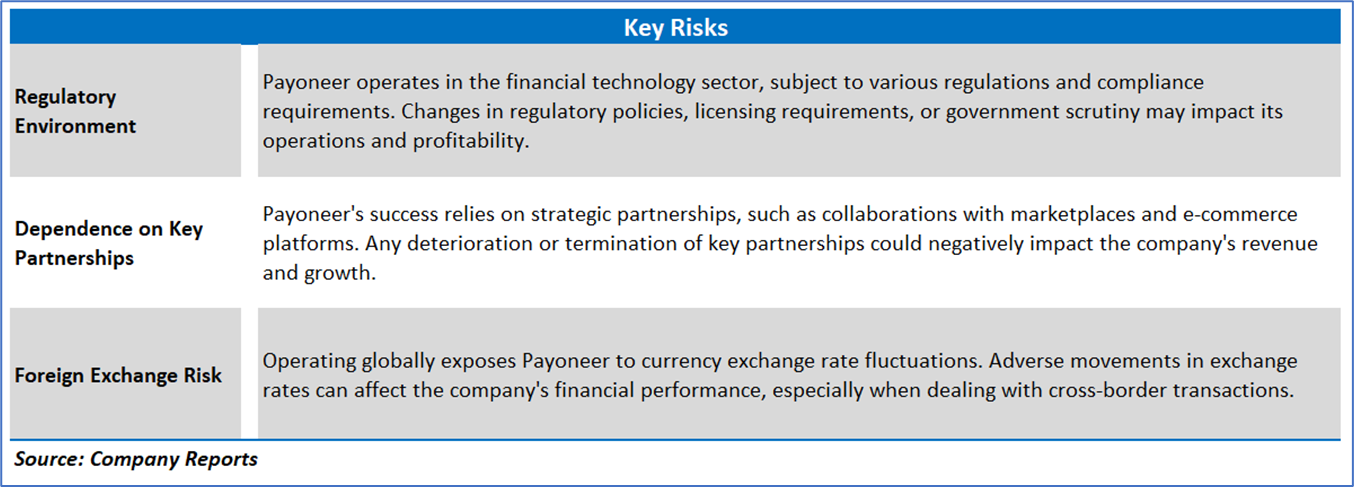

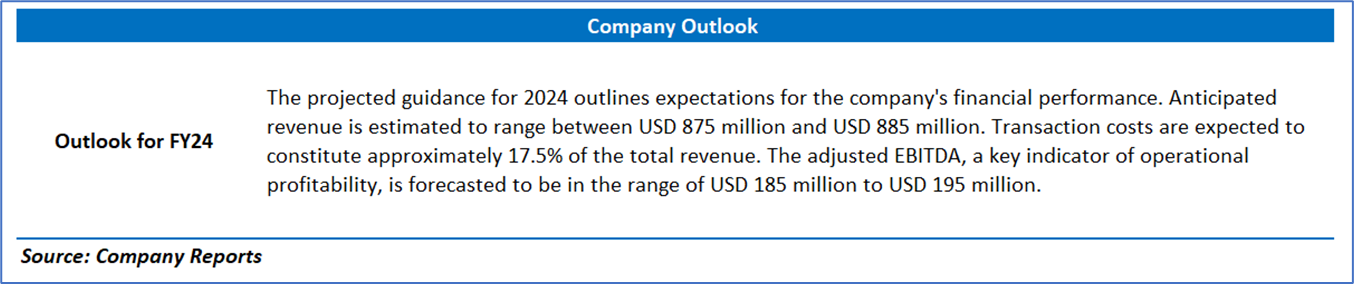

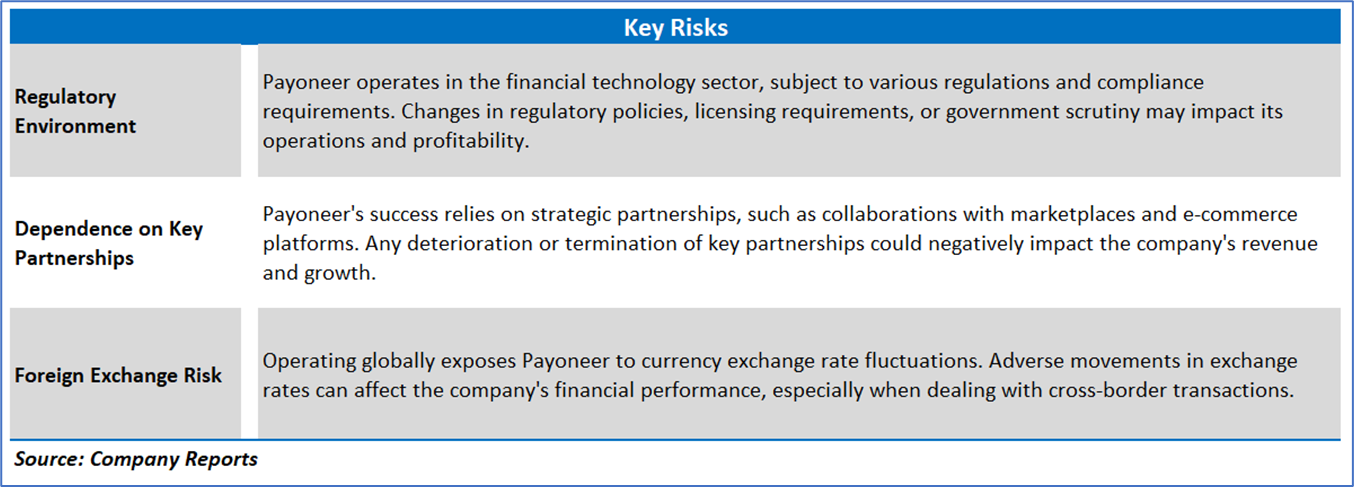

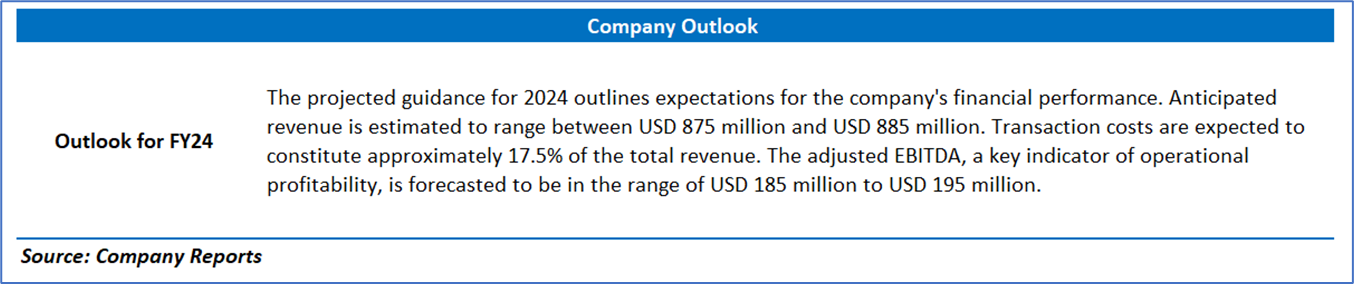

Section 3: Key Risks and Outlook:

Section 4: Stock Recommendation Summary:

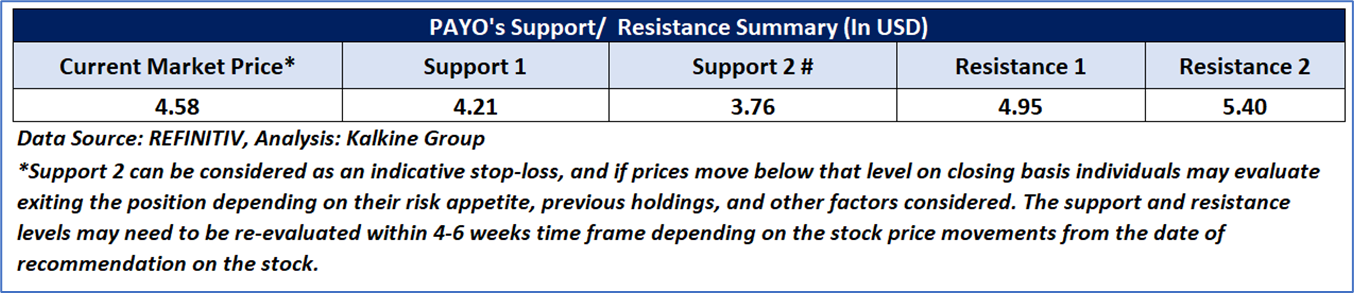

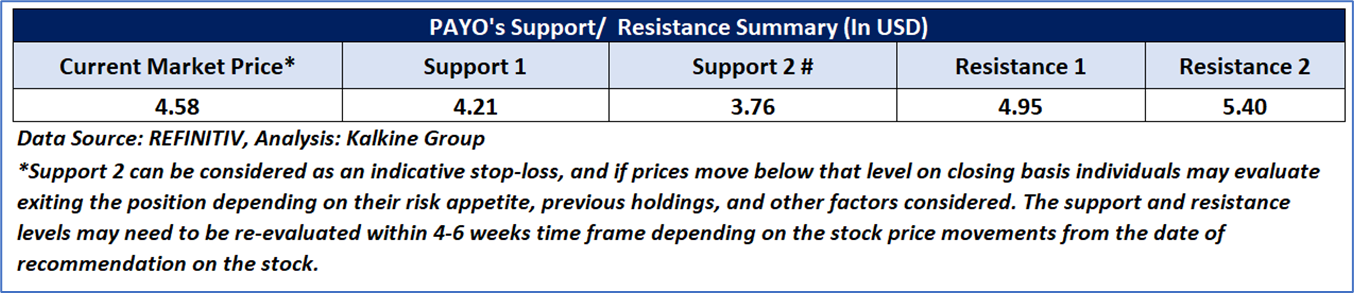

4.1 Price Performance and Technical Summary:

Stock Performance:

- The stock has corrected by 9.42% in the last three months as well as by 23.37% in the past six months.

- The stock is leaning towards its lower band of its 52-week range of USD 7.05 and 52-week low price of USD 4.02. Post the announcement of FY23 results the stock has corrected by 17.63%, with currently price is currently near an important support zone of USD 4-USD 4.50.

- The price is currently trading below its long-term (200-day) SMA and its short-term (50-day) SMA , with the current RSI of around 34.87.

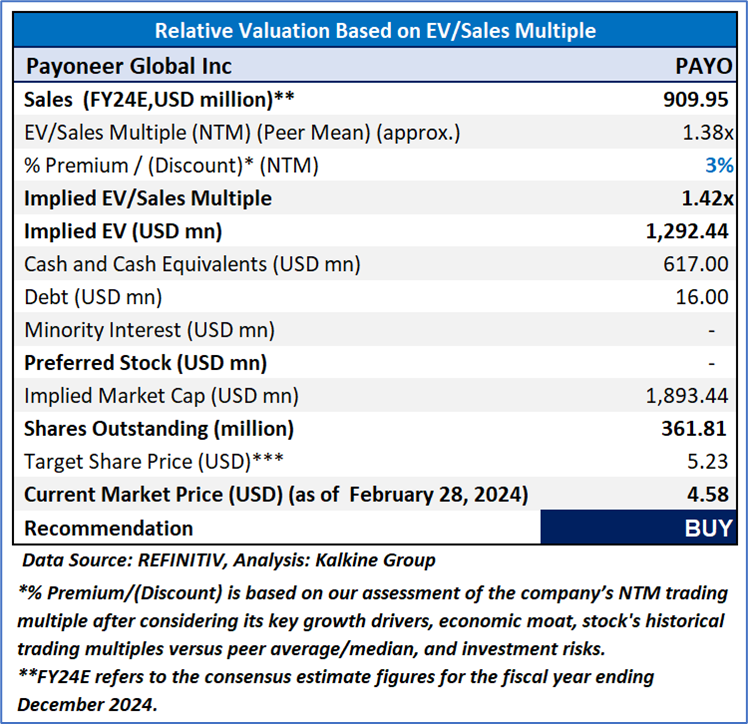

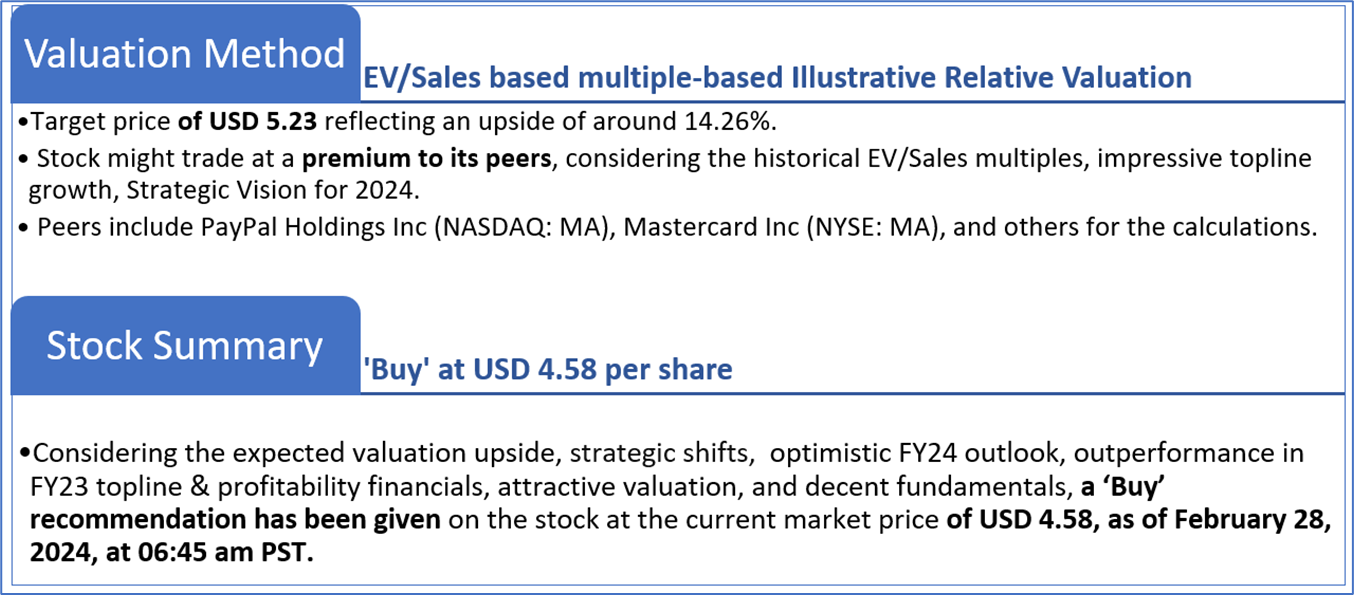

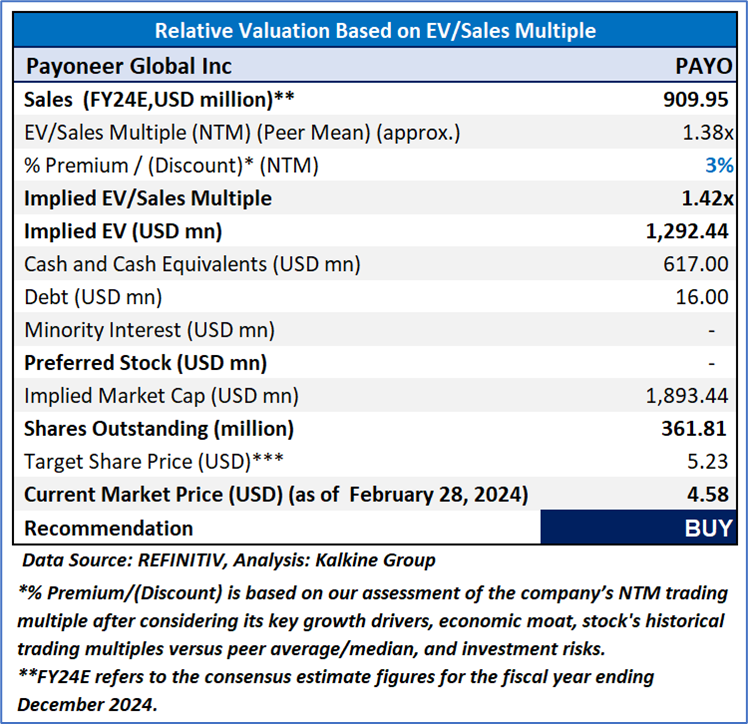

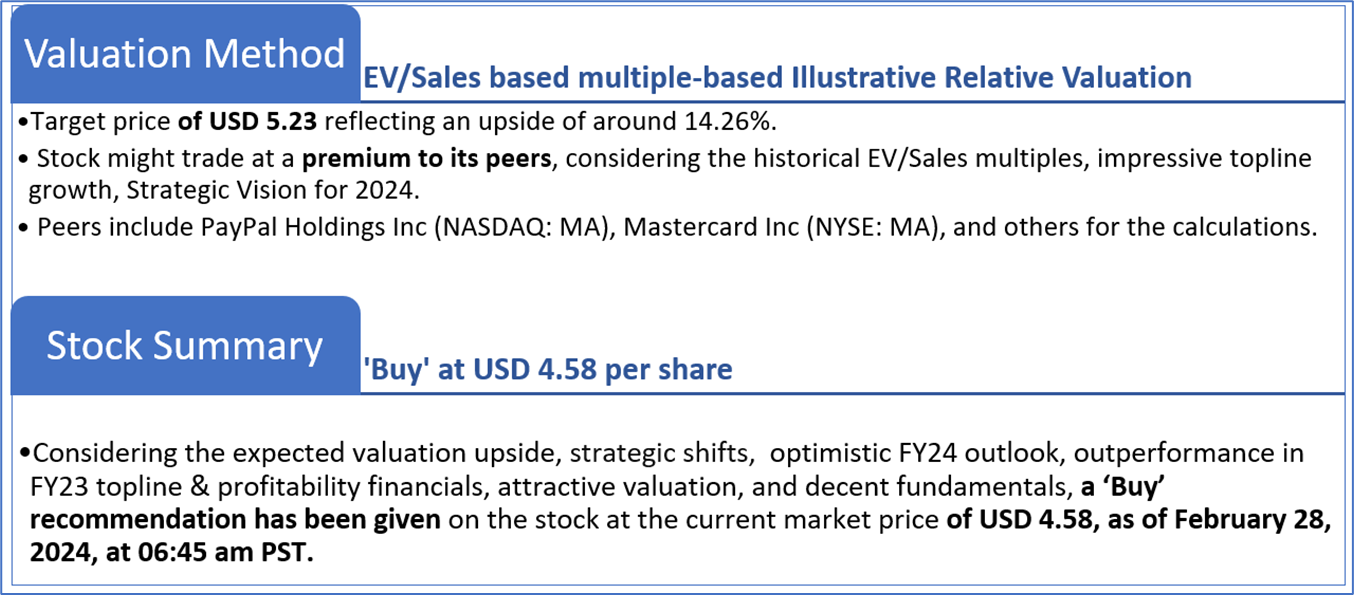

4.2 Fundamental Valuation

Valuation Methodology: Price/Earnings Per Share Multiple Based Relative Valuation

Markets are trading in a highly volatile zone currently due to certain macroeconomic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 28, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect against further losses in case of unfavorable movement in the stock prices.

CA

Please wait processing your request...

Please wait processing your request...